SIX REASONS WHY MARRIED/COUPLED PEOPLE ARE ABLE TO ACHIEVE MORE FINANCIAL POWER (WEALTH) THAN SINGLES (Revised December 1, 2017)

These thoughts are purely the blunt, personal opinions of the author and are not intended to be used as personal or financial advice.

There are many examples of financial discrimination of singles throughout the world. Canada is no exception. Six possible reasons as to why married/coupled people have so much more financial power and are able to achieve more wealth than singles are as follows:

(NOTE: Most of following reasons can be applied to income and tax rules of any country. Canada Revenue Agency is equivalent to IRS in the USA and RRSP/TFSA are equivalent to Roth IRAs, 401(k) and other savings plans in the USA.)

- Marital Manna Benefits and Marital Privileging – From beginning of marriage/cohabitation until death of spouse/partner, married/coupled people are able to use benefits to their advantage. (One example is Canadian pension splitting (cra), a method for reducing the taxable income of one spouse by allocating pension income on the tax return to the other spouse. One spouse can give up to 50% of their eligible pension income to their spouse so that they can reduce their combined payable income taxes. Another example is income sprinkling (

added October 30, 2017). For example, dividends that would have been received by the primary owner of the private corporation, would instead be paid to the spouse, partner or kids of the primary shareholder, who are often in lower tax brackets, therefore, the family’s total tax bill would be reduced. Since singles in their financial circle are basically financially responsible to themselves,‘Income sprinkling’ is of no benefit to single marital status entrepreneurs so they will pay more tax.) Singles get nothing that is comparable.

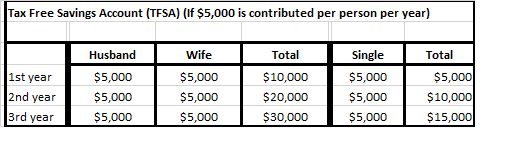

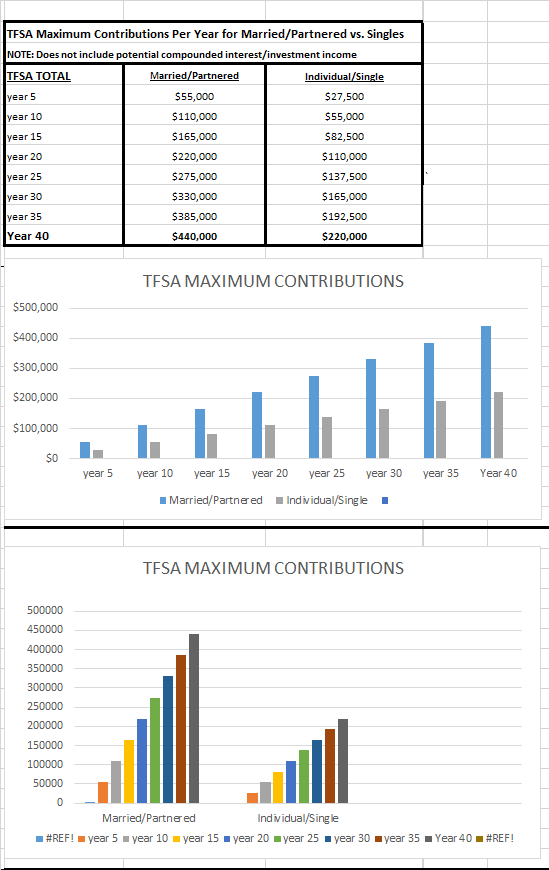

- Married/coupled people have possibility of multiplying their wealth times 2, all things being equal for both parties. (Examples: Registered Retirement Savings Plan (RRSP) and Tax Free Savings Account (TFSA) times two for the spouses; RRSP/TFSA times one for the single person. (RRSPs are savings plans using before tax income – interest/investment revenue earned is taxable on withdrawal from the account. TFSAs are savings plans using post tax income – interest/investment revenue earned is completely tax free). TFSAs, because they are tax free, are never counted as part of total income; therefore, it is possible to have huge TFSA accounts and still receive full Old Age Security (OAS) supplements and without OAS clawbacks. OAS is supposed to support those with low incomes, not the wealthy (added Dec. 15/17). Singles can never catch up to married/coupled contribution amounts.

(December 1, 2017-more graphs showing TFSA potential have been added at the end of this post).

- ‘Rule of 72’ (compound interest) times 2-In finance, the ‘Rule of 72’ (Rule_of_72)is a method for estimating an investment’s doubling time. For example, assets invested at a certain percentage should double/triple over a period of time, thus increasing wealth for the total income asset.

Since married/coupled people are potentially able to contribute more to factor times two without single people ever being able to catch up, married/coupled people are also potentially able to exponentially multiply their wealth (i.e. interest from investments) by rule of 72 to a greater advantage than single people. (If money is invested at 7% for 10 years, it should double in ten years, or inversely if it is invested at 10%, it should double in seven years).

- Manipulation of finances-married-coupled people are able to manipulate finances (all within legal limits of the financial laws of Canada Revenue Agency). Wealth generated from the manipulations can be likened to a gourmet ice cream cone. Ability to put monies into RRSP/TFSA are equivalent to ice cream cone for married/coupled persons and singles. The ability to gift money to spouse or to have only a 1% rate for loan of monies to spouse/partner can be likened to chocolate dip, maybe even two or three dips, on ice cream cone for married/partnered persons, but not for singles. The interest/investment monies earned from the manipulation can be likened to the gourmet sprinkles on the top of the ice cream cone for married/coupled persons, but not for singles. (Who in world gets a 1% loan rate except married/coupled persons?)

Examples: manipulation for tax purposes:

Spousal RRSPs Gift – If a spouse’s income from part time work will be low for a certain year (withholding amount is equal to amount tax owed for the year), the entire balance of the spouse’s regular Registered Retirement Savings Plan (RRSP) can be cashed out in increments of less than $15,000 per day. The net amount can be contributed to a new spousal RRSP via a gift of money to the other spouse, who then contributes to the spousal plan for the spouse cashing in the original RRSP. If this isn’t double dipping/triple dipping all within legal limits of the law, then what is?(income-splitting-strategies) Singles get nothing that is comparable.

Another example is Canada Revenue Agency’s (CRA) 1% lending rate benefit -Financial Post “How to gain from CRA’s 1% lending rate” (how-to-take-advantage-of-the-cras-1-prescribed-interest-rate). The strategy involves lending money to a spouse/partner to split investment income and to get around the attribution rules, which are designed to prevent most attempts at income splitting among family members. Basically, the rules say if you give your spouse or partner money to invest, any income, dividends or capital gains earned from the money so invested are attributed back to you and taxed in your hands. Who in world gets a 1% loan rate except married/coupled persons?

USA example is Social Security (high-price) that privileges married/coupled persons in many ways. Married woman can receive up to 50 percent of husband’s benefits while husband is alive. Spouses can also receive 100 percent of their dead spouse’s benefits, if the deceased’s benefits are higher than the recipient’s would have been. Also, when married women reach retirement age, they can claim Social Security as a spouse and then later as a worker. For example, they can sign up for spousal benefits at age 66 and then wait four years before claiming their own benefits, because by delaying they accrue credits which increase their benefits by a certain percentage (depending on their date of birth).

- In many circumstances, because of economies of scale, married/coupled people are able to live more cheaply than single people. Equivalence scales are one way of proving this (equivalence-scales) – added October 3, 2016.

- Married/coupled people will most likely receive two inheritances to singles’ one inheritance all things being equal. (Outside the box the box thinking, because singles are at a financial disadvantage –cannot multiply wealth same as married/coupled siblings, cannot live as cheaply as married/coupled persons, do not receive same benefits as married/coupled persons, sibling family units receive more benefits from parents than single person for things like gifts, RESP for grandchildren, etc., –parents should consider adding an additional 20 per cent to their single children’s inheritances than or married/coupled siblings. Added January 14, 2016).

FROM DECEMBER 9, 2011-FINANCIAL POST ALL-STAR PLAN (finance/all-star-plan)

This is a great example of how married/coupled people have benefited from the 2011 tax revisions for pension splitting at the expense of singles who have not been given the same tax advantages.

Analysis of the information shows:

- both are age 60

- both are already working part time at age 60 (singles generally cannot work part time at any time throughout their employment lifetime)

- they have been able to acquire multiple properties

- they are in the position of having as much as 60% more spendable income in retirement than while they were working

- he is already getting income from a defined benefit pension after having only worked for 25 years

- both want to retire at age 63 (how fortunate that they can do that)

- in retirement, they can split pensions to keep each partner’s taxable income in the lowest tax bracket. He can split pension income with his wife and keep more of their wealth for themselves. By pension splitting he can distribute $19,500 a year to her and save 7% on taxes. Seven per cent amounts to a lot of money. (Singles are never able to achieve this amount of financial benefit).

- if pension income, including RRIF distributions, is carefully split the couple is not affected by the OAS clawback (how nice, they even get to keep all of the OAS)

FROM INFORMATION RELATING TO DISCRIMINATION FROM MONEYSENSE MAGAZINE- September/October 2010, ‘Single and Secure’, it states:

‘Singles of all ages face discrimination in housing, taxes…..and even travel and entertainment. All of these things can result in disproportionately higher costs per capita for singles than married couples. For instance, a couple with two incomes generally has an easier time qualifying for a mortgage….Coupled with those higher expenses is the fact that the median income for households headed by a single person is substantially lower than for couples. According to Statistics Canada, the median family income for a household headed by a couple in 2007 was $73,000 annually, more than double that of a household headed by a single person with at least one child, at $34,500 annually. Singles on their own fare even worse. The annual median income for their households is only $22,800…

When you also take into account the fact that singles devote a larger percentage of their income to basics such as food…and utilities…it’s easy to see how singles often find they have little money at the end of the month…We hate to say it, but the sad truth is that most singles have to save a higher percentage of their income than couples (sic for retirement) to ensure a happy retirement. There are three main reasons for this. First, singles lack the economies of scale that couples have…The second reason is because singles lose out in a big way when it comes to taxes. In Canada taxes are applied to individuals, not families. That means a single person earning $100,000 a year pays far more income tax than a couple earning the same amount between them…In retirement , singles can’t take advantage of pension splitting, so they could end up paying more tax on their RRSP savings when they withdraw them as well…

’When it comes down to strictly financial and tax matters, the numbers show that everyone could benefit from being married’…The final strike against singles is that they are much less likely to own their own home…a single person with a paid-off home will need to replace about 60% of his or her working income (sic for retirement). If you don’t own your own home, that jumps closer to 75%…(sic for retirement investments, things to watch out for)…The first is that because of the higher per capita taxes for single households, plus the lower net incomes, most single households will have smaller investment portfolios that an equivalent couple. This unfortunately means that investing expenses will take a proportionately larger bite out of your portfolio….’

CONCLUSION

Careful consideration of the above should leave no doubt that married/coupled persons have a distinct advantage of achieving financial wealth over single persons.

Singles need to lobby government, decision making bodies and families about financial discrimination of singles. To affect change, it is important for singles to educate others about this discrimination and the importance of including singles equally to married/coupled persons in all financial formulas.

See next page for more graphs on TFSA potentials.

The blog posted here is of a general nature regarding financial discrimination of individuals/singles. It is not intended to provide personal or financial advice.

Visitor questions: This is a WordPress blog designed by a hired individual.