CAUSE AND EFFECT OF FINANCIAL POLICIES PROMOTING FINANCIAL DISCRIMINATION OF SINGLES AND THE POOR

(These thoughts are purely the blunt, no nonsense personal opinions of the author about financial fairness and discrimination and are not intended to provide personal or financial advice.)

This blog has attempted to describe some of the many government, politician, business and family financial policy decisions that lead to financial discrimination of singles and the poor.

The question that can be asked is: “Is there a cause and effect relationship to these decisions?”

From Wikipedia and other online sources (study) the definition of ‘cause and effect’ is follows: – Causality (also referred to as causation, or cause and effect) is the agency or efficacy that connects one process (the cause) with another process or state (the effect), where the first is understood to be partly responsible for the second, and the second is dependent on the first. In general, a process has many causes, which are said to be causal factors for it, and all lie in its past. An effect can in turn be a cause of many other effects.

A cause-effect relationship is a relationship in which one event (the cause) makes another event happen (the effect). One cause can have several effects. Cause-Effect Criteria – In order to establish a cause-effect relationship, three criteria must be met. The first criterion is that the cause has to occur before the effect. If the causes occurred before the effects, then the first criterion is met. Second, whenever the cause happens, the effect must also occur. Consequently, if the cause does not happen, then the effect must not take place. The strength of the cause also determines the strength of the effect when criterion two is met. The final criterion is that there are no other factors that can explain the relationship between the cause and effect.

A cause is why something happens. An effect is what happens.

While no scientific ‘cause and effect’ relationship (i.e. fishbone diagrams) has been applied in this blog, certainly many of the financial discriminatory effects of policy decisions (or causes) have been described. Some of these effects are listed below.

Boutique tax credits

- Every political party has introduced tax credits to give financial benefits to certain members of the population more than others. June 16/16 (credit)

Business policies

- Financial decisions by businesses such as not wanting to have minimum wage increase and not wishing to pay proposed increase of CPP employer contributions continue to help disintegrate the financial well being of singles and the poor. Sept. 12/16 (canada-pension-plan)

CPP

- Financial discrimination of the CPP plan. Aug 31/16 (plan)

CPP enhancements

- Financial discrimination of CPP enhancements includes higher income earners only paying 8 percent instead of 11 percent CPP contributions on earnings between $72,000 and $82,700. Sept 12/16 (canada-pension-plan)

Family tax credits

- Marital manna and family tax credits given over the years have continually increased the financial discrimination of singles and the poor. Many of these benefits have been implemented by the Federal Conservative government over the last decade and perpetuated by the Federal Liberal party since coming into power in 2015 as well as provincial parties. Aug 2/16 (credits)

Housing Affordability

- Just 1,048 new affordable housing units in Calgary have been built over the past 14 years; the need for affordable housing was great in 2002 and it remains so today (most of these years were under provincial forty year reign of the Conservative party). July 17/16 (housing)

- Homelessness – Two thirds of shelter beds in Canada are filled by people who make relatively infrequent use of shelters and are more likely forced into shelters by economic conditions (due to structural factors, the state of housing and labour markets that destine the very poor to be unable to afford even minimum-quality housing)…attacking housing affordability from the other side, by reducing housing costs, would also be effective….vast majority of homeless shelter users are single. May 23, 2016 (homelessness) and July 17/16 (housing)

Housing Upside Down Pricing and Financing

- Upside down pricing of housing where purchasers of smaller units pay more per square foot means they will proportionately pay more house taxes, education taxes, mortgage interest and real estate fees on less house and less take home pay. Nov. 19/15 (upside-down)

Income tax privileging for the middle class and the wealthy

- Tax cuts on both federal and provincial levels have targeted the middle class and the wealthy while making poor pay same amount or more in taxes.

- Alberta flat tax of 10 percent increased from 8 percent for low income. May 23/16 (homelessness)

- Federal tax by federal Liberal party decreased by 1.5% for those earning between $45,282 and $90,563. Aug. 23/16 (family)

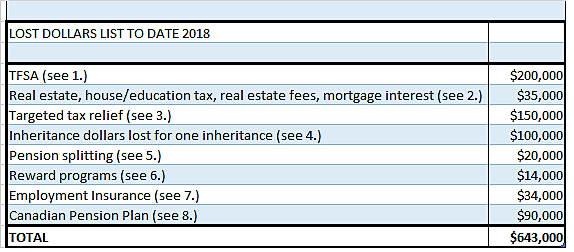

Lost Dollar value

- Lost dollar value list was created to show lost dollars experienced by singles because married or coupled persons are able to achieve more financial benefits. Some of these include pension splitting, reward programs and Employment Insurance (EI). April 10/16 (value)

Marital manna benefits

- 1% spousal lending rate, spousal RRSP, TFSAs times two with no cap on total amounts accumulated over years are all within legal limits of financial laws – Six Reasons….(six)

Marrying for money pays off

- Study shows persons who marry and stay married accumulate nearly twice as much personal wealth as a person who is single or divorced. Jan. 17/16 (pays)

Maternity and parental benefits

- Studies have shown that middle class and wealthy families benefit more from maternity and parental benefits. Many poor families cannot afford take full maternity and parental leave. August 23/17 (family)

Minimum wage/living wage

- Decisions and arguments to not increase minimum wage or implement living wage have a dramatic impact on financial well being of singles and the poor. May 4/16 (discriminatory) and Sept. 12/16 (canada-pension-plan)

Net worth and assets

- When net worth and assets are not included in family benefit formulas, benefits are often given to those who need these benefits less (middle class and the wealthy) than the poor who have less net worth and assets. August 17/16 (assets)

OAS recovery tax (OAS clawback)

- OAS clawback benefits wealthy couples and some widows the most. OAS for couples only begins at net income of $145,618 ($72,809 per person) thus allowing them to receive full OAS of $13,760 as a couple. Not many senior singles (except some widowed persons) who could ever hope to achieve a net income of $72,809. Aug. 29/16 (oas)

Pension splitting

- Pension splitting benefits only wealthy married or coupled family units. Singles don’t get to pension split. Jan. 31/16 (government) and May 4/16 (selective).

Reward programs, company perks, money benefit programs, and fee schedules benefit families the most

- Feb. 11/16 (company) and Mar. 7/16 (money) and Mar. 10/ 16 (reward) and April 27/16 (fee) and July 21/16 (2016/07/21)

‘Selective’ social democracy

- There has been much that is good about democratic socialism, but there also has been some negative outcomes . One outcome is ‘selective’ democratic socialism where certain members of society receive more social benefits than others. May 4/16 (selective)

Senior singles pay more

- Senior singles often ‘pay more, get less’ because they are not included equally in financial formulas. Singles also help support widowed persons and survivor pension plans. Dec. 22/15 (senior) and June 2/16 (retirement)

Singles not included or improperly identified in family definition

- Ever singles (never married, no kids) are often not properly identified in family definitions. Widowed persons and single parents are not ever singles. Widowed persons and single parents are afforded some benefits that ever singles do not receive. Dec. 2/15 (false) and Aug. 7/16 (definition)

CONCLUSION

It is very clear from the many examples above that government, politician, business and family financial policy decisions are often made in isolation and in financial silo fashion. Continuation of these practises without a clear path to proper evaluation of all ‘across the board’ financial formulas and their ‘cause and effect’ on each other will only lead to perverse financial privileging of the middle class and wealthy while continuing financial discrimination of ever singles, early in life divorced singles, single parents and the poor.

(This blog is of a general nature about financial discrimination of individuals/singles. It is not intended to provide personal or financial advice.)