CONSERVATIVE REGRESSIVE PENSION INCOME SPLITTING GOLDMINE FOR WEALTHY MARRIED PERSONS

(These thoughts are purely the blunt, no nonsense personal opinions of the author about financial fairness and discrimination and are not intended to provide personal or financial advice.)

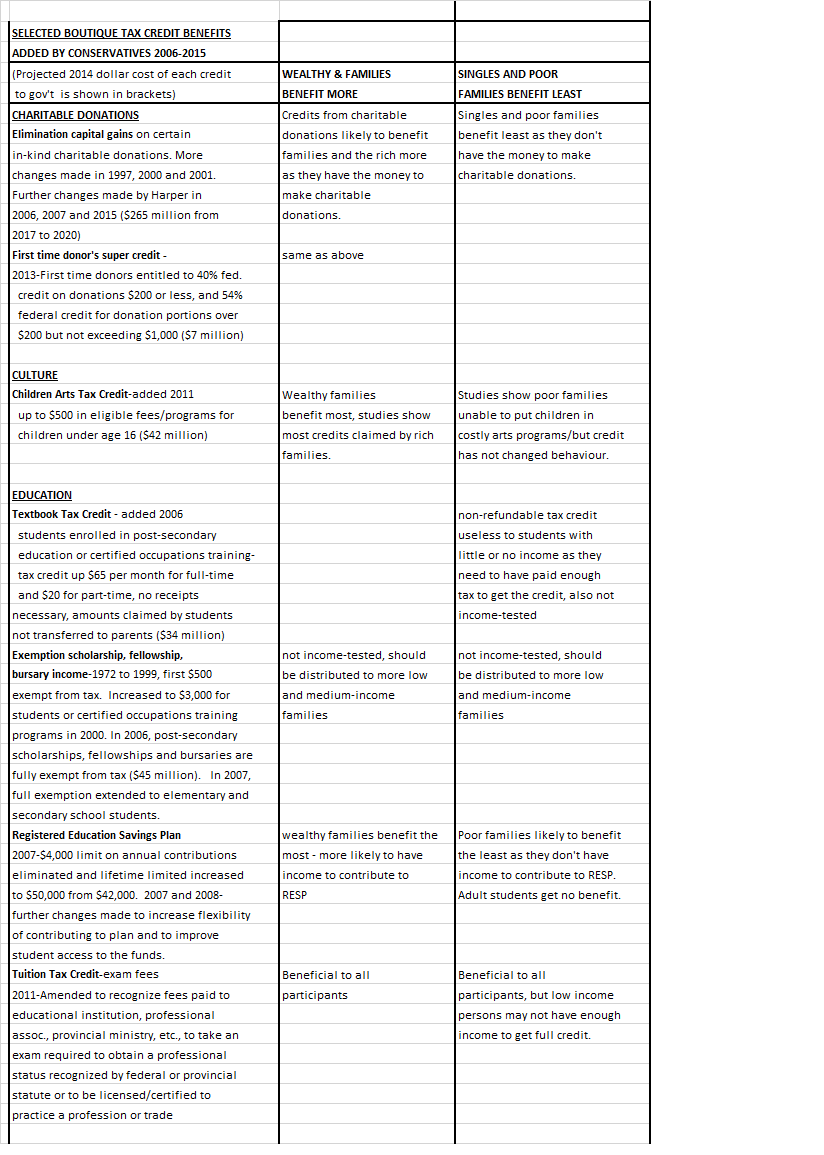

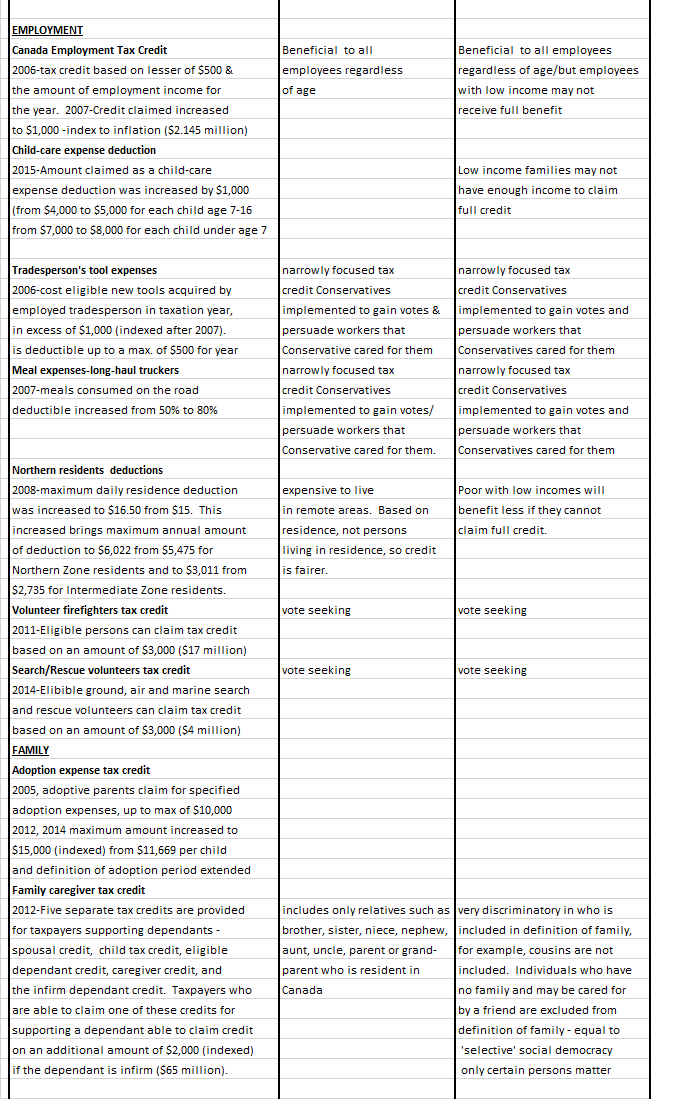

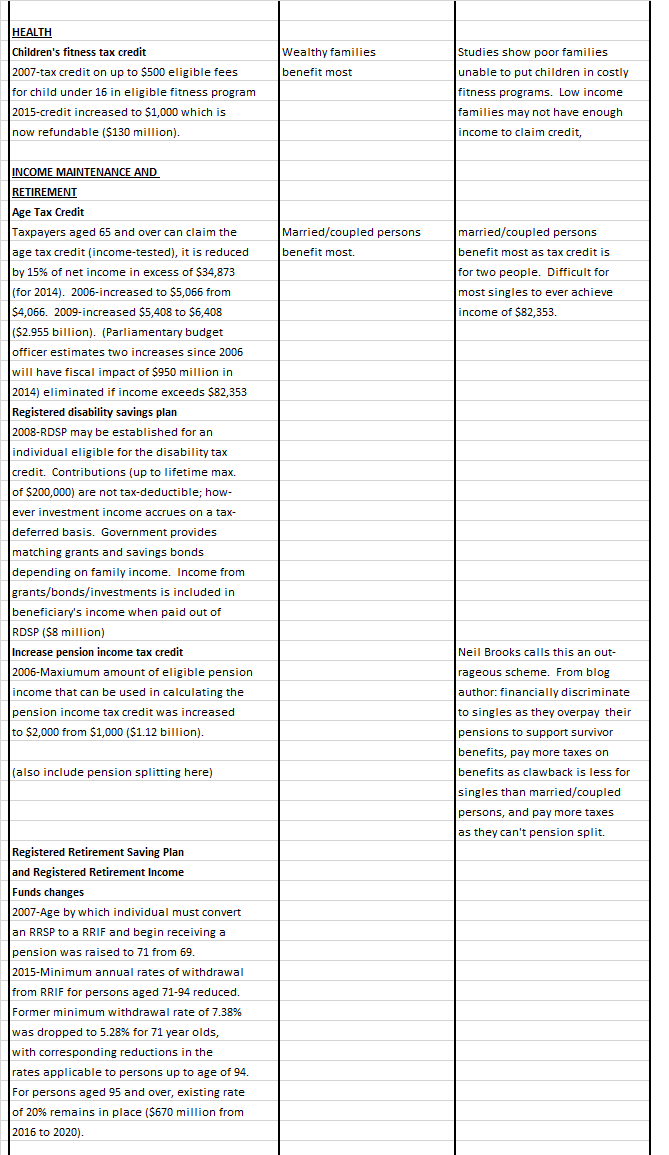

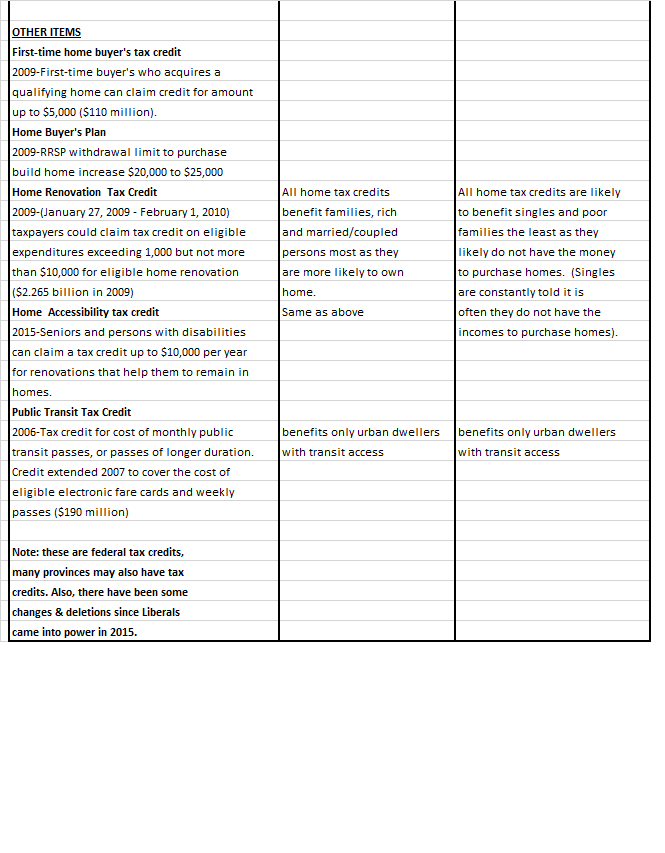

Regressive tax expenditures cannot be blamed on just one political party, however, some implemented by Conservatives are the most egregious of all.

The Canadian Centre for Policy Alternatives (CCPA) “Out of the shadows” (policyalternatives)is a must read for all taxpayers. It examines benefits distribution from 64 of Canada’s personal (business not included) income tax expenditures and provides egregious and shocking facts on how wealthy minority benefit the most. Only five were considered to be progressive. Remaining 59 regressive expenditures cost $100.5 billion in 2011 while providing more benefit to those above the median individual income level (based on CCPA individual income, not combined couple income, of $30,000 or $15/hr. wage based on 2000 worked hours) and in some cases benefit top decile of wealthy the most. The monies doled out in these expenditures equals same amount of all monies collected in taxes.

Stephen Harper, former Canadian Conservative Prime Minister, introduced the hastily and poorly planned regressive pension income splitting (P.I.S.) partly as appeasement for the controversial crackdown on income trusts (another regressive tax expenditure).

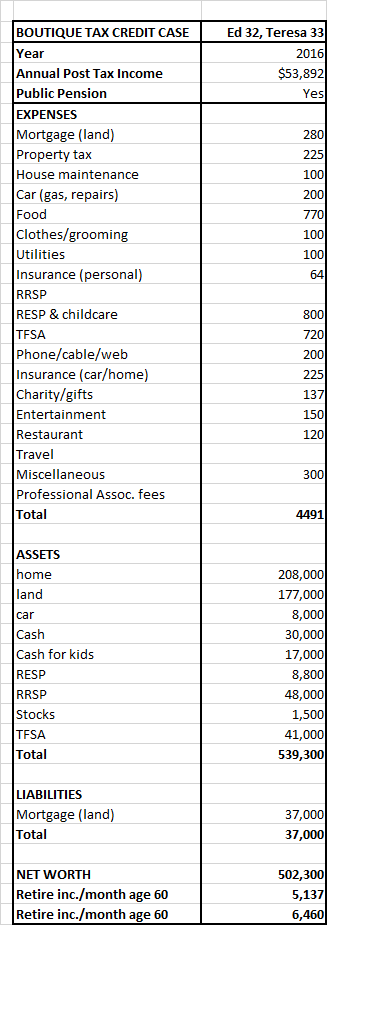

Fact Check: First, married seniors, who have never had children, using P.I.S. pay less taxes just because they are married even though it costs singles more to live (Market Basket Measure – MBM). Second, married seniors with equal incomes cannot use P.I.S. and, therefore, pay more taxes. Third, poor married seniors benefit less as they have less income to split. Fourth, senior singles and lone parents cannot use P.I.S., ever. So, the wealthy married benefit most (?including Stephen Harper worth $7million when he becomes a senior). Exactly how many Canadian taxpayer households are completely left out of this formula? – Certainly more than 50% or the majority. Just speak the truth, it is impossible for singles and low income seniors to achieve financial equality with this regressive tax expenditure.

Compounding effect of regressive expenditures ensures wealthy become even wealthier. Tax savings from P.I.S.means full contributions can be dumped into Tax Free Savings Accounts (TFSA) (another regressive tax expenditure implemented by Stephen Harper where maximum contributions now total $11,000 per year for married households). Wealth ripple becomes ever wider because investments earned from TFSA contributions without capping of individual limits are never taxed.

CCPA states P.I.S. is the most regressive tax expenditure costing government $975 million annually – that is almost $1 billion a year. Eighty-three per cent (83%) of benefit goes to top 10% and maxes out at $11,700 (equivalent to $6/hr. wage) when $128,800 (equivalent to $64/hr. wage) of pension income is transferred from higher earner to spouse with no income (10 times the maximum benefit to Canada’s poorest from only five progressive tax expenditures).

Over ten years the P.I.S. amount to wealthy married people could total almost $120,000. It is not possible to calculate the wealth achieved from TFSA investments. And, it is apparent that there is no shame on the part of the wealthy that they are robbing from the poor to pay themselves. Singles and poor seniors deserve to feel righteously angered at the gross financial discrimination of this formula.

CCPA states that from an aggregate perspective $103 billion lost annually to 64 tax expenditures is an embarrassing failure of Canadian tax policy. Many of those in poorest deciles are singles and lone parents.

When critical thinking brings sunlight to financial discrimination and selective socialistic (Conservative) financial privileging for the wealthy, it also demands financial discrimination be changed or eliminated. Taxpayers need to educate themselves on how they are impacted by these expenditures and contact their government officials demanding change. Although Federal Liberals have successfully eliminated some regressive tax expenditures, so far, they have refused to eliminate P.I.S. Transferral of P.I.S. tax expenditures to increased OAS and GIS based on MBM and net worth and assets would ensure greater financial fairness for all Canadian seniors.

P.I.S. has been submitted to the Canadian Human Rights Commission for adjudication of financial discrimination based on marital status and income levels and once again to the Liberals for elimination.

CONCLUSION

Canada is supposed a democratic country where fairness prevails at all levels including financial. Why aren’t regressive tax expenditures such as stock option reduction, dividend gross-up and tax credit, and partial inclusion of capital gains for the wealthy enough that we have to introduce further regressive tax expenditures such as pension income splitting, income splitting, and Tax Free Savings Accounts which again benefit wealthy the most?

Plutocratic capitalism, as discussed by many authors including Thomas Piketty, is no different than other egregious philosophies such as communism, dictatorships, far right and far left idealism which all eventually rob the poor to pay the wealthy. Balanced social justice is the answer to plutocratic capitalism and far right and left ideologies.

Thomas Piketty quotes (quotes):

- When the rate of return on capital exceeds the rate of growth of output and income, as it did in the nineteenth century and seems quite likely to do again in the twenty-first, capitalism automatically generates arbitrary and unsustainable inequalities that radically undermine the meritocratic values on which democratic societies are based.

- It’s important to realize that innovation and growth in itself are not sufficient to moderate inequality of wealth.

- We want capitalism and market forces to be the slave of democracy rather than the opposite.

- When inequality gets to an extreme, it is completely useless for growth.

- No hypocrisy is too great when economic and financial elites are obliged to defend their interest.

- I don’t think there is any serious evidence that we need to be paying people more than 100 times the average wage in order to get high-performing managers.

- What was the good of industrial development, what was the good of all the technological innovations, toil, and population movements if, after half a century of industrial growth, the condition of the masses was still just as miserable as before, and all lawmakers could do was prohibit factory labor by children under the age of eight?

(Addendum: A study of Stephen Harper profile, former Canadian Prime Minister, shows that he claims to be an economist with only a Master’s Degree, a Christian whose right wing financial philosophy appears to be to increase the wealth of the rich, and a family man styled after the 1950’s “Leave It To Beaver”, but never includes singles in the family definition. It seems one of his goals is to increase capital returns over wages by implementing formulas that benefit wealthy the most since they are the population who have the most capital.

After implementing Pension Income Splitting, he also introduced income splitting for families, another regressive tax expenditure benefiting the wealthy, but this was rejected by the Liberal Party who came into power shortly after.

During his tenure as Prime Minister he often introduced huge omnibus bills to hide controversial bills. His actions over time negatively affected environmental laws, cut health care funding, reduced number of food inspectors jobs, made it harder to qualify for EI benefits, and disallowed scientists to speak freely about their research, this is by no means an inclusive list. It should be stated that omnibus bills have also been submitted by other political parties. Harper also prorogued Parliament four times for a total of 181 days when he feared he would lose a confidence vote or didn’t want to deal with controversial issues.)

(This blog is of a general nature about financial discrimination of individuals/singles. It is not intended to provide personal or financial advice.)