TFSA (CANADA) – RAMIFICATIONS OF FINANCIAL DISCRIMINATION AND ABUSE OF THE PLAN

(These thoughts are purely the blunt, no nonsense personal opinions of the author about financial fairness and discrimination and are not intended to provide personal or financial advice.)

This case study outlines how a financial advisor has shown it is possible for Canadian TFSA holders with large accounts to evade paying income tax for a number of years (15) and use benefits intended for low income persons by circumventing the low income assistance programs.

HISTORY OF TAX FREE SAVINGS ACCOUNT (TFSA)

The TFSA was introduced in 2009 by Stephen Harper, Prime Minister and Leader of the Conservative Party, and Jim Flaherty, Minister of Finance.

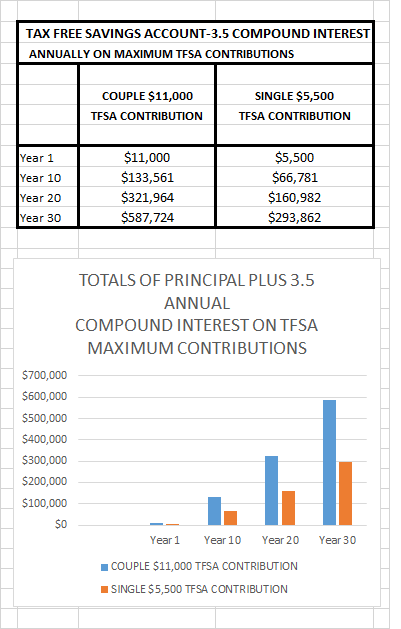

The maximum annual contribution room at present is $6,000 per year and is indexed to the Consumer Price Index in $500 increments to account for inflation. The 2015 Progressive Conservatives raised the contribution limit to $10,000 and eliminated indexation for inflation. However, the newly elected Liberal government re-implemented the pre-2015 contribution limit of $5,500 for 2016 which will be indexed for inflation after that. As of January 1, 2019, the total cumulative contribution room for a TFSA is $63,500 per person and $127,000 for couples and for those who have been 18 years or older and residents of Canada for all eligible years. Any unused contribution room under the cap can be carried forward to subsequent years, without any upward limit. There are no limits on withdrawals from TFSA accounts. TFSAs are not declared as income and, therefore, are not taxed.

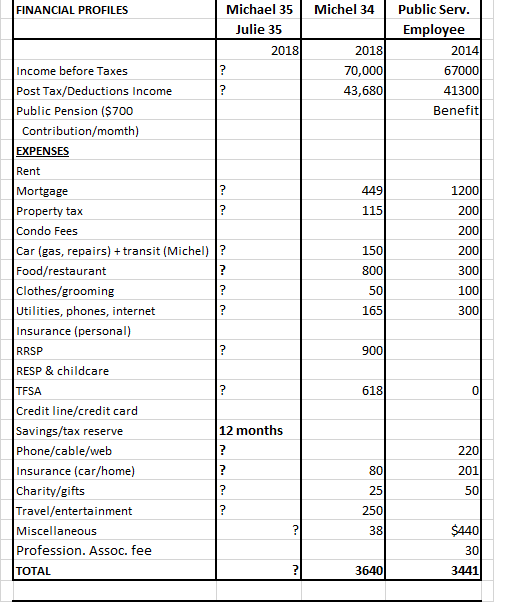

CASE STUDIES FOR COUPLE MICHAEL AND JULIE, UNATTACHED PERSON MICHEL AND UNATTACHED PERSON PUBLIC SERVICE EMPLOYEE

(1) THEY WANT TO SPEND $50,000 PER YEAR IN RETIREMENT. DID THEY SAVE ENOUGH? By Mark Seed, My Own Advisor and Owen Winkelmolen, PlanEasy) LINKS

Michael and Julie (they-want-to-spend-50000-per-year-in-retirement-did-they-save-enough) $600,000 paid for home and a million dollars in retirement savings.

Sources of Income chart for Michael and Julie (Sources-of-Income-50000-per-year-.png) – they want to retire on $50,000 per year at age 55 – shows how they can avoid paying taxes for 15 years while using benefits intended for low income persons.

Net Worth chart for Michael and Julie (Net-Worth-50000-per-year-post-September-5-2018.png) at age 100 they will still have an enormous amount of wealth, especially in TFSA accounts.

(2) ALL THE FRUGALITY IN THE WORLD WON’T LET THIS 34 YEAR OLD RETIRE AT 45 by Allen Allentuck LINK Michel (all-the-frugality-in-the-world-wont-let-this-34-year-old-retire-at-45)

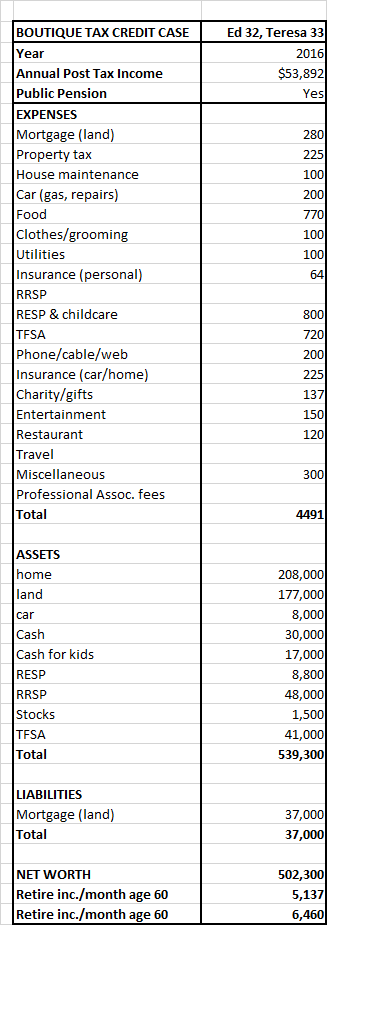

(3) PUBLIC SERVICE EMPLOYEE BASED ON THE REAL LIFE EXPERIENCE (SINGLE)

CAVEATS – Financial information for couple in this report is limited. It is difficult to determine if this is a real life case scenario or an example made up to illustrate what is possible for $50,000 retirement income. As stated in the report the investment returns for TFSA remains constant for each year which is not the case in real life. It also is not possible to assess if real estate value will go up or down. It appears the couple have no children.

Financial profile for unattached individuals – Michel’s food cost seems high (unless he requires a special diet and males require more calories). It appears he has no condo fees so he probably has expenses like condo maintenance. Public service employee profile is based on snapshots of real life experiences of unattached persons. For the most part it closely matches the financial profile of Michel. Food costs are replaced by mortgage costs.

Financial profiles are incomplete. For example, expenses like medical eye and dental care and saving for vehicle replacement are not listed.

DETAILS OF CASE STUDIES FOR MARRIED COUPLE MICHAEL AND JULIE (Ontario), AGE 35 AND UNATTACHED INDIVIDUAL MICHEL, AGE 34 (Quebec)

Retirement age – Michael and Julie want to retire at age 55. Michel wants to know if he can retire at age 45 and travel the world. Many married couples have the ability to retire at age 55. Some would say Michel’s desire to retire at age 45 is unrealistic. His financial advisor states that regardless of how frugal Michel is he will not be able to retire before the age of 60. Why is that unattached persons always have to be frugal and work longer?

Retirement income – Michael and Julie want a retirement after tax income of $50,000 at age 55. Michel’s financial advisor states he unequivocally has to work to age 60 to achieve a retirement after tax income of $40,000. There is that frugality once again!

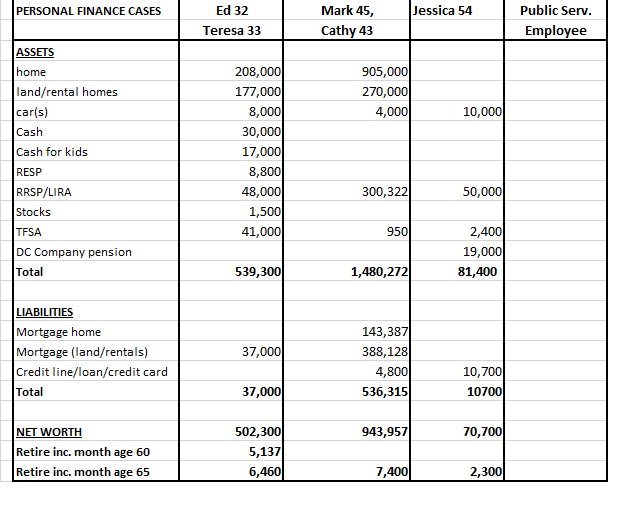

Investment Amounts at present time – Michael and Julie’s account at present time totals $570,623 in TFSA and $423,706 in RRSP. They have continually maxed out their TFSA accounts. Overall their portfolio has a 70/30 mix of stocks and fixed income. A 6% rate of return on stocks and a 2.5% rate of return on fixed income is assumed for the article. They already have at age 35 a total close to a million dollars so it is difficult to figure why the amount wouldn’t be in excess of well over a million dollars in twenty years time at age 55.

Michel has $24,329 in TFSA and $90,701 in RRSP. Calculations for retirement income are based on a 3% rate of return.

Investment Amounts at time of retirement – Estimate for Michael and Julie is stated in 2018 dollar value, not value at time of retirement, so value at retirement should be well over $1 million. Total capital estimates for Michel at age 60 are $895,000.

Housing – Michael and Julie own a $600,000 house which they expect to own outright at time of retirement at age 55. They plan on selling their home around age 80 and moving into an apartment or condo to rent. That might add $30,000/year to their expenses but they will have freed up almost $600,000 in real estate assets (minus 5% transaction fees).

Michel has a $165,000 condo. He has a $97,000 mortgage with 24 years remaining amortization. At present rates, the mortgage will be paid when Michel is 58.

Income – Michael and Julie’s income is not stated, but it must be quite high to achieve the investments and $600,000 house they have at the present time. Michel has an income of $70,000 which is well above the median and average incomes for unattached individuals.

Vehicle – Value of vehicle for couple is not stated. The value of Michel’s vehicle is $2,500 which must be pretty much a “junker”.

How Michael and Julie will achieve their goal of retirement income of $50,000 as outlined in article

Because all their retirement savings are inside registered accounts such as their TFSAs and RRSPs, Michael and Julie have a lot of control over withdrawals and allows them to reduce taxes and optimize government benefits like CPP, OAS, and GIS.

To start, Michael and Julie will withdraw just enough from their RRSP to maximize the basic tax exemption, the rest of their income will come from their TFSA. This mix of RRSP and TFSA withdrawals (with no other income sources) will help them pay virtually zero taxes for the first 15 years of their retirement. This will take them from ages 55 to ~ age 70. (In the process they will have gained almost $135,000 in benefits from paying no taxes for 15 years and reduced the income taxes on their estate to nearly zero. At time of death their investment portfolio will consists mainly of TFSA.)

There are two other ways they can optimize their taxes and benefits during retirement.

The first is to reduce their taxable income between ages 64 and 71 by drawing primarily from TFSA. By starting OAS at age 65, but delaying CPP to age 70, their TFSA withdrawals will allow them to be eligible for GIS, GAINS, GST and Trillium benefits which are supposed to be only for low income persons (definitions provided below). Between ages 65 and 72 these benefits meant for low income persons will add $108,305 to their retirement income.

The second way they can optimize their taxes and benefits is to slowly shift their RRSPs into their TFSA each year. By taking advantage of the lowest tax bracket, they can slowly draw down their RRSPs at a low tax rate and shift these investments into their TFSA. Moving money into their TFSA makes these funds easily available in the future and reduces the taxes on their final estate.

Once they reach age 65 their withdrawal rate on investment will drop dramatically as Old Age Security (OAS) and other government benefits kick in. Then it drops again at age 70 when their Canada Pension Plan benefits begin. By delaying withdrawal of CPP at 65 years to 70 years the rate of return on CPP will increase by 8.4% per year. By delaying CPP to age 70, they will receive 42% more than if taken at 65.

How Michel will achieve his goal of retirement income of $40,000 at age 60

From the article: “The problem of early retirement is twofold: Not only must one build up savings faster, but those savings have to last a longer time than they would with later retirement.

In Quebec, a man we’ll call Michel, 34, works in financial services. He earns $70,000 a year and takes home $3,640 per month after many deductions for taxes and benefits. Frugal in his spending, cautious in his investing, he wants to retire at age 45 with $40,000 income per year after tax. Assuming a 3 per cent return rate after inflation, that implies he will be able to add $1 million to present savings in 11 years. On present income, it’s unlikely.

Michel’s goals will be hard to achieve even by 50, the planner says. The earliest he can retire with a $40,000 income after tax is 60. Assuming that he can achieve and maintain a 3 per cent annual return after inflation, then in 26 years his RRSP with a present value of $90,701 and $10,800 annual contributions will have risen to a value of $612,000. With the same assumptions, his TFSA with a present value of $24,329 and $6,000 annual contributions including catch-up additions to fill space will have risen to a value of $283,800. His total capital available for retirement income will total $895,800.

Assuming a 3 per cent return before tax, his RRSP and TFSA capital at 60 would generate $40,475 per year based on an annuitized payout that would exhaust all capital and income in the following 35 years to his age 95.

If he waits until age 65 and were to draw QPP (Quebec Pension Plan) of 64 per cent of a theoretical maximum benefit of $13,600 in 2019 dollars per year at age 65, $8,704, his total income would be $49,179. Retiring early makes attaining this maximum unlikely even with scheduled increases in CPP/QPP contributions and benefits, a planned 52 per cent boost to be phased in starting Jan. 1, 2019. After 20 per cent average tax, he would have $39,343 per year or $3,280 per month. At age 65, he could add Old Age Security benefits, currently $7,210 per year for total income of $56,389 before tax. Still using the 20 per cent rate, he would have post-tax income of $3,760 per month.

Calculations show that even if Michel retires at age 60, 26 years from now, he would have to live very modestly. Retiring at 60 and starting QPP benefits with a 36 per cent discount would have a drastic cost on his total lifetime benefit from CPP. The amount he will give up each month compared to the full age 65 benefit, about $5,000 per year, will have cost him $171,500 with no compounding for the following 35 years. It is a very high price to pay for what amounts to a five year bridge to full benefits at 65.”

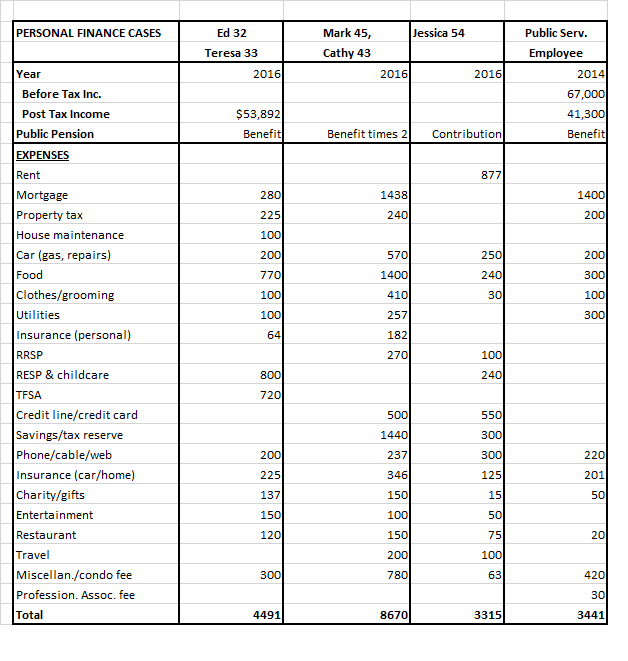

ANALYSIS OF FINANCIAL PROFILES

Housing – Couple has $600,000 house and Michel has $165,000 condo. Depending on what part of Ontario couple is from this is probably par for housing. For Michel it is possible that in parts of Quebec housing can be purchased for lower prices. However, Michael and Julie will probably have much higher investment possibilities when they sell their house versus when Michael sells his condo. One can bet that couple has a better lifestyle in their house than Michel in his condo. In many parts of Canada it would extremely difficult for an unattached individual to purchase housing under $200,000.

Accumulation of wealth – It is unmistakable that couple is able to achieve so much more in wealth than unattached individual even when unattached individual has a relatively high income and is frugal in his spending. At age 35 they are already millionaires. The net worth information in the article is not clear on how much net worth is expected to increase between present date and retirement at age 55. The Net Worth table appears to use the same net worth at present and at age 55 – about $1 million in real estate and RRSP and $600,000 in TFSA. At age 75, after paying no income tax for 15 years and using benefits that are supposed to be for low income persons, values appear to be about the same. However, what is shocking is how even though RRSP and non registered accounts have virtually been depleted at age 100 the TFSA has increased in value to over $2 million. The reader is encouraged to view the tables at the links provided above. They provide a striking picture of how income tax collection is flatlined at $0 and how net worth increases over time to age 100 instead of being depleted.

It is impossible for unattached persons, no matter how wealthy they are, to ever achieve the wealth that is possible for couples because it costs more for singles to live and they must save a greater retirement amount for one person as opposed to two persons.

Taxes – Many of the financial profiles of unattached individuals with Michel’s income show he would probably pay a rate of 20%. Couples who are able to use tax avoidance vehicles like pension splitting are often shown to pay income tax at rates as low as 10%. For Michael and Julie they are able to not pay income tax for 15 years. It is an understatement to say that couples, even wealthy ones, seem to pay less income tax because of manipulation of marital benefits, pension splitting, etc. Unattached individuals are bearing the brunt of the Canadian tax system which purposely favors married persons over unattached persons.

LESSONS LEARNED

Financial advantages of couples over unattached individuals – Just how many times can it be said that according to Market Basket Measure it costs more for unattached individuals to live than couples without children (if single has value of 1.0, the value for a couple without children is 1.4, not 2.0). Couples without children are able to maximize their net worth over unattached individuals because of marital benefits, ability to multiply wealth times two (TFSA) and compounding of investments times two. All things being equal it is virtually impossible for unattached individuals to achieve the same financial wealth as couples even though it costs more for singles to live.

TFSA outrageously is a goldmine for the wealthy and the married – TFSA has been in place for ten years. Maxed out TFSA now total $127,000 for couples and $63,500 for unattached individuals.

It is astonishing how Michael and Julie and Michel have been able to reach their TFSA amounts at present time with maxed out contributions.

It stands to reason that the wealthy are more likely to exponentially increase the value of their TFSAs especially if they are more risk tolerant in investment plans than low income persons.

Vetting of Income for GIS and other low income applications – Interest and investment income does have to be declared on low income applications. However, TFSA investments are not declared as income ever. This is what allows the wealthy to circumvent the financial restrictions on who can receive assistance the low income assistance programs.

Hypocrisy of TFSA declaration of non income – This may be harsh but TFSA not needing to be declared as income creates anger and despair for those who do not have the means to contribute to TFSA. TFSA holders who purposefully use benefits not intended for the wealthy could be called TFSA grifters or chiselers – grifters or chiselers are con artists; in this case they swindle people and governments out of money but all within legal limits of the law.

Hypocrisy of those who demonize public pensions – Many, including far right Conservatives and proponents of private enterprise versus government jobs, berate those who receive public pensions, especially defined benefit plans . Many of these persons are financially illiterate by stating the taxpayers pay for these systems. The real truth is that defined benefit plans are made up of employee, employer contributions and well managed investments.

Persons who are members of public pension plans must contribute a substantial amount (10%) of their income to the plan, pay taxes as contributors and pay taxes when benefits are received. Many who do not have a choice or choose to contribute to public pension plans cannot contribute fully to TFSAs because their incomes do not allow them to contribute to both pension plans and TFSAs.

Public pensions are not a given. They can fail if investment managers make bad decisions and if companies decide to abandon public pensions in bankruptcy.

The Canadian Pension Plan (CPP) is a defined benefit plan, so do these same beraters want to abolish CPP?

Those who are able to maximize their TFSA should also pay taxes on their TFSA investments before they demonize public pensions.

Future consequences and collateral damage if TFSA remains the same – Ability to contribute to TFSAs have now been in place for eleven years. If the plan is not changed so TFSA is declared as income and taxed then the wealth spread between the rich and poor will increase exponentially. Only the need to help the middle class is being discussed by some political parties. The middle class is already being transformed into the upper middle class and wealthy while singles and the poor (boondoggle-for-singles-and-low-income) are being pushed further into poverty by the actions of these same political parties. There will be no middle class.

Every year that goes by with no revisions to the TFSA will ensure elimination of the middle class and singles and poor families getting poorer. Every year that goes by with the upper middle class and wealthy not paying any tax on TFSA investments and these accounts growing to incredible wealth will ensure bankruptcy of the Canadian economy. How are schools, hospitals, roads going to be built if there is an insufficient tax base to support the building of these projects?

COMPARISON OF TFSA TO OTHER PLANS (how-does-the-tfsa-stack-up)

All TFSA plans are designed to supplement and manage income from other forms of savings. It appears only the USA, UK, South Africa and Canada have tax free savings plans. It also appears Canada has the most generous plan with the only limit being annual contribution limit.

The USA Roth IRA has similar contribution limits ($6,000 for those under 50 and $7,000 age 50 and over) but Americans can only make the maximum contribution if their gross income is below a specific threshold – in 2019 the threshold for unattached person modified adjusted gross income limit is $122,000 or less. Contributions limit is reduced for income between $122,000 to $136,999 and is completely eliminated for income over $137,000. For joint filers (couples) the income limit is $193,000. Contribution limit is reduced for incomes $193,000 to $202,999 or less and is completely reduced for incomes $203,000 or more. US residents have to wait a ‘seasoning’ period of five years, and be at least 59-½ years of age, before they can withdraw tax-free from a Roth IRA. TFSAs are primarily multi-purpose vehicles while Roth IRAs are primarily meant for retirement savings.

The fine print on Roth IRA contributions limits (roth-ira-contribution-limits) is that contributions cannot be more than individual’s taxable compensation for the year. That means that if taxable income is $3,000, the cap on Roth IRA contributions is also $3,000 for that year. If there aren’t any taxable earnings during the year, there can’t be any contributions. The one exception is the spousal IRA which allows a nonworking spouse to contribute to an IRA based on the taxable income of the working spouse. Roth IRA distributions aren’t included in income in retirement so are not taxable. Monies earned from investment are tax-free.

Persons age 59½ or over may withdraw as much as wanted as long as Roth IRA has been open for at least 5 years. Persons under 59½ years of age may withdraw the exact amount of Roth IRA contributions with no penalties. However, the earnings from the principal cannot normally be withdrawn prior to age 59½ without paying the 10% early withdrawal penalty.

It should be noted that the Roth IRA has an equivalence scale method built in similar to the Market Basket Measure. The couple limit of $193,000 to $202,999 is not twice that of the unattached person limit of $122,000 to $136,999.

SOLUTIONS

If Canada as a country does not want to go bankrupt as a result of tax not being collected on TFSAs it is incumbent upon government and politicians to change policies so that TFSA cannot grow to unabated levels. Also, Market Basket Measure (MBM) must be applied to TFSA formulas so that income does not benefit married persons over single unattached persons. The US Roth IRA does this. Why can’t the same be done for the Canadian plan? The US Roth IRA does not allow the wealthy over specified limits to have a Roth IRA at all. Also, change the plan so that only contributions can be withdrawn early without penalty like the Roth IRA. Lastly, the nonsensical ability to withdraw contributions from the plan and then at a later top them up again benefits only the wealthy. Once a contribution is made it should be not able to be topped up again when withdrawn.

Donald Trump’s ignorance on MBM and similar equivalence scale measures is demonstrated by his income tax amount reductions to double for couples to that of unattached persons instead of applying equivalence scale values of 1.0 for singles and 1.4 for couples.

It is unfathomable that Stephen Harper, an economist and Leader of the Progressive Conservatives and the PC Party, would not have taken into account the future ramifications and collateral damage that this plan would cause in creating every widening separation of the rich from the poor as the years go by.

How do governments and politicians change discriminatory financial plans that have been in place for many years without backlash from the privileged and those who feel entitled even with the discrimination? Which political party will take this on?

For God’s sake, politicians, political parties and those who demonize social programs need to educate themselves on costs of living for unattached persons and poor families versus wealthy couples and consider full ramifications of how to avoid financial discrimination now and into the future. If heed is not taken to the above then be prepared for the anger as has already been displayed by the poor throughout the world. You have been forewarned!

DEFINITIONS

GAINS – Ontario Guaranteed Annual Income System may provide a monthly, non-taxable benefit to low-income seniors to between $2.50 and $83 in 2018.

GIS benefit – Guaranteed Income Supplement provides a monthly non-taxable benefit to Old Age Security (OAS) pension recipients who have a low income and are living in Canada.

GST credit – The goods and services tax/harmonized sales tax (GST/HST) credit is a tax-free quarterly payment that helps individuals and families with low and modest incomes offset all or part of the GST or HST that they pay. It may also include payments from provincial programs.

Trillium benefits – Ontario Trillium Benefit combines three credits to help pay for energy costs as well as sales and property tax: Northern Ontario Energy Credit, Ontario Energy and Property Tax Credit, Ontario Sales Tax Credit. Beneficiaries need to be eligible for at least one of the three credits to receive the benefit.

(This blog is of a general nature about financial discrimination of individuals/singles. It is not intended to provide personal or financial advice.)