CANADA CHILD BENEFIT PROGRAM SHOWS FINANCIAL DISCRIMINATION AT ITS BEST

(These thoughts are purely the blunt, no nonsense personal opinions of the author and are not intended to provide personal or financial advice).

(boutique-tax-credits-pushing-singles-into-poverty)

From CBC News-”New Canada Child Benefit program payments” July 20, 2016 (cbc) – Analysis of new Liberal Canada Child Benefit program and old Conservative UCCB program

The old Universal Child Care Benefit or UCCB (Conservative) provided $160 per child per month for children under six and $60 per month for children aged six to 17. That money was paid out to families regardless of income level. The Conservative philosophy was that there should be some component of assistance for families that was universal. However, this benefit was to be included as income and required payment of taxes.

Conservative universal approach could be viewed as all families should receive some component of assistance. Just because they make a lot of money they should not be penalized, they should not be losing out and not getting any government benefits, (Note: only for families, ever singles don’t matter).

The new Liberal program Canada Child Benefit (CCB) begins this month and combines the CCTB and UCCB into one payment that is entirely income tested up to $190,000 of income. The new payment is also tax-free making it more expensive than the UCCB. Less than $30,000 in net annual household income generates benefit $6,500 for each child under six and $5,400 for children aged six through 17 tax free. 300,000 fewer children would live in poverty in 2016-17 compared with 2014-15. The Liberals also reduced the tax rate from 22.5 per cent to 20 per cent for middle-class Canadians earning between $44,700 and $89,401 a year. The Liberal (Trudeau) approach is that these benefits should be based on income testing. Wealthier families can carry more of the load…they don’t need additional government handouts.

Since provinces also provide some child benefits, there was concern that provinces would clawback CCB from children on social assistance. So far eight provinces has indicated they will not clawback CCB.

Illustration provided shows Ava Williams as a Toronto social worker with a net income of about $30,000, who lives in community housing. As a single mother of four children between the ages of six and 17, she says the new program will boost her old annual federal benefit payment by about $6,000 per year with added benefit of the new payment being tax free. Something does not add up for the totals given.. One wonders if she means an additional $6,000 to what she received in 2015. Assuming her net income is under $30,000 and her children all under the age of 18, it appears she will receive somewhere between $21,000 and $26,000 in child benefits, for a total net income between $51,000 and $56,000 all tax free. This is in additional to subsidized housing and other possible federal and provincial benefits such as GST/HST credits with no clawback of the benefits..

An example of additional benefits received on a provincial basis with no clawback is Alberta. In Alberta the non taxable child benefits are applied to working families with children under 18 and a net income starting at $25,500 with phasing out up to less than $41,220 per year. Total annual maximum benefits for one child could be up $1,863, two children $3,107, three children $4,073, and four children $4,762. Ava if she lived in Alberta with four children could receive total tax free federal and provincial child benefits of approximately $55,762 plus subsidized housing ($30,000 net income $21,000 CCB and $4,762 Alberta child credits). (There is no clarification on her marital status, which should not matter, but many readers wanted to know where the father was).

SYNOPSIS OF APPROXIMATELY 2500 READER COMMENTS FROM TWO NEWS ARTICLES

Approximately 2500 reader comments from two news articles were reviewed.(not number of readers, as some some readers comment many times) The majority of comments were classified into the following major categories:

-Negative comments (most were negative)

-Not happy with amounts received between new Liberal and old Conservative benefits or it is not enough

-Positive comments (very few)

-Bashing of political parties (Liberals versus Conservatives)

-Worried about future debt generated by benefits

-Many comments bashing Ava and where is the father of these children

-Other programs would be more beneficial than the child benefit program

-Program will be abused

-Benefits given for children but seniors and disabled receive much less

-Singles feel they have been left out of process and families of all types bash singles

-Divorce and death of one parent as well as other causes have impact on poverty

-Child benefits not only on federal level, but also provincial level

-In addition to benefits, should also be teaching budgeting and financial responsibility

-Immigrants

-Education

-Advantages of Child Benefits

-Benefit programs – have lots of other programs in addition to child benefit

-Eighteen years a long time for benefits

-Misconceptions about what is benefit versus welfare

-In addition to benefits, income taxes also cut for middle class

-Net worth and assets

Because of the length of the post, only issues regarding ‘Singles’ and ‘Net Worth and Assets’ will be discussed here. Other categories will appear at the end of the post for those who wish to review all other categories in their entirety.

Reader comments regarding SINGLES

Single response-We’re sending cheques to families with household incomes up to $190,000/year yet there’s nothing for the 30% of single female seniors living in poverty. There’s a number of programs for single female seniors. I’m sure though that you and I would agree that it’s not enough.

Reader response-For all you single people out there, if you want to get tax free money , you better get married and start having kids because that is the only way you will get a tax shelter.

Single response – Nobody ever wants to help single people with no kids. Ever occur to you that I have no kids because I am responsible and do not want to bring kids into a life of poverty?

Reader response – According to the left if you are single and no kids you need no help. You are well off and should pay more taxes.

Reader response -or you are selfish and don’t want to spend money on anyone but yourself.

Reader response – Don’t worry, that ‘right person’ is out there somewhere.

Reader Response -Yet other people’s kids will be the ones to take care of you when you are elderly. Don’t you think that’s worth a little bit of investment?

Single response – If the govt had money to throw away they could have reduced the tax rate for all of us, not just those who think they are poor because they gave birth to 4 kids.. Single people get NOTHING, just pay up more.

Reader response – We don’t have another human depending on us for life and those who have taken that responsibility deserve the help managing the full time obligation.

Reader response – I doubt that that is what he meant at all. A sense of responsibility is not selfishness. Having kids is one of the most important things you’ll ever do. Granted, you cannot anticipate every life outcome, but generally speaking a responsible adult has an idea of their finances, and where they expect their finances to be in future. Most adults can actually budget their grocery store purchases – I believe they can budget the price of a child. And having babies is not a right. Nobody should be under any obligation to financially support a stranger’s kids.

Reader response – You should be asking yourself why you need help if you’re single with no kids.

Reader response -And second, it’s not to say that single people with no kids can’t or shouldn’t receive support, it’s just that why would you need support for being single or having no kids? If you’re also elderly, or disabled, sick or unemployed sure, but being single and having no kids isn’t making it harder for us to live reasonably.

Single response – Hey, maybe all the poor single people – the disabled, etc., will simply die off and make room for all the government-supported kids.

Single response – as a childless middle aged man I am sick of paying for everybody’s kids, especially the Harper garbage boutique tax credits for hockey and ballet school.

Reader response – More likely you don’t get along with women very well or can’t find someone that will have your kid. Ever occur to you that poor kids may not necessarily have been born that way and that layoffs and economical hits create poor kids? That divorce also creates poor kids. Death of a spouse creates poor kids. You can be a millionaire and bring kids into the world and then have your investments tank the next day and you’re poor.

Reader response – If you are single your costs are much, much lower than if you have kids. Your contribution to the economy is also lower. When I go out to dinner my contribution is 5 times what a single person will bring to a restaurant but I still only need one table. This creates jobs as well. My kids go to swimming lessons (jobs and economic boost), they take the bus (jobs and economic boost), eat food and wear clothes and you name it. Grow up.

Reader Response – Single people do not pay more in taxes, that is a lie.

Single response – they certainly don’t get all the freebies (singles)

Reader response – I don’t think it’s that single people with no kids expect support, it’s simply that they perhaps don’t understand why people with kids should get rewarded with their tax money for having babies.

Reader response– Everyone at some point has paid taxes, not just single people. To say that only “single” taxpayers are funding tax benefit programs is hogwash.

Single response–Single and no kids myself, in my early 50s, barely able to keep a roof over my head even with a full-time job and living frugally. Where’s *my* handout/monthly allowance from the gov’t?

ANALYSIS OF COMMENTS REGARDING SINGLES

It is clear that families with children (and even some singles) are financially illiterate and have no understanding of what it costs a single person to live. Living Wage for Guelph and Wellington (2013 living wage of $15.95 per hour), a bare bones program to get low income and working poor families and singles off the street, allows a calculated living wage income for single person of $25,099 with no vehicle, food $279, transit and taxi $221 (includes one meal eating out per month). (In 2015, the living wage for Guelph and Wellington has been set at $16.50 per hour). Note, this is not Vancouver, Toronto or Calgary where living costs are much higher.

–Singles get no benefits except in abject poverty. In both Liberal and Conservative programs, families with children (including single parents) get the benefits while ever singles and divorced persons without children get nothing.

–Singles pay more. Yes, ‘singles pay more taxes’ is a false statement. Truth is that singles, person to person, pay same taxes, but get less benefits. From the time they are married until one spouse is deceased, married or coupled families with children will likely have received shower, wedding, baby gifts, possibly maternity/paternity leave benefits, child benefits times number of children, TFSA benefits times two, reduced taxes, pension-splitting, possible survivor pension benefits, and then want to retire before age 65. In certain cases some of these families will not have paid a full year of taxes. Single parents will receive child benefits and possible other benefits as well. When all the benefits that families with children receive are taken into consideration, ever singles and early divorced persons with no children do pay more.

-There is a the perception by families that a reason to have children is that they will take care of future generations. Financial responsibility implies that everyone including families should be financially paying for and taking care of themselves. Future generations do not deserve to have heavy tax burdens placed on them to finance this generation and future generations of parents and children. Likewise, financial responsibility implies that children do not deserve huge inheritances, while singles have a much more difficult time achieving same standard of living and saving for retirement as families with children.

Reader Comments regarding NET WORTH AND ASSETS

Comment-Liberals are so dumb that they don’t even know that the measure of true wealth is NOT income but net worth. Are they so stupid to think that a lot of your neighbors, who declare zero income (and I know a lot of them) but can afford Jaguars and Bentleys and multi-million dollar homes really are poor? My wife and I are middle class folks, who live in a modest townhouse in Vancouver who won’t qualify for this now because we “make” too much. Sorry, Justin Trudeau, but 150k a year in Vancouver won’t get you very far.

Comment-if you only make $30,000.00 a year, maybe stop after the second child. Kids are expensive. “According to MoneySense.ca, the average cost of raising a child to age 18 is a whopping $243,660. Break down that number, and that’s $12,825 per child, per year — or $1,070 per month. And that’s before you send them off to university.”

Comment – Take my numbers for example: Property tax in Oakville Ontario is very high. I live in a 3000 sq/ft house on a tiny 90×90 lot and property tax is $12,000 a year. Food cost for a family of 3 is about $15,000 a year, Utilities is $9000, Gas/Car/Insurance (2 cars) is $13000, Clothing/Phone/Living Expenses $8000. I am only listing off the big expenses. Not including a lot of the little things. That comes to $57,000 a year. Hardly enough to live.

Reader Response to above-That sounds more like someone living beyond their means. And taxpayers are expected to step in and assist families like yours who have a more luxurious lifestyle than most could even dream of. If you mean 3 kids, maybe, but 3 people, well, then you want too much. A family of 3 in a 3,000 sq. ft house? $300 in groceries a week for for 3 people? Did you know your taxes would be that high before you bought the house? If so, then you brought that on yourself.

ANALYSIS OF COMMENT REGARDING NET WORTH AND ASSETS

-Sense of entitlement. It is absurd how the wealthy and rich families believe they are entitled to everything (3,000 square foot house)..

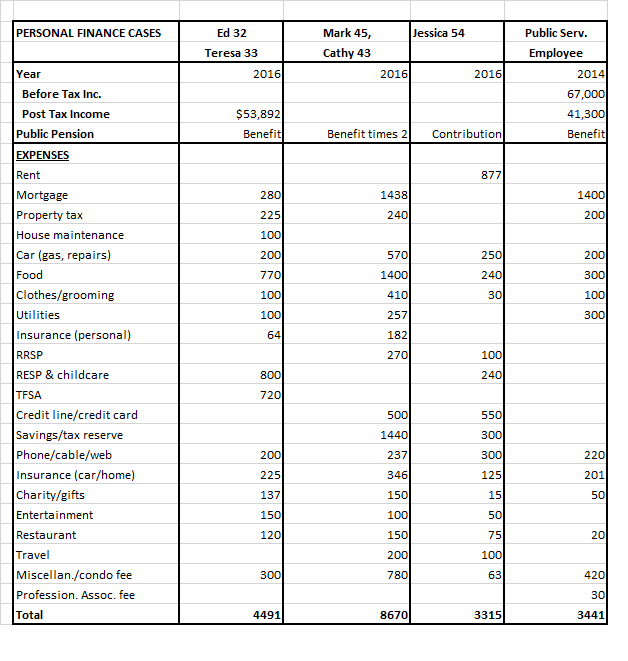

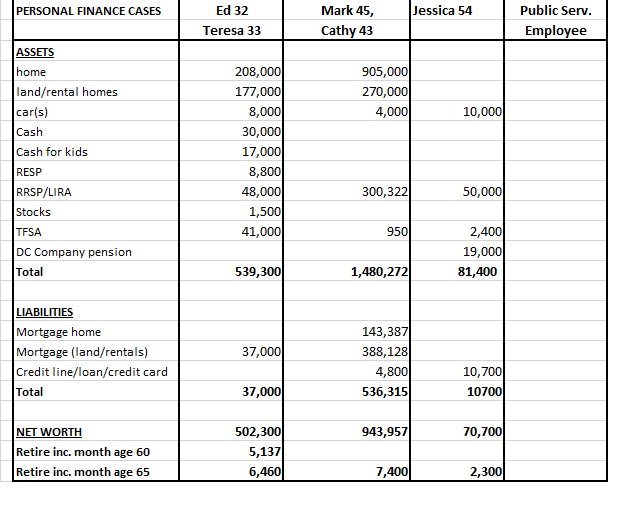

-Net worth and Assets. None of these benefit plans include elimination with high net worth and assets, so again, the wealthy and rich families are receiving benefits they do not deserve. One of our last posts (see link at top of page) showed how families with considerable assets ($500,000), one spouse working and four children under age of six would receive considerable benefits while never paying a full year of tax if they retired at the age of 60 when their youngest child turned 18.

-Middle-class families with higher income levels for child benefit program complain they don’t receive same level of benefits. Yet they refuse to acknowledge that they are the ones who would also receive the reduced tax rate from 22.5 per cent to 20 per cent for middle-class Canadians earning between $44,700 and $89,401 a year.

CONCLUSION

It is completely obscene how governments and politicians can implement programs that do not look at net worth and assets. Families units (including singles) with high net worth and assets and low (of any kind) income do not deserve to get child benefits and other wealth-creating benefits and programs.

It is also financially discriminatory when governments and politicians only include certain family units in their financial formulas. In Canada, family units with children benefit most while ever singles and early divorced persons without children get nothing. In the USA, Bernie Sanders has managed to accomplish some wonderful things for financial fairness. However, even some of his accomplishments agreed to by Hillary Clinton again target only certain family units, that is those with children (free college/university for families with incomes $125,000 or less and paid parental family and medical leave). Most politicians, whether right or left leaning, only talk about families, with most benefits given only to families. Singles are never mentioned let alone included in financial discussions and formulas. What if singles want to go to college/university to get a better wage? Why are they are not included?

Many of the reader comments correctly identify divorce and death of a spouse as having a big financial impact on family units. However, it is also irresponsible for family units to not have life insurance to cover these life circumstances. Life insurance for spousal death should be mandatory, just like car and house insurance, and should be ample enough to cover big ticket items like mortgages. Maybe divorce insurance should also be implemented and made compulsory so that ever singles are not forced to support divorced family units.

For many years there have been great universal government programs in place like public school education, and health care. For financial fairness, absurd programs like the child benefit programs need to be replaced with universal day care, government paid for college and university education (at least first couple of years of university) and affordable housing (should be available to all types of family units).Then, if wealthy families want to send their privileged children to elite private schools, day care and university, they can spend their own money to do so.

Benefit programs like income splitting and pension splitting under Conservatives are bad policy as they discriminate against singles, and the widowed and divorced (and spouses earning equal incomes). Benefit programs should focus on the poor with inclusion of net worth and asset assessments in the financial formulas.

Governments, politicians, and families need to become financially educated on what it costs ever singles and early divorced persons without children to live. All Canadian citizens deserve equal financial dignity and respect regardless of the type of family unit they are in.

Once children become ever single and early divorced without children adults, they should not become invisible and made to feel like they are no longer financially important to society. All lives matter including ever singles and early divorced without children adults.

Additional Reader Comments: click on link below:

CANADACHILDBENEFITSCOMMENTS2 (1)

(This blog is of a general nature about financial discrimination of individuals/singles. It is not intended to provide personal or financial advice).