REWARD PROGRAMS BENEFIT MARRIED/COUPLED PERSONS AND FAMILIES MORE THAN SINGLES

These thoughts are purely the blunt, no nonsense personal opinions of the author and are not intended to provide personal or financial advice.

In the last post money programs such as the Alaska Permanent Fund Dividend program was discussed on how these programs benefit married/coupled persons and families.

This post discusses ‘freebie’ programs like fuel discounts, and giveaways like glassware, etc. Safeway Canada in Alberta will be used as the company of choice in the examples outlined here (note: reward programs may vary from province to province). A family of four will be compared to a single person’s grocery budget. For ease of comparison a family grocery budget of $840 a month or $210 per week will be used and for a single person $200 a month or $50 per week (remember, previous reader opinion letters have stated singles should be able to live on $200 a month for groceries /reader-opinion-letters/). For ease of comparison a vehicle with 100 litre fuel capacity will be used for both family units and singles, even though it is recognized families are more likely to have vehicles with larger fuel capacity than singles.

(Caveat: food budgets are dependent on region, what is included in food budget and the age of the children. Some regions have very expensive food costs, some budgets include paper and cleaning products, and food budgets will increase as children get older.)

Present Safeway ‘freebie’ programs running at the present time include:

- Fuel – Spend $35, get 5 cents off per litre

- Spend $70, get 6 cents off per litre

- Spend $105, get 7 cents off per litre

- Spend $210, get 10 cents off per litre

- Air Miles Points program – Collect 95 cash miles – get $10 off grocery purchase (for comparison here only the coupon for ‘spend $100, get 100 air miles’ once per month will be used. Additional air miles for buying certain products will not be used as it would be too difficult to calculate).

- Glassware (Spiegelau) program – collect stamps from Oct 30, 2015 to March 3, 2016. For every $10 spent in groceries, one stamp would be received at the checkout. For every 50 stamps collected, purchaser would be eligible for one pair of glasses (for example, white wine, red wine glasses, etc.). Safeway retail price stated in brochure is $39.99 for a pair of glasses.

COMPARISON

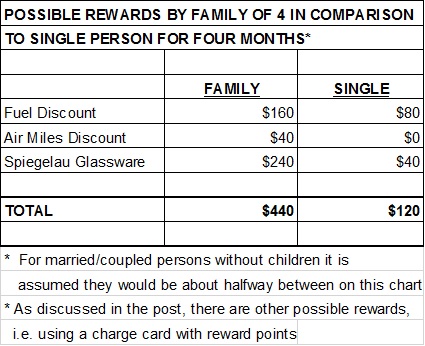

Fuel – For comparison purposes here, it will be assumed that families will spend $210 per week on groceries and, therefore, will receive 10 cents off per litre of gas. For a vehicle with 100 litre fuel capacity requiring a complete refuel, the fuel discount would be $10 times four weeks for a total of $40 per month for a family and $5 time 4 or $20 a month for a single. The total discount for four months for a family would be $160 for a family and $80 for a single; therefore, totals of $160 and $80 will be entered on chart.

Air Miles – If coupon ‘spend $100, get 100 air miles’ is used once per month families would be able to get a discount of approximately $40 on groceries (for every 95 Air Miles get $10 off) for four months, while singles would not be able to use this coupon as they have not spent $100 to get 100 air miles points. On chart $40 will be entered for families and $0 will be entered for singles.

Glassware Rewards – Groceries by family at $840 per month times four months equals $3360. This amount divided by $10 equals 336 stamps divided by 50 stamps gives possibility of acquiring 6 sets of glassware (2 glasses per set). The value of six sets of glasses at approximately $40 or $240 will be entered on the chart.

Groceries for a single person at $50 per month equals $200 times four months for a total of $800. This amount divided by $10 equals 80 stamps divided by 50 stamps gives a single person the possibility of acquiring only one set of glasses (2 glasses per set). The value of one set of glasses at approximately $40 will be entered on the chart.

FINAL EVALUATION

For this particular example, families have been able to receive rewards totalling approximately $440 to that of $120 for a single person. Married/coupled persons would probably fall halfway between families and single persons.

It should also be noted that even more rewards are possible if, for example, charge cards with reward points are used to buy groceries provided that the charge cards are paid every month in a responsible fashion so as not to have to pay interest charges.

It is also recognized that those ‘with the money’ (for example, the rich, middle class families and married/coupled persons) will be able to acquire more rewards value , than the poor and singles because the setup of the reward programs makes it possible for those ‘with the money’ and families to get more rewards.

LOST DOLLAR VALUE

This list is still a work in progress. However, for the list a ’lost dollar value’ for singles $240 for fuel rebates will be used ($160 minus $80 times three for total of 12 months). The only ‘lost dollar value’ that will be added to the list is the fuel rebate as this is the only constant available and easily calculated for an entire year. (Lifetime total age 25 to 85, $240 times 60 years equals $14,000.)

CONCLUSION

Initially, examination of the fuel discount program reveals that this is a good program for those with less money to spend as only $35 needs to be spent to get a 5 cent discount, but $210 (six times more in dollars) needs to be spent to get 10 cent or double discount. However, in the end, extra dollars spent on groceries and stacked rewards still means family of four will get a greater discount than the single person.

Manipulation of reward point programs can also occur in many ways. It is known that some spouses of married/coupled persons and families will split the grocery bill between them. A family with a $210 grocery bill will split bill between each spouse at $105 to each get 7 cents fuel discount and 100 air miles Each spouse can fill up their vehicles once week and get 7 cent discount.

What can one say about rewards programs? Not much, except to say that reward programs benefit the rich, married/coupled persons and middle class families the most. Can anything be done to level the playing field on reward programs for the poor and singles? Probably not, except maybe to put a cap on the programs or eliminate them completely. Elimination would mean everyone would be on level financial playing field with everyone paying same price.

Once again, most married/coupled persons, families and rich are completely unaware of the financial power and advantage they have over the poor and singles. And, imagine what other financial advantages are out there as this is only one reward program out of many.

The benefits of reward programs are in the eye of the beholder. Of course, those who benefit the most relish the thought of accumulating whatever they can, often tier upon tier upon tier. Many believe that one should be rewarded more if one spends more, even if it is at the expense of the disadvantaged and those who have limited food budgets.

And, it does not help for singles to band together (for example two people)to buy groceries as half a discount on a tank of gas is only half a discount. Half of a set of glassware is only one glass. Singles are told over and over again that they spend too much. The reality is that reward programs force them to pay more and get less for the necessities of life like groceries.

“OUR BIG FAT WALLET” BLOGGER’S OPINION -new-pilot-program-are-bigger-fuel-discounts-ahead/

The blog “Our Big Fat Wallet” talks about reward programs in the post ‘Safeway’s New Pilot Program: Are Bigger Fuel Discounts Ahead?’ Some interesting comments are made on reward programs as well as reader comments as follows:

“Tiered Savings Programs

I’m hoping the pilot program is implemented permanently and other stores follow suit by increasing their fuel savings.

Ideally I would like to see stores have a tiered savings program like Safeway – that rewards bigger spenders with bigger savings. I like to eat – a lot – so our grocery costs tend to be higher than most.

A tiered savings program would benefit anyone who spends a decent amount each month on groceries and if all stores implemented a similar program, it wouldn’t matter what store you buy your groceries at.

If you spend more than $200 in-store, you should be rewarded with a larger fuel discount than someone who only spends $35. With food prices climbing higher and higher, it’s becoming even easier to reach new heights on grocery bills so any additional discount at the pumps would help.

Reader comment:

Interesting! When will we know whether the “test program” is put in for good? I’m secretly hoping it is as my husband and I spend way more on groceries than we should so any place we can save a buck or two helps

Another reader comment:

I love fuel money tied to grocery stores. Where I live, gas prices are provincially regulated, so there is no option of driving down the street a kilometer and saving an extra $0.02/L, so these programs are the only way to get discounts.

A while ago, Sobey’s had a deal where if you bought $200 in GCs you would get $0.10/L off. And you could stack them. Then, if you used them at their gas station, you got $0.035/L to use in the grocery store. It was an awesome circle because you sometimes they’d let you buy gift cards with other gift cards. We got a few very cheap tanks of gas, LOL.

“Our Big Fat Wallet Blogger comment”:

I actually didn’t know gas prices could be provincially regulated. Using gift cards to buy gift cards – now that’s a sweet deal!

Another reader comment:

It’s really nice that it works in your favor, especially since you spend a lot on groceries. Well, hopefully they will implement it permanently!

“Our Big Fat Wallet” Blogger’s response to this reader’s comment:

I am hoping they will implement the program for good and that other retailers will be forced to offer more incentives so we can all start to get bigger fuel discounts”

This concludes the post.

This blog is of a general nature about financial discrimination of individuals/singles. It is not intended to provide personal or financial advice.

RSS Feed

RSS Feed

Pingback: LOST DOLLAR VALUE LIST TO DATE AND FINANCIAL DISCRIMINATION OF SINGLES | Financial Fairness For Singles

Pingback: REWARD PROGRAM DISCRIMINATION OF SINGLES AND POOR FAMILIES CONTINUES | Financial Fairness For Singles

Pingback: CAUSE AND EFFECT OF FINANCIAL POLICIES PROMOTING FINANCIAL DISCRIMINATION OF SINGLES AND THE POOR | Financial Fairness For Singles