REGRESSIVE TAX EXPENDITURE MISCONCEPTIONS INCLUDING GOVERNMENT DIVIDEND CHEQUES

(These thoughts are purely the blunt, no nonsense personal opinions of the author about financial fairness and discrimination and are not intended to provide personal or financial advice.)

This opinion letter was originally submitted in abbreviated format to a local newspaper in response to a reader opinion letter. It emphasizes the bizarreness of Conservatives who don’t see Alaskan natural resources dividends as being equivalent to a basic income program, view dividend cheques to be a right, not a privilege (while touting individual responsibility), and have no problem with receiving these monies even for children who haven’t worked for it or paid taxes.

The blog post ‘Money Benefit Programs Financially Benefit Married/coupled Persons and Families More Than Singles’ highlighting Alaska Permanent Fund Dividends was originally published several years ago and has been reproduced in its entirety at the end of this post.

RE: READER OPINION LETTER ON ALASKA PERMANENT FUND DIVIDEND (PFD)

(Alaskan dividend program was established by the Republican (conservative) party in 1976. From 1996 to 2015, the benefits have ranged from a low of $846 to a high of $2,072 annually. For a family of four the twenty year total amounts to $113,156, and for a single person household the amount is $28,289. A lot more can be done with $113,000 than $28,000. And, all is not as rosy as it seems. Alaska also has concerns about excessive government spending (pfd-effect). For the third straight year, dividends would be more than $1,000 less than they would be under the previous formula written into state law).

The reader opinion letter, while stating Klein and related Conservative ilk took money out of voter pockets, also implies that it is better that every Alaskan man, woman, and child has received $43,000 in annual dividend cheques since 1982 – 2017 amount was $1,100. Single person household would have received $1,100, lone parent with child or married with no children $2,200, two adults, one child $3,300 and two adults, two children $4,400. You figure out what each household would have received over twenty years during lifecycle of rearing children.

The same truth applies to Klein $400 bucks. A family with eight children received $4,000 while single person received $400 (this is a true story).

Why is it that Conservative families are always in the business of making more money for themselves, but tout individual responsibility? Why should children, like a one day old infant receive dividends when they haven’t paid any taxes or contributed to getting those resources out of the ground? Instead, they are consuming resources such as education without contributing to them by paying taxes.

It doesn’t matter whether it is dividend cheques, Klein ‘bucks’ or natural disaster relief funds (fire-disaster-assistance). When children are treated financially equal to adults, single adults will always be the losers even when they have worked more than forty years, not used EI or maternity/paternity benefits, paid education taxes when they have no children, etc. Families with children are receiving government transfers that singles don’t receive.

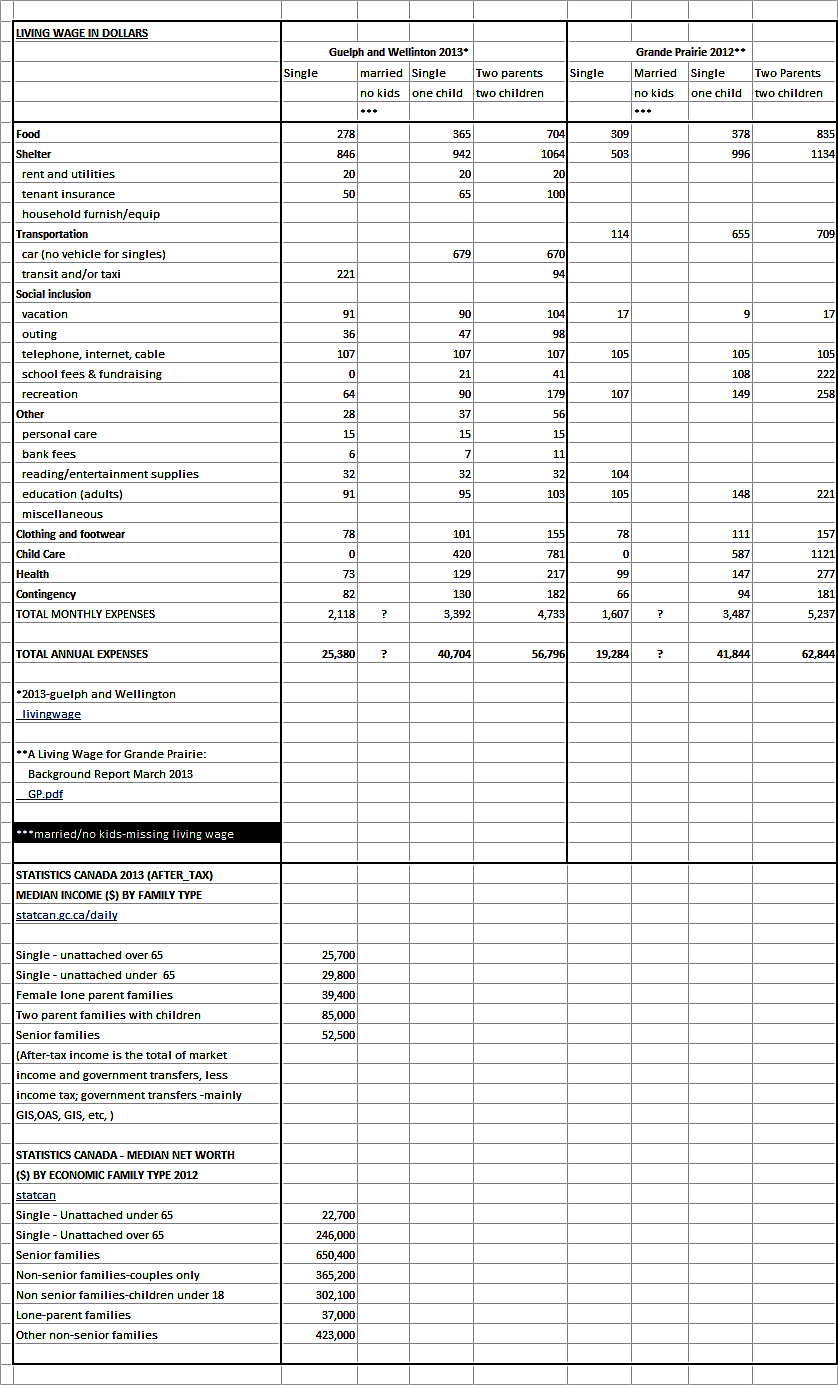

Financial fairness for all Canadians, regardless of marital or child status, will only be achieved when Market Basket Measure and net worth and assets are included in financial formulas. The Canada Child Benefit is financially fairer than natural resource dividends (good thing for lone parents and poor families). The Market Basket Measure cost of living scale counts an unattached individual as 1.0, and adds 0.4 for the second person (regardless of age), 0.4 for additional adults, and 0.3 for additional children. The addition of an adult or child to household does not double or triple the cost of living, but adds smaller percentage to it.

It is time for politicians, married persons and families to stop the financial cherry picking and gaslighting. Instead of spreading half truths it is time to develop fair financial formulas based on MBM and net worth irrespective of what political party person belongs to.

ANALYSIS OF REGRESSIVE TAX EXPENDITURES SUCH AS DIVIDEND CHEQUES

Critical common sense thinking highlights the fallacies of Conservative thinking which they, themselves, cannot see.

- Conservatives don’t see Alaskan dividends as equivalent to basic income programs and they don’t see this as equivalent to socialist programs. Doug Ford, since coming into power as Ontario Conservative Premier, has broken his promise by deleting the basic income pilot program authored by the outgoing Liberal Party. Alaskan dividends are as socialiastic as any basic income program.

Karl Widerquist and Michael W. Howard on Alaskan dividends (see blog article below) state: ‘It provides a model of cash transfers to individuals without any stigma of dependence, fraud, waste, or failure—attributes often attached recipients of other government cash transfers. The PFD funding source in natural resources rather than in taxes on individual income or wealth seems to exempt its recipients from any need to justify their use of the dividend, and to exempt the transfer as a whole from the ‘socialist’ label….’

- Alaskan dividends are paid irrespective of any income from other sources and does not require the performance of work or the willingness to accept a job if offered. Unlike social assistance programs, it is not means-tested. Surely, this should rile up Conservatives who continually talk about personal responsibility and denigrate the poor as being lazy. Conservatives never want to raise the minimum wage.

- Conservatives just don’t get that Alaskan dividends are a regressive tax expenditure. Karl Widerquist and Michael W. Howard state: ‘the PFD together with the elimination of the state individual income tax that was part of its founding has an overall regressive effect on income distribution. To have a significant redistributive effect, the PFD would have to be recouped from wealthy individuals; in the absence of a progressive state income, consumption, or wealth tax, the PFD would have to be distributed on a sliding scale with larger dividends given to those with less income from other sources, rather than as a uniform flat payment….’

- Alaskan dividends are paid out to individuals rather than households. Payouts based on Market Basket Measure (MBM) or OECD Equivalence scales (equivalence-scales) would be financially fairer and would spread monies over a longer period of time.

- What about those states or provinces that do not have natural resources? How do they handle progressive versus regressive tax expenditure? The answer is through taxes and social justice programs.

- It has been argued that it is preferable to have dividends from natural resources be distributed broadly rather than end up in the pockets of only a few corporate executives, wealthy shareholders, and political cronies. However, dividends distributed without marital status, number of children, income and net worth and assets consideration still means there will be an uneven distribution of dividends benefiting wealthy the most.

REPRODUCTION OF PREVIOUS BLOG POST

MONEY BENEFIT PROGRAMS FINANCIALLY BENEFIT MARRIED/COUPLED PERSONS AND FAMILIES MORE THAN SINGLES

Married/coupled persons and families often receive ‘free money’ benefits that financially benefit them much more than singles.

Two very good examples of these benefits are the Alaska Permanent Fund Dividend and the ‘Ralph Klein $400 Bucks’ Program.

Alaska Permanent Fund Dividends

The Alaska Permanent Fund Dividend (PFD) program implemented in 1982 is an annual payment paid to individuals (children as well as adults) rather than households. It is paid irrespective of any income from other sources and does not require the performance of work or the willingness to accept a job if offered. Unlike social assistance programs, it is not means-tested.

The book “Alaska’s Permanent Fund Dividend: Examining Its Suitability as a Model”, edited by Karl Widerquist and Michael W. Howard states the following:

‘…..In 2008, when the PFD reached its highest level at $2,069, the individual poverty threshold in the United States was approximately $11,000; for a family of four it was approximately $22,000. Thus, at its highest level, the PFD would have provided less than 20 percent of the income necessary for an to individual to reach the poverty threshold, but almost 40 percent of the income necessary for a family of four to reach the poverty threshold……Thus, on basis of its level alone, the PFD is at best a partial basic income…

Finally, because of its flat and universal nature, the PFD on its own makes a very modest contribution to the reduction of inequality. But the PFD together with the elimination of the state individual income tax that was part of its founding has an overall regressive effect on income distribution. To have a significant redistributive effect, the PFD would have to be recouped from wealthy individuals; in the absence of a progressive state income, consumption, or wealth tax, the PFD would have to be distributed on a sliding scale with larger dividends given to those with less income from other sources, rather than as a uniform flat payment….

The PFD does serve as an excellent model for the conceptualization of natural resources as commonly owned—an important step along the path to acceptance of the idea of a basic income. It provides a model of cash transfers to individuals without any stigma of dependence, fraud, waste, or failure—attributes often attached recipients of other government cash transfers. The PFD’s funding source in natural resources rather than in taxes on individual income or wealth seems to exempt it recipients from any need to justify their use of the dividend, and to exempt the transfer as a whole from the ‘socialist’ label….’

It has been argued that it is preferable to have oil profits distributed broadly rather than end up in the pockets of only a few corporate executives, wealthy shareholders, and political cronies.

Alaska is the only state that does not collect sales tax or levy an individual income tax on any type of of personal income, either earned or unearned. Every Alaskan, children as well as adults, receives a payment each year from the Alaska Permanent Fund Corporation. The USA does not have child benefits, although there is a child tax credit system for parents or guardians of children under 17 who meet certain requirements. (The PFD is taxable by the Federal government).

Further review of information shows that in 2002, the poorest 20% of Alaskans relied on their dividend for 25% of their total income….some Alaskans depend on their dividend for up to a quarter of their yearly income, especially Native Alaskans, who make up 15% of the population. Those in poverty brackets and many of those living a subsistence lifestyle cannot afford to lose the dividend as a source of income.

However, review of articles on this program also states that the sense of entitlement has been established where it is very difficult to reduce state spending in this particular benefit at the expense of politicians losing their jobs, because state residents view these dividends as ‘rights’, not ‘privileges’.

One could argue that monies are being given to children who have not earned that privilege. They have earned no money and have not paid any taxes.

If one looks at the PFD contributions over a twenty year period (lifetime of a family with children) in comparison to singles /individuals, the financial unfairness becomes apparent very quickly. From 1996 to 2015,the benefits have ranged from a low of $846 to a high of $2,072 annually. For a family of four the twenty year total amounts to $113,156 and for a single person household the amount is $28,289. A lot more can be done with $113,000 than $28,000.

Prosperity Bonus (‘Ralph Klein $400 Bucks’) Program

The Prosperity Bonus, also nicknamed Ralph (Premier of Alberta at that time) bucks, announced in September 2005, was the name given to a program designed to pay money back to residents of the province of Alberta as a result of a massive oil-fuelled provincial budget surplus. This program gave $400 to every citizen of Albertan in the year 2005.

For a family of four, the benefit was $1,600, while a single/individual received $400.

ANALYSIS

‘Free Money’ Benefits allow families to achieve greater wealth than singles/individuals even though the children of these families have not earned any income or paid any taxes. Married/coupled persons without children also achieve greater financial benefits because of accumulated assets times two.

SOLUTIONS

To achieve greater financial equality between singles/individuals and married/coupled persons and families, the following suggestions are submitted:

- Eliminate children from these programs until they reach the age majority since they have not made any contributions to the coffers in the form of salaries or taxes; rather, they are using resources such as education instead of contributing to them.

- Top up benefits to singles at rate of 1.4 Market Basket Measure to that of married/coupled persons as it costs more for singles to live than married/coupled persons living as a single unit.

(This blog is of a general nature about financial discrimination of individuals/singles. It is not intended to provide personal or financial advice.)