HISTORY OF FAMILY TAX CREDITS OVER DECADES ARE FINANCIALLY DISCRIMINATING TO SINGLES-Part 1 of 2

(These thoughts are purely the blunt, no nonsense personal opinions of the author and are not intended to provide personal or financial advice).

This post was updated on August 3 and 9, 2016.

Child Benefits (also known as Baby Bonus) have been around for a long time. While this, in as of itself, may or may not have produced substantial financial discrimination for singles, it is all the additional marital manna benefits given to married or coupled with and without children family units over the years that have continually increased the financial discrimination of singles.

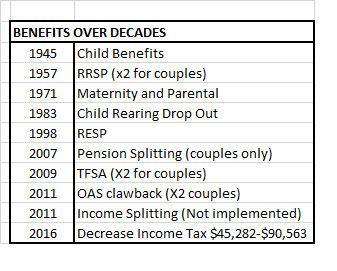

Some of most money-enhancing benefits beginning in 1945 to present date are outlined below.

The Family Allowance (currently called Canada Child Benefit) began in 1945 as Canada’s first universal welfare program. Benefits were awarded without reference to the family’s income or assets – based on the idea that all Canadian children are worthy of public support. Since the 1980s, however, such allowances have been increasingly targeted to low-and-middle-income families. The Child Benefits program has gone through different variations over the years. The amount is calculated each year based on family income and the number of children in the family under the age of 18. Supplements are also available for handicapped children. It is said that the incidence of child poverty in Canada is second highest among Western developed nations – second only to the USA. The Canada Child Benefit program is still based only on income, not assets and net worth.

The Registered Retirement Savings Plan (RRSP) was introduced in 1957 to encourage Canadians to provide for their own retirement. They are intended to encourage private savings for retirement and thus contribute to the earnings-replacement objective. Money placed in RRSP account,, as well as investment earnings on the money are tax-deferred until withdrawn on retirement or earlier. As well as RRSP account for individuals, there also can be a spousal RRSP which allows a higher earner, called a spousal contributor, to contributed to an RRSP in their spouse’s name (it is the spouse who is the account holder). A spousal RRSP is a means of splitting income in retirement and, therefore, possibly pay less tax.

Maternity and Parental Benefits began in 1971 and are a part of the Employment Insurance program. Parents must have contributed to EI program. The basic rate of these EI benefits is 55% of average insurable weekly earnings up to a maximum of yearly amount of $50,800. EI maternity benefits can be paid for a maximum of 15 weeks and EI parental benefits can be paid for a maximum of 35 weeks. Some companies offer ‘top-up’ programs with increased benefits in amount of pay and length of payment. (Added August 21, 2016)

Child Rearing Drop-Out Benefit (CDRO) began in 1983. This benefit allows parent to increase Canada Pension Plan (CPP) benefit if he/she stayed at home to take of children under the age of seven. The period of time parent stayed at home can be excluded from the calculation of the CPP benefit so that CPP benefit is increased. The CDRO can only be used for months when Family Allowance Payments were received or Canada Child Benefits are eligible and earnings were lower because work was either stopped or there were fewer worked hours. (Added August 21, 2016)

The Registered Education Savings Plan (RESP) began in 1998. From 1998 (the first year the program started) to 2006 inclusive the annual contribution limit was $4,000 and lifetime contribution limit $42,000 (including any contributions made prior to 1998). From 2007 to present there is no annual contribution limit and the lifetime contribution limit is $50,000 (including all contributions made prior to 1998). Based on the amount of the RESP contributions and income level, the government may additionally contribute up to $7,200 per child as well as other grants.

Since 2007, Canadian spouses or common-law partners have been allowed to split the pension income one of the spouse receives between the two spouses. This strategy allows the spouse who has the highest income to lower his tax payable by sharing up to 50 % of his pension income with his spouse.

The Tax Free Savings Account (TFSA) began in 2009. The amount of $5,000 new contribution room (from after-tax income) was allowed for each year from 2009 to 2012. For the years 2012 and onwards, the amount is $5,500 per person. The maximum amounts for an individual for years 2009 to 2012 is $20,000 and for a couple in a married or coupled family unit it is $40,000. From years 2013 to 2016, the maximum amounts for an individual are $22,000 and $44,000 for a married or coupled family unit. For years 2009 to 2016, the maximum allowable amounts for an individual total $42,000 and for a married or coupled family unit comprised of two adults $84,000 (all tax free).

OAS is a federal social program designed to provide a very modest pension to low- and middle-income retirees. In 2016 the OAS is $6,680 for single person and $13,760 for a couple. OAS clawback which began in 2011 does very little to clawback the income of wealthy persons. The clawback of OAS benefits in 2016 starts with a net income per person of $72,809 (couple $145,618) and completely eliminates OAS with income of $118,055 (couple $236,110). The repayment calculation is based on the difference between personal income and the threshold amount for the year. The repayment of OAS is 15 percent of that amount. All OAS is clawed back if personal income is over $118,055. According to Human Resource Development Canada, only about five percent of seniors receive reduced OAS pensions, and only two percent lose the entire amount. This program benefits wealthy couples and widowers the most. OAS clawback for couple only begins at net income of $145,618 thus allowing them to receive full OAS of $13,760 as a couple. There are not many ever single seniors and early divorced in life seniors who could hope to achieve a net income of $72,809; however, for wealthy widowers this may be easier to achieve and they are the ones who complain about clawback.

Starting in January 2016, tax changes decreased income taxes (federal) for those making between $45,282 and $90,563 from 22 per cent to 20.5 per cent. It also increased taxes on those making above $200,000 from 29 per cent to 33 per cent. The majority of ever singles and early divorced persons do not have incomes over $45,282 (statcan). While middle class families with children get less of the Canada Child Benefits because they are based on income, this is offset with reduced income taxes. So, who financially loses out yet again?-answer, singles. (This paragraph was added on August 9, 2016).

Income splitting would have allowed couples with children younger than 18 to transfer up to $50,000 in income from the higher earner to the lower earner for tax purposes, for a benefit that will be capped at $2,000. It was to start with the 2014 tax year, but was eliminated by the Liberal government.

Other possible benefits on the federal level are too numerous to mention. Married or coupled with children family units may also receive other top up benefits on the provincial level.

From the time a married or coupled with children family unit begins at marriage until death of one of the spouses, it is possible they will receive shower, wedding and baby gifts, maternity/paternity leaves, child benefits, TFSA benefits times two, RRSP benefits times two, reduced taxes, pension-splitting, and possible survivor pension benefits. There also are probably a great number of years where they never pay full taxes while increasing their wealth. Singles are not able to achieve these same level of benefits and tax relief.

SOLUTION

To bring some sort of sanity to all the benefits upon benefits upon benefits that married or coupled family units receive, for starters it would be prudent for politicians and government to apply square root equivalence scales (finances) to any and all benefits, past and future. An example when implementing benefits would be to apply a square root equivalence value of 1.0 for a single person family unit and a value of 1.4 for a married or coupled without children family unit.

CONCLUSION

As shown above benefits have been given to married or coupled persons with children family units for seventy five years and have not been as kind to singles. The majority of the benefits have been implemented by the Federal Conservative party in the last decade and continue to be perpetuated by the Liberal party. Ever singles and early divorced singles without children have not received the same level of benefits (single parents with children do receive some benefits, but these still are not at the same level as married or coupled family units, for example, pension splitting and spousal RRSPs). There is no issue with providing support to poor and low income family units with children. However, singles should take great issue with benefits being given to family units with children without taking into consideration income as well as net worth and assets so that they can increase their wealth from these benefits. Also, there should be great issue with poor and low income singles not receiving same level of assistance.

As stated in a previous post (decades), how many more decades is it going to take before singles are equally included in financial formulas as married or coupled family units? When is the financial discrimination of singles going to end? This is not just a Canadian problem, but a worldwide problem. Singles need to speak out about financial discrimination.

(This blog is of a general nature about financial discrimination of individuals/singles. It is not intended to provide personal or financial advice).

RSS Feed

RSS Feed

Pingback: WHAT IS THE POINT OF POLITICS AND POLITICIANS IN FINANCIAL DISCRIMINATION OF SINGLES? | Financial Fairness For Singles

Pingback: HISTORY OF FAMILY TAX CREDITS OVER DECADES ARE FINANCIALLY DISCRIMINATING TO SINGLES – Part 2 of 2 | Financial Fairness For Singles