DOING THE MATH ON FAMILY TAX CREDITS SHOW FINANCIAL DISCRIMINATION OF POOR, LOWER MIDDLE CLASS FAMILIES AND SINGLES-Part 2 of 2

(These thoughts are purely the blunt, no nonsense personal opinions of the author about financial fairness and discrimination and are not intended to provide personal or financial advice.)

Part 2 of 2 of ‘Doing the math…’ provides further discussion on the comments of the financial analysts in Part 1 of 2. Regarding the Canada Child Benefit, it is difficult once again to understand the financial intelligence of politicians and government and whom they consult when formulating their policies.

Repeated again from part 1 of 2 are the following scenarios from “Doing the child benefit math” by Jamie Golombek (financialpost), Financial Post, September 30, 2016 showing financial evaluation performed by Jay Goodis from Tax Templates Inc. This evaluation shows the impact of CCB on various levels of income in 2016, the after-tax cash they would keep along with their effective tax rates.

‘Scenario 1 – Low-income family

A Manitoba family has two kids under five and two working parents, each earning $15,000 of employment income. They are eligible for the entire CCB of $12,800; after paying CPP, EI, and a bit of tax, they net $39,560 of cash.

What would happen if one parent was able to work more, or was to get a higher paying job, such that she now made $25,000 — an increase of $10,000? While she’s still in the lowest federal and Manitoba tax brackets, once you factor in the loss of CCB, the additional tax, CPP, and EI, her take-home extra cash is only $5,563, resulting in an effective marginal tax rate of a whopping 44 per cent (39 per cent if you ignore the additional CPP and EI contributions.)

As Goodis observed: “The CCB skews the progressive tax system and imposes a high effective tax on low income earners with children.”

Scenario 2 – Median-income family

A British Columbia couple has two children under the age of five. Their family’s income, consisting solely of employment income, is $76,000 split equally between each spouse. Their $12,800 of CCB is reduced to $7,448; and after federal and provincial taxes, CPP, and EI, the family nets $69,135 of cash. In other words, even with the clawback of some of their CCB, the couple has kept 91 per cent of their earned income.

Scenario 3 – High-income earner

Finally, consider an Ontario professional with three kids, two under five and one teen, earning $200,000 annually. His CCB will be about $750 for the year. If he were to earn an extra $1,000 of income, he would keep only just under $400 of it, resulting in an effective marginal tax rate of just over 60 per cent once loss of CCB is taken into account.’

DISCUSSION

Several points of interest will be discussed in regards to the Canada Child Benefit: 1) income tax and marginal tax rates with increased income, 2) CPP contributions and pensions, and 3) the effect of minimum wage and Canada Child benefit on the economy and future entitlements like the Canada Pension Plan (CPP).

NOTE: The marginal tax rate is the tax rate paid on last dollar of income and rate likely to be paid on next dollar of income-it is usually more than what is actually paid in tax because basic exemptions like CPP contributions and EI, and other benefits on provincial level, GST rebate, etc. have not been taken into consideration.

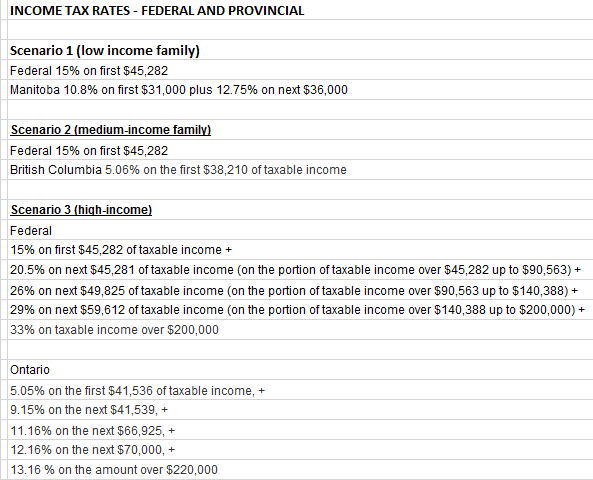

- INCOME TAX RATES FEDERAL AND PROVINCIAL (cra)

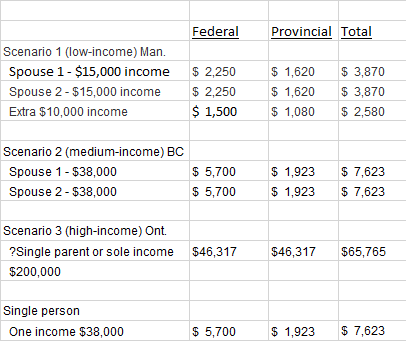

The following shows the likely actual federal and provincial tax rates shown in the three scenarios (the federal and provincial rates used in the calculations are shown at the end of the post).

Taxes paid do not show other possible deductions taken off (CPP and EI), non refundable tax credits and additional benefits (GST rebate) added on to income:

In scenario 1 (low-income family), the financial analyst makes the statement that if one spouse earned an extra $10,000 she would pay an effective marginal tax rate of a whopping 39 per cent factoring in the loss of the CCB and without additional CPP and EI contributions. Her take-home extra cash is only $5,563. However, with calculation of possible additional actual tax rate of $2,580, and reduction of $12,800 CCB by $896, her take home income with the additional $10,000 would be $10,000 minus $2,580 minus $896 for CCB for total extra cash of $6,524. Whether it is an additional $5,500 or $6,500 why is this not considered to be a good thing, when even though she has more income tax deductions and small decrease in CCB, she has much more money to spend on her family while benefitting the Canadian economy through additional use of goods and services and additional income tax to be used for public services?

In scenario 2 (middle-income family), the financial analyst states that ‘ even with the clawback of some of their CCB, the couple has kept 91 per cent of their earned income’. That is a very good rate of return all because of tax-free CCB. Another reason why they are able to keep such a large per cent of their earned income is that Province of BC has a 5.06% tax rate on first $38,210 while Manitoba in Scenario 1 has a provincial rate of 10.8% on first $31,000.

In scenario 3 (high earner) the financial analyst states that with just an additional $1,000 income the person will only take home an extra $400 using the marginal tax rate. For poor people, the reaction might be “so what?” when take home income is already at level of $8,000 to $10,000 per month plus he has been able to use Liberal reduced income rate of 1.5% for income between $44,401 to $89,401 that scenario 1 and 2 have not been able to use.

For single person, income after tax would be approximately $30,377 or about $15 per hour. This does not equal living wages to prevent homelessness for singles, examples of which are usually greater than $15 per hour (singles-finances).

- CPP CONTRIBUTIONS AND PENSIONS

In scenario 1 (low-income family) it has been estimated that this family will have about $7,500 annual CPP benefits. With the addition of just $10,000 income (and YMPE), resulting extra CPP contributions and reduced $896 CCB annual benefits, the CPP (using 2016 rates) annual benefits will jump from about $7,500 to $10,000. This should be viewed as a good thing as the extra CPP benefits outweigh the reduced CCB benefits and will reduce poverty in retirement.

- THE EFFECT OF MINIMUM WAGE AND CANADA CHILD BENEFIT ON THE ECONOMY AND FUTURE ENTITLEMENTS LIKE CPP

- The more poor are taken out of poverty, the greater the benefits to everyone because the poor will be using less government boutique tax credits and handouts (CCB).

- Increased minimum wage benefits income earners in retirement years through increased CPP contributions during working years.

- Increased minimum wage benefits everyone through collection of increased taxes, financial well being of income earner, and the economy through increased spending on goods and services, thereby, increasing value to the economy.

- Boutique tax credits that benefit only certain segments of society (families and married or coupled persons) and failure to increase the minimum wage are financially discriminatory and detrimental to low income persons and singles.

CONCLUSION

Why do we continue to allow politicians and governments to make bad financial decisions like forever increasing boutique tax credits, increasing the wealth of the rich and not increasing the minimum wage when it can clearly be shown that increasing the minimum wage benefits everyone? The creation of financial silos (financial-illiteracy) where one financial decision is made (example: CPP enhancements) without looking at how this impacts other financial processes makes for very bad financial decisions. ‘Selective’ social democracy (selective) where some family groups benefit more than other family groups only produce financial discrimination while benefitting the upper-middle class and the wealthy most.

The upside down financial decisions where boutique tax credits are brought in by one political party, eliminated or changed on election of another political party and increasing CPP benefits, but not increasing the minimum wages at the same time does nothing to provide financial stability for Canadian families, married or coupled persons and singles.

Outside the box and critical thinking like tri-partisan (all political parties) cooperation in financial decisions for all Canadians would create better decision making across the board and prevent schizophrenic political processes like CPP increases being controlled by federal governments and minimum wage increases being controlled by provincial governments. All Canadians deserve better from their politicians and governments in financial decision making.

INCOME TAX RATES by FEDERAL AND PROVINCE (cra)

(This blog is of a general nature about financial discrimination of individuals/singles. It is not intended to provide personal or financial advice.)

RSS Feed

RSS Feed