‘GASLIGHTING’ (FINANCIAL) OF SINGLES, THE POOR, MILLENNIALS AND OTHER DISADVANTAGED PERSONS

(These thoughts are purely the blunt, no nonsense personal opinions of the author about financial fairness and discrimination and are not intended to provide personal or financial advice.)

This post addresses financial gaslighting which seeks especially to spread financial untruths about the disadvantaged such as singles, the poor and minorities. Two articles at the end of this post give the history of gaslighting and how it affects society.

WHAT IS GASLIGHTING?

From Wikipedia ‘gaslighting’ is a form of manipulation that seeks to sow seeds of doubt in a targeted individual or in members of a targeted group, hoping to make them question their own memory, perception, and sanity. Using persistent denial, misdirection, contradiction, and lying it attempts to destabilize the target and delegitimize the target’s belief.

GASLIGHTING OF THE DISADVANTAGED-EXAMPLES

Middle class definition – Middle class rhetoric says middle class are financially doing poorly, but rhetoric doesn’t include the poor. Gaslighting occurs when the wealthy won’t admit they are rich.

Poor create their own poverty – Dr. Ben Carson, who grew up in poverty and Trump appointee as USA Secretary of Housing and Urban Development, has made statement that the poor create their own poverty. This statement is so false, in fact poverty is created for them and they are forced deeper into poverty by decisions and policies of the wealthy, right leaning politicians and society in general.

Children are expensive – Real truth is housing is biggest lifetime expense, not children (at present time though things could change if housing prices drop significantly). Monthly $1000 rent over sixty year adult lifespan to age 80 equals $720,000 negative net worth, seventy year adult lifespan to age 90 equals $840,000, eighty year adult lifespan to age 100 equals $960,000. Home purchases and child expenses occur only over twenty to twenty five years. While home purchasers may have child expenses they are also accumulating wealth, renters aren’t.

Even one right wing think tank, Fraser Institute, has published article describing why children basic costs are gaslighted and conflated by making them higher than they really are because poor budgeting principles are applied in establishing the costs. They state cost of raising children per year only costs between $3,000 and $4,500 (cost-of-raising-children). Statement from second article provides further explanation: (explaining-cost-raising-children)

“Families are generally left free to decide how to raise their children and how much to spend. And families at all income levels have successfully raised children and continue to do so. Most of us will know friends and colleagues who were raised in lower income families. The amount you spend on your child is not the measure of the quality of your parenting. It would be a shame if we discourage prospective parents by insisting that it costs $12,000 to $15,000 (or more) per year to raise a child.”

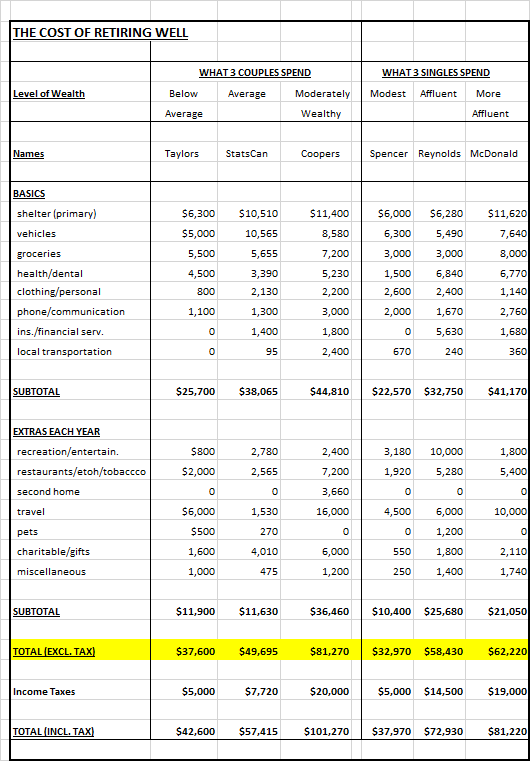

Singles are told it costs them less to live – Families and married or coupled households without children believe it costs them more to live, one major factor being they are uneducated in the financial realities of what it costs ever singles (never married, no kids) to live. Gaslighting occurs when households believe married or coupled households have double the expenses and families with two adults and two children have four times the expenses. However, Low Income Cutoff (LICO) (cost-of-living) and Market Basket Measure (MBN) show if single person is given a value of 1.0, expenses for married or coupled households are 1.4 and for two adult, two children households around 2.0 or 2.2.

Gaslighting of definition of what family is – An example of singles not being included in family definition is a chart showing family unit description of five stages of family unit life cycle comprised of childhood, early adulthood, married and rearing of children, empty nest and senior stages. It is disconcerting to note that this chart did not include ever singles (never married, no kids) in the family unit. After the childhood and early adult stages, singles were not included and were, in fact, invisible in the family unit chart. Financial gurus often talk about singles, when they really are talking about widowed persons resulting in ever singles being left out of the discussion and false financial advice being perpetuated.

Gaslighting of millennials and future generations – In present political situation future generations are in for a huge financial shock re paying for the financial excesses that have been given to previous generations. Some of their parents will have been able to accumulate significant wealth in their homes and egregious benefits like Tax Free Savings Accounts (TFSA) and pension splitting not paid for because insufficient tax has been collected to pay for this financial wealth.

Their parents say they want to leave something to their children, but children will be getting less because they will have to pay the taxes their parents didn’t pay. An example is TFSAs. When one spouse is deceased TFSA will be transferred to surviving spouse with no taxes deducted. However, when TFSA is transferred to children as an inheritance taxes will be deducted, some at a very significant rate if TFSA amount is substantial.

Square footage of housing for future generations is getting smaller and smaller. Millennials apparently are saying they don’t want live in the McMansions of their parents but it is unrealistic to think anyone will be happy living in 100 or 200 square foot apartments. It is inhumane to stick anyone into housing that is the size of two jail cells.

Present political financial policies are ensuring benefits and tax loopholes are benefiting wealthy and married and coupled households more while pushing singles and poor households further towards poverty.

LESSONS LEARNED

Shea Emma Fett wrote in Everyday Feminism:

“I believe that gaslighting is happening culturally and interpersonally on an unprecedented scale, and that this- gaslighting- is the result of a societal framework where we pretend everyone is equal while trying simultaneously to preserve inequality”.

The financial gaslighting phenomenon appears to be a result of an ‘only me is important’ thinking and lack of critical and balanced thinking on how financial issues affect all segments of society, not just the middle class, married or coupled persons and families with children. This financial dysfunction is perpetuated by political systems where vote getting appears to preserve the thinking that they are trying to ensure everyone is more financially equal while simultaneously preserving financial inequality. Financial policies may appear to help low income persons, but same policies also make the rich even richer (Tax Free Savings Accounts). Charity has become an ever increasing gaslighting method of helping the poor, but charity only masks poverty, it does not solve causes of poverty.

SIX REASONS WHY MARRIED/COUPLED PERSONS ABLE TO ACHIEVE MORE FINANCIAL WEALTH (POWER) (reasons).

TWO ARTICLES ON HISTORY AND MEANING OF GASLIGHTING

From Theater to Therapy to Twitter, the Eerie History of Gaslighting by Katy Waldman (history_of_gaslighting) – the following are excerpts from the article which gives a history and discussion of gaslighting.

‘In the 1938 play Gas Light a felonious man seeks to convince his wife that her mind is unraveling. When she notices that he’s dimmed the gaslights in the house, he tells her she is imagining things—they are as bright as they were before. The British play became a 1944 American film starring Ingrid Bergman as the heroine, Paula, and Charles Boyer as Gregory, her abusive, crazy-making husband.

A match struck; a metaphor flickered to life. Gas Light reminded viewers how uniquely terrifying it can be to mistrust the evidence of your senses. Flame made an evocative figure for Paula’s consciousness—her sense of self guttering when Gregory insisted she hadn’t seen what she saw.

Today to gaslight means to overwrite someone’s reality, to manipulate her into believing she’s imagining things…..Prototypical gaslighter. The term can attach to anything surreal enough to make you question your sanity, like the political news cycle, but gaslight arose from psychoanalytic literature, where it described a specific “transfer” of psychic conflicts from the perpetrator to the victim. In a 1981 article called “Some Clinical Consequences of Introjection: Gaslighting,” psychologist Edward Weinshel sketched out the dysfunctional dance: One person “externalizes and projects,” while the other “incorporates and assimilates.”…..Shea Emma Fett wrote on Everyday Feminism, “I believe that gaslighting is happening culturally and interpersonally on an unprecedented scale, and that this is the result of a societal framework where we pretend everyone is equal while trying simultaneously to preserve inequality.” Members of minority groups that face stereotypes about poor mental competence are seen as especially vulnerable.

Gaslighting identifies a real phenomenon: the way critics of a line of thought sometimes try to discount the perceptions of the person producing that thought. Gaslighting equals misdirection, distraction, and the deliberate denial of reality……Donald J. Trump is more than a flickering gaslight (or gasbag)—he’s the Great Chicago Fire of 1871. Republicans are moths in his flame.’

The Economic Gaslighting of a Generation by Anastasia Bernoullli (describes herself as an aging millennial) – following paragraph is a excerpt of an excellent worthwhile to read article (the-economic-gaslighting-of-a-generation):

“We are acting like a nation, and a generation, that feels guilty over screw-ups we did not commit. I obviously support the idea that everybody should live within their means, pay their bills, and be generally responsible, but when you’re doing your best, and you still can’t make ends meet, despite working full time, that’s a society problem, not a you problem. We need to overcome the lifetime of financial gaslighting we have received. Honestly take a look at your spending, and see if you’re as stupid as you’ve been lead to believe you are. I think it will be eye opening.”

(This blog is of a general nature about financial discrimination of individuals/singles. It is not intended to provide personal or financial advice.)