TAX FREE SAVINGS ACCOUNT (TFSA) DESIGNED TO MAKE MARRIED AND WEALTHY EVEN RICHER

(These thoughts are purely the blunt, no nonsense personal opinions of the author about financial fairness and discrimination and are not intended to provide personal or financial advice.)

Tax Free Savings Accounts (TFSA) have been previously been addressed in this blog (boondoggle). However, what has not been addressed is how financially discriminatory TFSAs are to senior single person (never married) and poor family households in terms of benefits like Old Age Security (OAS) payouts and surviving spouse benefits. Discussions of financial benefits by media and think tanks for TFSAs usually only occur as a single entity unto themselves, but not TFSAs impact on total financial formulas. Assessment of OAS benefit payouts and surviving spouse (widowed) benefits need to include assets such as TFSAs since wealthy do not need and do not deserve OAS support.

History of TFSAs

The Federal Conservative Party brought in TFSAs in 2009 beginning with $5,000 maximum contribution per eligible person per year. In 2015, the Conservatives raised maximum contribution to $10,000. The Federal Liberal Party, when they came into power dropped maximum contribution to $5,500. Withdrawals from TFSA do not affect the total TFSA maximum contribution amount. TFSA can be topped to maximum contribution amounts even with withdrawals. (Thank goodness, $10,000 contribution limit was dropped to $5,500-maintaining $10,000 amount would have meant married/coupled household contribution limits rising to $120,000 to date, $240,000 in twenty years and $360,000 in thirty years-single person households would be half of these amounts).

Also, many TFSA holders with modest incomes have a spouse with higher income. Their family’s total income can be much higher, and TFSA rules permit a high-earning spouse to contribute to both their own and their lower-income spouse’s TFSA-each up to the $5,500 annual limit, for a total of $11,000 per couple.

As expected, TFSAs benefit married/coupled households and wealthy over single person households and poor families since they do not have the same financial ability to maximize contributions. Also, less tax revenue will be generated by governments as a result of TFSA implementation since TFSAs are not considered to be income.

“Why TFSA doubling will exacerbate income inequality” article states: (tfsa-inequality)

‘Using Statistics Canada’s Survey of Financial Security for 2012, a radically different picture emerges of the TFSAs tilt toward higher incomes. This survey provides a revealing view of TFSA patterns at the level of family incomes rather than individual incomes, and it also reflects the increasing size of account balances with family income.While households including unattached persons with total incomes below $60,000 constituted 52 percent of all families, they held only 31 percent of all TFSA balances in late 2012-less than half the share of TFSAs based on individual incomes. At the other end of the income spectrum, only 4.4 percent of families had incomes of $200,000 and higher-but they held more than triple that share of all TFSA balances at 15 percent.Upper-income families enjoy TFSA tax savings to an even more unbalanced degree than those statistics might suggest: they typically generate higher investment returns on their TFSA assets than lower earners, and they avoid the higher personal tax rates that would otherwise apply on the income from assets shifted into their tax-free accounts.’

TFSAs maximum contribution amounts to date: Every eligible Canadian got $5,000 of new contribution room each year from 2009 to 2012. For the years 2013 and onwards, the amount is $5,500 except for year 2015 when the limit was $10,000 per person. To 2017, the total eligible amount per single person household is $52,000. For married/coupled household total eligible amount is $104,000.

The above information only deals with TFSAs as a single entity of financial formulas for households. What is not mentioned is the impact TFSAs (not counted as income) have on other income sources for single person versus married/coupled households.

TFSA Benefits Married/Coupled Households and Wealthy Most for OAS and Total Income

Contributions to a TFSA come from after tax income and are not deductible for income tax purposes. Any amount contributed as well as any income earned in the account (for example, investment income and capital gains) is generally tax-free, even when it is withdrawn. When withdrawals occur, contributions can still be made up to maximum TFSA contribution room. Therefore, it is possible to have huge TFSA accounts and still receive full Old Age Security (OAS) supplements without OAS clawbacks (oas-clawback-outrageously-beneficial addendum) and oas-clawback-outrageously-beneficial). The clawback of OAS benefits in 2016 starts with a net income per person of $73,756 (couple $147,512) and completely eliminates OAS with income of $119,615 (couple $239,230). OAS is supposed to support those with low incomes, not the wealthy. Furthermore, even while receiving OAS times two for married/coupled family unit, each spouse can still contribute $11,000 per year to TFSA accounts and pay less tax because they can pension split.

TFSA Benefits Surviving Spouse over Singles

A TFSA holder can name a spouse or common-law partner as the “successor holder” in the TFSA contract. On the death of the holder, the spouse becomes the new holder, keeping the tax exempt status of the TFSA. This will not affect the TFSA contribution room of the spouse. The Income Tax Act only allows the tax exempt status of the TFSA to be passed on to a spouse or common-law partner who is a successor holder, which differs from a beneficiary. If some other person is named as a beneficiary of the TFSA, the account will no longer be a TFSA.

If a surviving spouse/common-law partner receives proceeds from the TFSA, the proceeds can be used to make an exempt contribution to the survivor’s TFSA, and not affect the contribution room of the survivor, as long as it is done before the end of the first calendar year following the holder’s death (rollover period), and it is designated as an exempt contribution in the survivor’s income tax return for the year the contribution was made (taxtips).

So, if spouse is deceased in 2017, in future years surviving spouse (widowed) through exemption can:

- keep all of previous TFSA proceeds achieved as a married/coupled household

- accumulate investment income on total TFSA achieved as a couple

- continue to make full TFSA contributions as single person household.

Potential Investment Income

If one considers that earning potential for the wealthiest occurs for thirty years between ages of 30 to 60, then in 2017, the TFSA potential principal for married/ coupled household is $100,000+, in 2027, $200,000+, and in 2037, $300,000+ not including investment income.

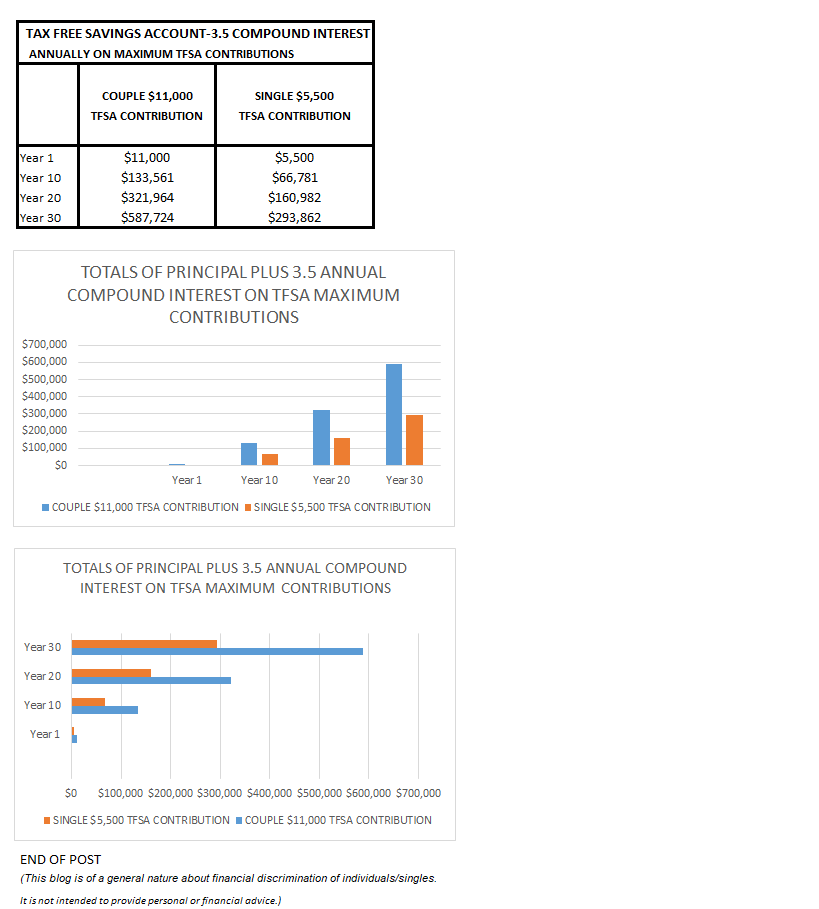

Using the ‘rule of 72’, a simple calculation of possible investment income is as follows: money invested at 7% will double in 10 years, if invested at 10% it will double in 7 years. A modest and achievable interest of 3.5% annually means money will double in about twenty years.

If $11,000 TFSA is invested for one year at 3.5% annual interest, it will double in about twenty years to $22,000. If $11,000 is invested every year for 30 years at a 3.5% return, it will be worth $568,893. These simple examples show the potential TFSA principal and investment asset for a surviving spouse whose partner is deceased after thirty years, all of which is tax free and will not affect OAS if income is less than $73,756 per year as the survivor spouse.

CONCLUSION

There can be no doubt TFSAs benefit widowed, married/coupled households and the wealthy over single person and poor family households. To correct the financial inequality and discrimination, a cap needs to be placed on total monies in TFSA accounts. Clearly, financial formulas need to be revised to include assets such as TFSAs before OAS payouts are allowed. To compensate for huge TFSA assets for widowed, married/coupled households and the wealthy, OAS payouts should be reduced or eliminated from these households, and transferred to single person and poor family households below certain income thresholds. Regardless of marital status (single, divorced, widowed, or married) all retirement security programs such as OAS should include assets, not just income as determination of eligibility for OAS.

GRAPHS SHOWING PRINCIPAL AND INTEREST ON MAXIMUM TFSA CONTRIBUTIONS FOR MARRIED/COUPLED HOUSEHOLDS VERSUS SINGLE PERSON HOUSEHOLDS

See next page.