CONTINUED FINANCIAL ILLITERACY OF FINANCIAL GURUS EQUALS FINANCIAL DISCRIMINATION OF SENIOR SINGLES (Part 2 of 2)

(These thoughts are purely the blunt, no nonsense personal opinions of the author and are not intended to provide personal or financial advice.)

This blog post is a comment on the Broadbent Institute Report on the economic circumstances of Canadian seniors. The Broadbent Institute is a left-leaning social democratic think tank founded by Ed Broadbent who was a past leader of the New Democratic Party . It describes itself as an independent, non-partisan organization championing progressive change through the promotion of democracy, equality, and sustainability and the training of a new generation of leaders. Its mission is to “Support, develop, and promote social democratic principles for the 21st century”, “Propose new solutions for a more equal society”, and “Equip a new generation of progressive campaigners & thinkers with the tools they need to build a social democratic society through training and education”.

This post addresses excerpts from the report first (Part 1), and then is followed by comments on the report (Part 2).

COMMENTS ON REPORT – PART 2 OF 2

In February, 2016 the Broadbent Institute in Canada and Richard Shillington of Tristat Resources published the report: “An Analysis of the Economic Circumstances of Canadian Seniors”. (analysis_of_the_economic_circumstances_of_canadian_seniors)

The report information is mainly directed towards poverty of seniors without an employer pension plan (roughly 47 per cent) and therefore, many of these seniors have wholly inadequate retirement savings.

(It should be noted in the report that single seniors does not refer to marital status, but the fact that they live alone. Therefore, single seniors includes ‘ever’-never married, no kids-singles, divorced/separated, and widowed seniors living alone).

Review of the report reveals some points that are very disconcerting.

- The true facts of what it costs singles to live is under-reported. Married/coupled persons and, indeed, the author of the Broadbent report do not seem to realize that the widowed (married/coupled persons whose spouses are deceased) are a part of the singles population. It is a well known fact that it costs singles approximately 70 per cent of what it costs married/coupled persons to live as a single unit. This fact is never addressed in the report. (Using LIM 11.1 percent of seniors live in poverty–719,000 seniors: 419,000 singles and 250,000 living in an economic family. The poverty is astonishingly high at almost 30 per cent for senior singles without employer pension plans). (Widowed persons and the extra benefits they get are discussed later in this post).

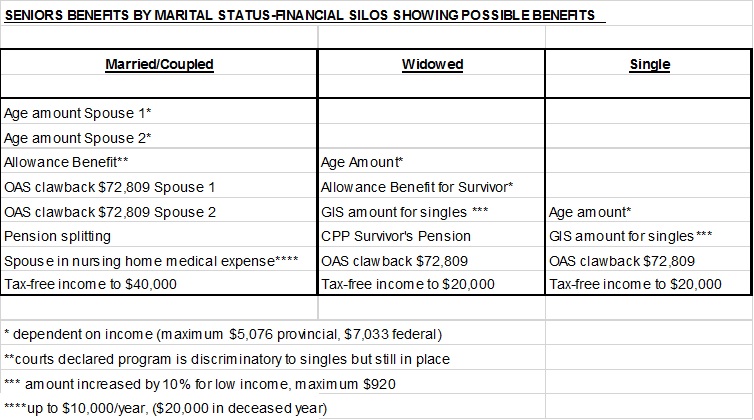

- All the extra benefits that have been given to married/coupled persons are never addressed. Governments continue to create financial silos where more and more benefits are given to married/coupled persons even though they are able to live with less because of economies of scale, but not to singles resulting in financial inequality. (Following table was updated on March 8, 2016 with additional information).

- It is ludicrous that this report does not treat home equity as a retirement asset. Those who have to rent are at a much greater financial disadvantage than those who own their own home. Quote from report : “ …..Many of those who argue that there is no looming pension crisis have included home equity as a liquid asset. This analysis has not treated home equity as a retirement asset because the replacement rate analysis has as its objective an income that allows one to enjoy a lifestyle comparable to that which existed pre-retirement. We do not include home equity here because we accept that the pre-retirement lifestyle for many middle- and moderate-income Canadians include continued homeownership”, (Page 19).

According to Statistics Canada 2011 articles “Living Arrangements of Seniors” and “Homeownership and Shelter Costs in Canada”: (statcan.gc.ca) and (statcan)

- The average household total income for couple-family households was about twice that of non-family households (which were primarily one-person households) and lone-parent households ($101,000 per year versus $43,000 per year and $55,000 per year respectively). Thus, while lone-parent households and non-family households had a lower cost than couple-family households, the lower household total income results in a higher proportion exceeding the affordability threshold”.

- Approximately 69 per cent of Canadians own their own home. About four out of five (82.4%) married/coupled people own their own home, while less than half (48.5%) of non-family households (singles) own their dwellings. Just over half (55.6%) of lone-parent households own their dwelling. (It stands to reason that more senior married/coupled and widowed persons will own their own homes, while senior singles–‘ever’ single and early divorced)–are more likely to have to rent placing them in greater income inequality and a lower standard of living and quality of life). Regardless of housing tenure, the proportion of non-family households and lone-parent households that paid 30% or more of total income towards shelter costs was about twice the proportion of the couple-family households.

- Quote “approximately 56.4 per cent of the senior population (5 million total seniors in 2011) live as part of a couple and about 24.6 per cent of the senior population live alone (excludes those living with someone else, in senior citizen facilities and collective housing).

Singles are constantly told to ‘go live with someone’ when they have difficulties paying for housing; meanwhile married/coupled and widowed persons may be living in their big houses (enjoying the same lifestyle they had before pre-retirement) and seeking help with paying their taxes while refusing to move to a less expensive dwelling. (senior-singles-pay-more-part-3-of-4)

- It is ludicrous for this report to state that seventy per cent income replacement should be a benchmark in the formulas. Seventy per cent income replacement is entirely different for those who own their own home versus those who rent. It is selfish to think that the rich and married/coupled persons should be able to live same lifestyle post-retirement as pre-retirement when singles and early divorced generally will have a poorer lifestyle throughout their entire lives.

An example is the Financial Post financial evaluation “Bright Future Despite Big Debt, Small Income” published in Calgary Herald on February 20, 2016 where Ontario young couple’s after tax income is $4,800 per month and their food budget is $800 and entertainment $160 per month for two people. Just these two items are 20 per cent of their budget. Either they live in an area with very high food costs or they are living the high life for one of the necessities of life in Maslow’s Hierarchy of need. Seventy per cent replacement at retirement would give this couple an unreasonably high style of life for food in comparison to singles. Reader letter mentioned above in ‘senior-singles-pay-more-part 3-of-4’ link suggested singles should be able to live on just $200 per month for food.

- It is ludicrous to suggest that persons without employer pension plans cannot save, especially those with incomes over $100,000.

Quote from report: “For those with incomes in $50,000-$100,000 range, the median value (savings) is only $21,000” (Page 3).

If those with pension plans have forced saving, it it is ridiculous to say that those without pension plans are not able to save. For example, a $75,000 before-tax income may result in $600-$700 per month being deducted from pay cheque (employer deductions are excluded in this discussion). It is also ridiculous to say that in this First World country persons with $100,000 plus incomes cannot save. One of the principles of good finances is to save 10 per cent. Whole report promotes greed of looking for more benefits and not planning for the future if there is no plan for saving during working years.

- Reporting false information on marital status is a crime. Quote from report states: “Table 7 represents the results of increasing the single and married GIS amounts by the same percentage. One should keep in mind that there is an incentive for seniors to appear as singles to governments even if they are living as a couple. This is because the GIS for senior couples is less than twice the amount for singles. An increase in the GIS for singles only (with no increase for couples) would increase this so-called ‘tax on marriage’ and associated incentives. This would encourage couples to hide their cohabitation from the authorities for financial reasons”, (Page 21).

GIS for senior couples should, repeat, should be less than twice the amount for singles. Singles (particularly ‘ever’ and early divorced singles including the author of this blog) have worked very hard to have financial formulas include singles at 70 per cent of married/coupled persons living as a single unit. The GIS for senior singles is more than married/coupled persons because it costs more for singles (including widowed persons) to live than it does for married/coupled persons living as a single unit. Why can’t married/coupled persons understand this? When married/widowed persons become widowed their living costs will go up.

The statement “An increase in the GIS for singles only (with no increase for couples) would increase this so-called ‘tax on marriage’ and associated incentives. This would encourage couples to hide their cohabitation from the authorities for financial reasons” is absurd and selfish. Tax on marriage, why can’t married/coupled persons realize all the extra benefits they receive as outlined in table above??? When is ‘enough’ ever going to be ‘enough’ for them???

The notation (# 28) at the bottom of page 21 states: “While legislation treats those cohabiting the same regardless of their marital status, it is easier to deceive the government if you are not married”. This statement is false and backwards. If it is anyone being deceitful, it is the married/coupled persons. Can someone explain why it would be easier to deceive the government if you are not married (‘ever’ single)? The issue with false reporting lies with those who are married/coupled, divorced or separated. They are trying to ‘milk’ the system by falsely reporting their marital status even though the Canada Revenue income tax rules clearly define the parameters of marital status.

False reporting is a crime. It would be very easy to track deceit by following income tax declaration of marital status and address of residence over several years. Deceit of married/coupled persons would incrementally increase the monetary value they would receive from the deceit as it costs them less to live as a couple than it does single persons.

It seems married/coupled persons want it all even if they have to lie about it. So what will they do when their spouse goes to a nursing home or is deceased? In order to collect the benefits they are entitled to as one spouse living at home and the the other in a nursing home and widowers, they will need to lie again and change their marital status from single to married/coupled or widowed when filing their income taxes.

‘Ever’ singles (never married, no kids) throughout their entire working lives pay same amount of taxes as each individual (with equal income to the single person) reporting income tax in a married/coupled relationship and have supported/subsidized families who use mom/baby hospital care, EI benefits for maternal/paternal leaves, etc. They are never recognized for their tax support and for using less resources than families. Since singles have paid supportive taxes throughout their entire working lives, they deserve to live with the same financial dignity and respect as seniors and as married/coupled persons. As seniors, ‘ever’ singles deserve to have their own space and their own bathroom and not be forced to cohabitate with other persons.

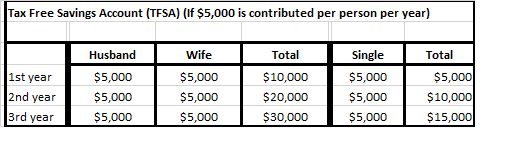

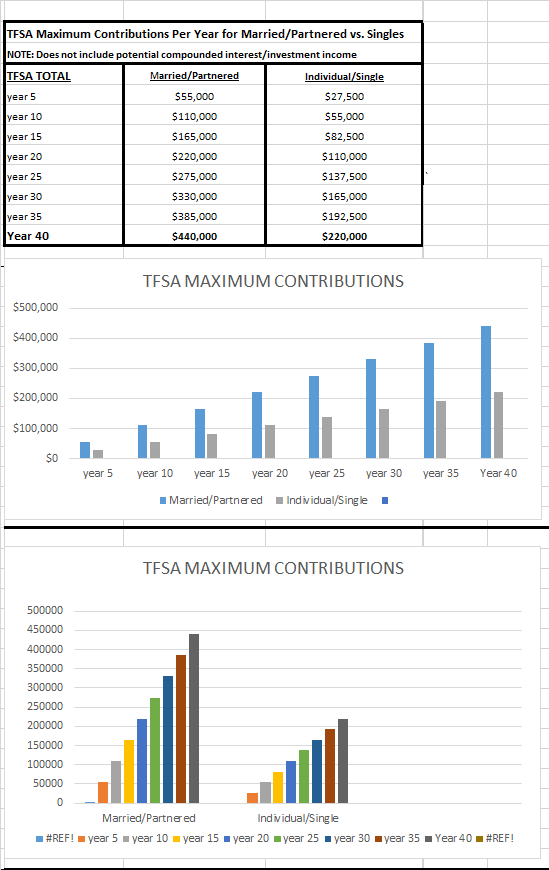

The real financial lives of singles is revealed when a simple math calculation is used for the targeted tax relief where a single senior can now earn $20,360 and a senior couple $40,720 before paying federal income tax. This so called tax relief for seniors allows federal tax relief for singles equal to $1,697 per month and for senior couples $3,393 per month. The tax relief for senior singles hardly covers a rent or mortgage payment of $1,200 and $250 for food per month (Maslow’s Hierarchy of Need), but amply covers this amount for a senior couple. For a couple $1200 for rent or mortgage and $500 for food leaves $1693 (or 50% of $40,000) for other necessities and maybe even a nice little vacation all tax free.

CONCLUSION

It is incredible how in just a few paragraphs a think-tank can undo the hard work that singles have been trying to achieve in seeking financial equality. Think-tanks and financial gurus continue to practice financial illiteracy on what it truly costs singles to live. (false-assumptions-four-ways-seniors-singles-lose out) and (financial-gurus-financially-illiterate-about-singles-finances)

Even though the final statement of the report states: “The GIS is the most effective federal mechanism in the short term for reducing the poverty rate and the impact of poverty on seniors, and it can be targeted at senior singles who need it the most”, there are many shortcomings to this report.

This report is encouraging irresponsible financial behavior. It is morally, ethically and socially reprehensible in a First world country to say that one cannot save with an income over $100,000 and to promote financial inequality and discrimination of singles.

The Broadbent Institute is supposed to be about ‘a more equal society’, so where is the financial equality?

SOLUTIONS

In order to ensure financial equality between singles (including widowers) and married/coupled persons the following measures need to be taken:

- change financial formulas so that senior singles receive 70 per cent of whatever is given to married/coupled senior persons as it costs more for singles to live than it does married/coupled persons because of economies of scale

- financial formulas should be revised to include all senior persons regardless of marital status in one financial formula. To eliminate financial silos that benefit married/coupled persons most, delete benefits already given to married/coupled persons such as pension splitting (benefits the rich most) so that there is a level financial playing field for all regardless of marital status. (It is understood that it is expensive to raise children and benefits given for children should last for first twenty years of the life of the child. However, beyond the twenty years of the children, any other benefits given to married/coupled persons should be deleted or should also be given equally to singles at rate of 70 per cent)

- create a side-by-side list of all possible benefits under categories of married/coupled, widowed and single and analyze the total value of benefits in each category (see table above). Financial formulas should be created equally for all categories, not just the married/coupled and widowed.

- delete allowance benefit that has been ruled to be discriminatory by the courts

- education, education and more education on financial literacy for singles. Think tanks, financial gurus and married/coupled people need to educate themselves on what it really costs singles to live.

(These thoughts are purely the blunt, no nonsense personal opinions of the author and are not intended to provide personal or financial advice.)