TRUDEAU’S CPP INCREASE FOR WIDOWS MUST BE AN APRIL FOOL’S JOKE

(These thoughts are purely the blunt, no nonsense personal opinions of the author about financial fairness and discrimination and are not intended to provide personal or financial advice – financialfairnessforsingles.ca).

Liberal Prime Minister Justin Trudeau’s CPP increase for widows must be an April Fool’s joke except it is not an April Fool’s day.

Justin Trudeau in one of his campaign promises has promised astounding 25 per cent increase to the Canada Pension Plan (CPP) for widows or widowers and would receive up to $2,080 in additional benefits every year with the increased survivors’ benefits under the CPP and Quebec Pension Plan (QPP). (Added November, 2019 Survivor benefits would see an increase of up to $2,080 under the Liberal proposal, which would need provincial approval.)

Trudeau said losing a partner is one of the hardest things to endure, and this added support will help during the period of grief. “Seniors have built the Canada that we know and love today. And they deserve to enjoy their golden years to the fullest,” Trudeau said “Our parents have worked so hard and sacrificed so much to give us a good life,” Trudeau said. “Once they get to retirement they shouldn’t have to worry about their savings running out.”

Apparently the only persons who experience grief and/or who have worked so hard and therefore deserve more are the married and married parents.

Apparently this would take effect when person is widowed but at what age? (Updated October 1, 2019)

(added November, 2019) Excerpt from article ‘The election promises that could affect your personal finances’ by a financial planner (election-promises): “The Liberals have also proposed an increase in Canada Pension Plan (CPP) survivor benefits payable to the surviving spouse of a deceased CPP contributor. This could be meaningful for many widows and widowers, who might otherwise receive only 60 per cent or less of the CPP pension of their deceased spouse. That said, those who already have high CPP pensions of their own may receive little to no CPP survivor benefits if they are already entitled to the maximum CPP or close to it based on their own contributions — a potential flaw in the CPP system.” (Comment by blog author: A potential flaw, really? Why is it many financial planners only take into consideration married persons while excluding singles from the household definition? As of this date it is unknown whether this election promise will be kept and what form it will take.)

WHO IS INCLUDED AND WHO IS NOT

Included:

Married seniors with and without children who have deceased spouses and can check off that magic box ‘widow’ on their income tax forms.

Excluded:

Singles never married, no children

Singles who have adopted or are parents of children (sometimes willingly or unwillingly through horrible circumstances)

Divorced/separated persons with and without children

Common law persons with and without children – are they considered to be ‘widowed’ or just common law?

MOST PENSIONS BENEFIT MARRIED THE MOST

At present time, the CPP plan already benefits married the most. Singles who have worked for forty years while contributing to CPP can die at one day after the age of 65 and receive only the flat rate death benefit of $2,500. This amount has been in place for many years, is not indexed for inflation and doesn’t begin to cover funeral costs. Their entire lifetime CPP contributions except $2500 will be forfeited without any benefit to the estates of single persons.

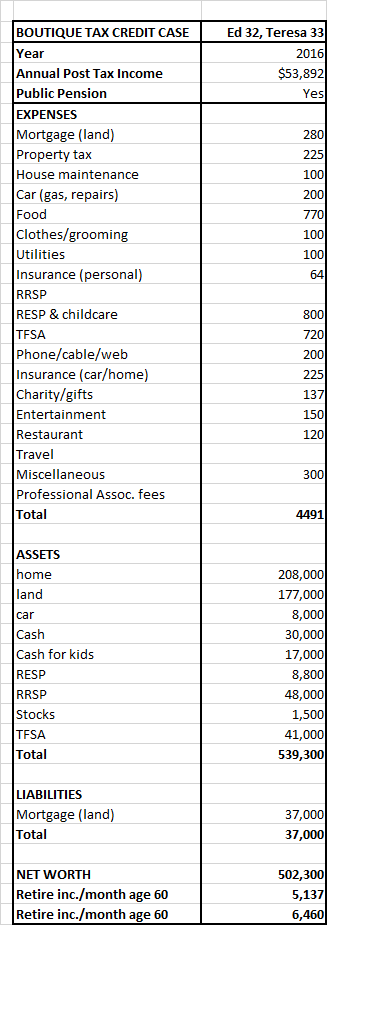

Combined survivor and retirement pension at age 65 in 2019 already equals $1,154.28 for both widowed and singles. Why does Trudeau believe widowed should receive more CPP benefits and have better lifestyles than singles? After all widowed are now ‘single’ and should have to live the same frugal lifestyle of many singles.

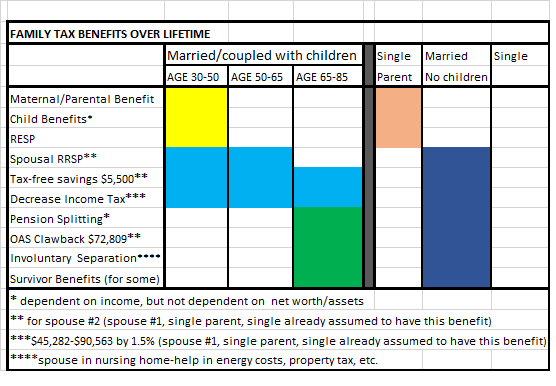

Public and private service pensions are taxed, but both spouses will be able to pension split and maybe receive less OAS clawback while one spouse or both spouses are receiving pensions. There also is the possibility of receiving multiple pensions – surviving spouse of the deceased employee will receive pension to which he/she has not contributed as an employee plus receive his/her own pension. With 25 per cent survivor CPP increase this is just another example of compounding of benefits on top of benefits for the wealthy and the married, both in married and widowed state (regressive tax expenditures).

Elizabeth May, Green Party applauds social justice but has lobbied to repeal legislation that denies pension benefits to spouses who have married after the age of 60 or retirement even though these newly married spouses haven’t contributed one dollar to that pension plan. Now as widowers they will also receive a whopping additional 25 percent CPP bonus at age 75 after being married for only 15 years or less. (Many pension plans have this clause for newly married elderly persons in their pension policies).

CONCLUSION

Where is the critical thinking on the part of politicians? Do they really think all Canadians are stupid and can’t do the math? Which political party should one vote for when they all are like ‘pigs at the trough’ making unrealistic vote getting promises that benefit wealthy and married the most and don’t include Market Basket Measure and declaration of assets in financial formulas? Where are the Elizabeth Warrens’ of the Canadian political world who have financial formulas that provide social and financial justice for all, not just the wealthy and the married?

Only the married at the time of being widowed would ever get an astounding 25 per cent CPP widow pension increase. The Canadian senior population is not made up of just married/widowed persons.

Reader opinion letters in newspapers on this subject are interesting to read. They are mostly slam Trudeau or present a sense of entitlement by the married with no critical thinking of how the rest of the population will be affected.. For example, one of the few very comments about persons not able to benefit like LGTB couples, the comment was “a spouse is a spouse is a spouse”. In other words, everyone who is not married be damned.

Trudeau, who touts gender equality, indigenous people rights, etc., has flagrantly financially discriminating on the basis of marital status.

Selective socialistic privileging of election promises like this one only lead to the rise of anger and rising populism.

(Addendum: Added November, 2019 It is yet unclear how the above policy if implemented will be carried out. If implemented it is likely that widowed seniors will be the beneficiaries. Singles never married and divorced persons will receive zero benefits since they do not have spouses.

CARP – Canadian Association for Retired Persons in past years has stated that older unattached women are especially vulnerable to poverty. In 2016 approximately 28 percent of single older women (widowed, single or divorced) lived in poverty. CARP has advocated that the federal government support single seniors, with particular regard to older women, with an equivalent to spousal allowance for single seniors in financial need.

Why are politicians giving benefits only to widowed seniors?

(This blog is of a general nature about financial discrimination of individuals/singles. It is not intended to provide personal or financial advice).