‘SELECTIVE’ DEMOCRATIC SOCIALISM FINANCIALLY DISCRIMINATORY FOR SINGLES AND THE POOR

These thoughts are purely the blunt, no nonsense personal opinions of the author and are not intended to provide personal or financial advice.

Democratic socialism or socialized democracy has achieved some very good things for equalization of social rights in Canada such as the Canada Pension Plan, Employment Insurance Plan and universal public healthcare as well as human rights policies. Also included are benefits meeting the current basic needs of society for all – care for the elderly, school systems and social security systems such as Old Age Security and Guaranteed Income Supplement. This has resulted in improving the lives of women, First Nations, racialized Canadians, the poor and the elderly by social equalization.

Worker benefits won by unions have greatly benefited fairness in working conditions: such as equal pay for equal work, weekends off, lunch and work breaks, vacation and sick leave, minimum wage, eight hour working day, overtime pay, child labor laws, safety and health laws,workers compensation, pensions, health care insurance, etc. The list goes on and on.

Unfortunately, some of the social and economic equalization has been undone by governments giving tax cuts to profitable corporations and high income individuals, giving boutique tax credits to only certain parts of the population and replacing progressive tax systems with flat tax systems. Results of unequal social benefits include lack of affordable housing (violating Maslow’s hierarchy of basic needs), high student debt and less job security.

Raising the minimum wage to $15 an hour has been a contentious issue. The ruling social democratic party in the province has said it is not fair for a single parent to work 50 hours a week and then have to stop at the foodbank to feed the family. Review of research states the premise behind ‘a minimum wage policy supported by a strong social policy is an efficient mechanism against poverty and income erosion of the poorest households. Minimum wage is one of the instruments which can control wage disparity and in this way reduce income inequality’.

An editorial view in the Calgary Herald, April 22, 2018 ‘Meddling with Wages’ (meddling-with-wages) argues against increasing the minimum wage :

‘a higher minimum wage of $15 will add further pain to employers and hurt those the measure is intended to benefit.’

The editorial implies that the single parent referred to in above paragraph does not happen very often and only occurs for two per cent of the provincial population. The editorial then goes on to state that most of the two per cent are not single parents, but youth getting a start in the labour force by working part time while living at home.

‘ The minimum wage was never intended to be something a single person could support a family on. Raising the minimum wage….further imperils the the viability of small businesses and creating greater incentive to trim by shedding jobs and cutting hours.

Canadians are helping low-income families through generous supports from both the federal and provincial governments . More should be done to lift people out of poverty, of course, but it should be achieved with programs that boost their skills and increase their employability. It should not be done by clumsy government meddling.’

Blog author’s comments: Writer states that the minimum wage was never intended to be something a single person could support a family on. Really? REALLY? The premise behind a minimum wage policy supported by a strong social policy is an efficient mechanism against poverty and income erosion of the poorest households. Minimum wage is one of the instruments which can control wage disparity and in this way reduces income inequality. To say that a young person still living at home does not deserve a wage equivalent to a single parent is like saying all those persons working in sweatshops in Bangladesh also don’t deserve a wage equivalent to the same jobs performed in non-third world countries. Also, raising the minimum wage helps the economy through increased spending on the necessities of life and more taxes being paid to support social programs.

Two reader comments put a proper perspective on the results of not increasing the minimum wage. First comment (from Canadian Poverty Institute at Ambrose University) ‘Businesses should pay decent wages’ (pressreader):

‘…..If minimum wage had kept up with inflation, it would be around $15 today. While education and training programs may reduce poverty, demands for austerity would cut exactly these programs. In abdicating responsibility to pay decent wages, business uploads the cost of low wages to government. Poverty costs the provincial government $7-9 billion annually.

A business model based on poverty wages is untenable. Decent wages are the cost of doing business.

Ensuring a decent income is a shared responsibility. Individuals are doing their part by working. Business must do its part by paying people appropriately, not relying on government and taxpayers to pick up the tab.’

Opinion letter from second reader ‘Creating a more humane province’ (pressreader):

‘By concentrating heavily on the economics of the minimum wage (and indeed, low wages in general), the editorial misses the central point that wages are more about increased opportunity for inclusion and participation. To deny an expansion of these dimensions to low-income workers, simply because of stereotypes, economic short-termism and the assertion that only two per cent of people actually work for minimum wage, reflects a fundamental misunderstanding of what it means to be a citizen of this province.

I’m glad our provincial government continues to act in the interests of ordinary citizens and realize that the expansion of justice has a cost. A higher minimum wage, together with the provision of living wages, is the price we can and should pay for the creation of a more just, humane and inclusive province.’

Then there are those who have no regard for left-wing politics. An example is Calgary Herald editorial comment: ‘How soon we forget the economic carnage of left-wing policies’ (calgaryherald). The argument made is that:

‘those who ignore socialist history are doomed to repeat it…..If nobody had ever tried left-wing policies before, we might be justified in giving this “new” socialism a chance. Unfortunately, the world has long been a laboratory for socialist policies with mostly disastrous results.

Democratic socialism has left valuable legacies – like subsidized, widely available health care and education – but also has created a lot of economic carnage. During the 1970s, big-spending, left-wing governments in Canada, Scandinavia and Great Britain created high unemployment and sluggish growth before buckling under the weight of their taxes and debt…

……The province’s premier doesn’t understand, or perhaps doesn’t care, that raising taxes makes struggling citizens poorer, and just transfers wealth from the already wounded private sector to the public sector.

She wants to appease her union comrades by massively raising the minimum wage , which will raise inflation , hurt less profitable industries and reduce employment…..How did our collective memories become so short?’

Reader’s opinion letter ‘Right-wing policies fail’ (pressreader) in response to this editorial states:

‘This column is nonsense….The highest rate of unemployment in the U.K. in recent years were under the reign of Margaret Thatcher. Currently, the only people who benefit from the right wing U.K. government’s policies are the rich.

Food banks, unknown in my younger years, are common and very necessary.

It’s also true that the province’s unemployment rate is unacceptable, but to criticize the premier is wrong. If our economy had been less dependent on oil and gas, we would be better off.

The right-wing trickle-down economic theory is utterly discredited.’

‘SELECTIVE’ DEMOCRATIC SOCIALISM

As noted in the above, there has been much that has been good about democratic socialism, but there also has been negative outcomes to democratic socialism. One negative is what we will call ‘selective’ democratic socialism where certain members of society get more social benefits than others.

Examples of ‘selective’ democratic socialism:

Women not being paid same amount as men for same job – Unions have forced the private sector to enforce social benefits such as eight hour day, overtime pay, vacation and sick pay, etc., and above all equal pay for equal work, but the private sector in many cases still has neglected to pay women the same wage for doing same job as men.

There are many who object to the wages and pensions federal and provincial civil and public servants receive. They say these employees are paid too much money, thus causing economic concerns. The irony of this negativity is that one reason why the budgets for civil, public and union employees is higher is that women are actually paid the same wage as men doing the same job.

It would be nice if right-wing financial think tanks used some outside the box thinking and conducted studies on how much of the budgets of unionized employees is dedicated to paying women equally to men. Or, vice versa, how much more money would it take to pay women in the private sector equally to men?

Keep minimum wages low and don’t consider living wages – ‘Selective’ democratic socialism allows the top employees (elite one per cent and the rich) to outpace wages of those at the bottom. Then, because they have the money to do so, they will bypass the democratic social programs of health care and public schools to pay for elite services of private health care and private schools.

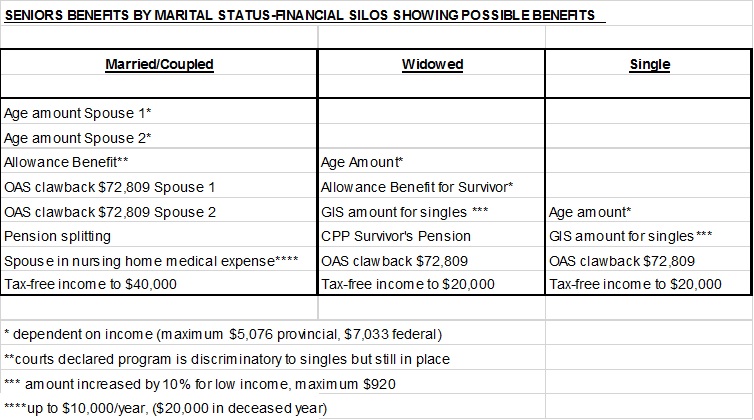

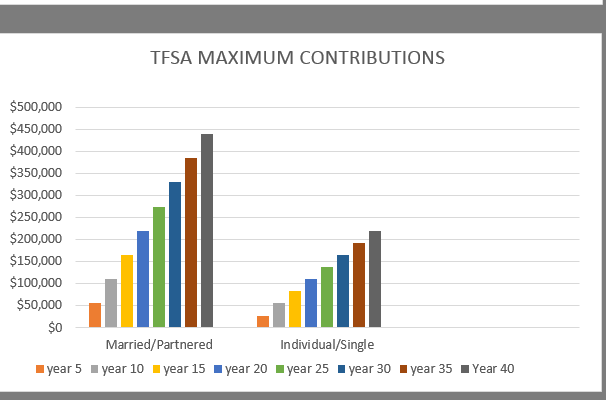

Married/Coupled person get more benefits than singles and the poor (singles often excluded from these benefits) – Many persons leaning to political right and working in the private sector view defined contribution public pensions to be unfair as they perceive money for these pensions to be coming from the public purse. However, they also refuse to recognize that singles receiving public pensions are supporting/subsidizing the public pension plans of married/coupled persons. While married/coupled persons are receiving their public pensions, they have been given a boutique tax credit where they get to pension split (benefit added on top of benefit), thus paying less income tax. Singles don’t get to do this and poor married/coupled persons do not get the same benefits from pension splitting as the rich. Yet another level of ‘selective’ democratic socialization is added to the mix when widowed persons (who now technically are single) get a supplementary public pension from their deceased spouses.

It is very difficult for political parties to eliminate the unfair pension splitting tax credit for fear of being voted out. A solution to making the playing field fair for singles versus married/coupled persons could be to give singles a fully refundable tax break during their pension years that is equivalent to amounts received in pension splitting by married/coupled persons. For the widowed person’s public pension marital manna benefit, a solution to remedy this could be to give the widowed spouse whatever is left of the pension in a lump sum just like single deceased persons receive in their estates upon dying. Again, it would be nice if financial think tanks would use some outside the box thinking to evaluate how fair the public pension system is to singles versus married/coupled persons and to analyze who really is getting the bigger slice of the pie.

Affordable housing prices out of reach for singles and poor families – Another ‘selective’ democratic socialist outcome is when affordable housing solutions are put in place, but the poor still pay more per square foot for this housing. The housing prices are out of whack when rich proportionally pay less per square foot (often the bigger the house the less they seem to pay per square foot), but ‘ever’ singles, early divorced persons and poor families pay more. As a result, they also pay more in housing and education taxes, real estate fees and mortgage interest charges than the rich since these are based on price and not the square footage of the housing.

What better evidence is there of this than the case where a single person from San Francisco created a ‘pod’ in the living room of an apartment so he could have a private place to sleep instead of the couch (singles-deserve-affordable-housing). Another is ‘free rent for sex’ advertisements resulting from the out of control Vancouver housing market (pressreader.)

Then there is the insanity of the charmed lives of the rich building luxurious playhouses for their children (pressreader). These playhouses range from $7,000 to $100,000 and may include electricity, fireplaces and cabinets. The sleeping pod of the San Francisco single man could probably be the size of the doghouse for the pets of the children owning these playhouses.

‘Selective’ democratic socialism where families get social benefits and singles are excluded – Many government and business financial solutions and social programs appear to include only families with singles being excluded. One example is Habitat for Humanity who build houses for families only, not singles.

‘Selective’ democratic socialism above all means FAMILIES RULE – Government and politicians in their discussions talk mainly about family, family, family and the middle class instead of talking about ‘families and individuals’. Singles are rarely included in the discussions. ‘Selective’ democratic socialism by definition is exclusionary and selects families to receive benefits with singles rarely being included equally in the benefits.

CONCLUSION

These are just a few examples of ‘selective’ democratic socialism. How positive or negative democratic socialism has been is in the eye of the beholder. However, it is very hard to say that there have been more negatives than positives when one looks at the list of all the accomplishments of union rights and democratic socialism.

Now, if only ‘ever’ singles, early divorced singles and poor families were included equally to other members in society in democratic social formulas, the world would be an even better place.

This blog is of a general nature about financial discrimination of individuals/singles. It is not intended to provide personal or financial advice.