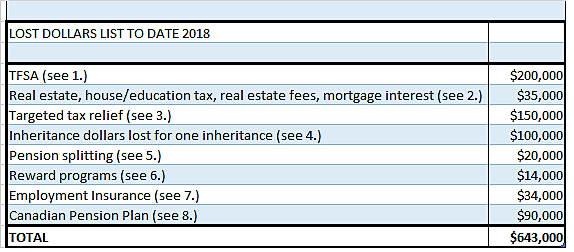

LOST DOLLAR VALUE LIST TO DATE

These thoughts are purely the blunt, no nonsense personal opinions of the author and are not intended to provide personal or financial advice.

The Lost Dollar Value entered in posts to date (updated April 28, 2018) have been collected and are itemized below. Description of Lost Dollar Value item as well as the date of the post in which item was described are given below the table.

- Tax Free Savings Account (TFSA) Boondoggle (November 8, 2015 post) 2015/11/08/tfsa – If age 25 to age 65 or forty years and annual contribution of $5,000 is calculated for maximum contribution of TFSA that can be used by spouse number two, then calculated lost dollar value equals $200,000 ($5,000 times 40 years. This does not include amounts lost through compound interest and investment potential.)

- Real Estate Upside down finances (November 21, 2015 post) 2015/11/21 – For a 700 square foot condo where price is $50 more per square foot than lowest price of largest condo in complex, it can be assumed that the purchaser will be paying $35,000 more than purchaser’s base price of largest condo; if the price per square foot is $100 more per square foot then purchaser will be paying be paying $70,000 more; if the price per square foot is $150 more per square foot then purchaser will be paying $105,000 more and so on. The amount of house and education taxes, real estate fees and mortgage interest will also incrementally increase. For Lost Dollar Value $50 per square foot including gestimate loss for taxes and real estate fees, interest charges will be used as the example.

- Targeted tax relief-Senior singles pay more (December 5, 2015 post) 2015/12/05/senior-singles-pay-more – Since it costs ‘ever’ single and divorced/separated seniors with rent or mortgage about 70% – 75% of married/couple seniors’ income, lost dollars of 70% for $20,000 extra that married/coupled seniors get tax free or $6,000 per year (age 65 to 90) will be added to the list. Total value of dollars lost will be $150,000 or $6,000 times 25 for years age 65 to 90).

- Inheritances (December 30, 2015 post) 2015/12/30/inheritances– A value of $100,000 lost will be added to the list. This is probably grossly understated since, first, inheritances are likely higher than $100,000, and second, the rule of 72 growth has not been added since it is not possible to calculate. (However, using rule of 72, a rate of return of 3.5 per cent would double the original $100,000 in twenty years.)

- Pension Splitting (January 31, 2016 post) lostdollars/2016/01/31– From estimate on income splitting described in research (lop.parl.gc.ca), it has been suggested that income splitting would provide tax relief of $103 for income $30,000 or less and $1,832 for income of $90,000 and over or an average of $794 overall. If $800 ($794 rounded off) is calculated times 25 years (age 65 to 90), then Lost Dollar Value will equal $20,000 (value revised April 14, 2016).

- Reward Programs (March 10, 2016 post) 2016/03/10/reward-programs– A ’lost dollar value’ for singles of $240 fuel rebate for total of 12 months) will be used. The only ‘lost dollar value’ that will be added to the list is the fuel rebate as this is the only constant available and easily calculated for an entire year. (Lifetime total, age 25 to 85, $240 times 60 years equals $14,000).

- Employment Insurance (April 6, 2016 post) 2016/04/06/employment-insurance– For a person (‘ever’ single and married/coupled persons without children) who has been gainfully employed for forty years and paid an average gestimate of $900.00 of EI per year (which is now at a maximum of $930.60 per year), the lifetime Lost Dollar Value would be $36,000 per person. (Review of data shows that over last couple decades, EI premiums have been as low as approximately of $800.00 per year to a high of over $1,000 per year.)

- Canadian Pension Plan death benefits (CPP) (added April 28, 2018) (financial-death benefits) – Estates of singles never married, no kids who die, including tragic deaths, before receiving (CPP) benefits may forfeit huge dollar value of CPP contributions. In just ten years of employment with maximum $2,500 annual CPP contributions or $25,000, deceased single person’s estate will only receive a $2,500 death benefit. Total of $22,500 contribution is forfeited to be used by the survivors of married or coupled households. Imagine what the total might be for forty years of CPP contributions (?$90,000)!

ADDITIONAL FINANCIAL DISCRIMINATION AGAINST SINGLES NOT INCLUDED IN ABOVE (added April 11, 2016)

- Extra surcharges for fees like library, recreational, gyms, hotel rooms, etc.

- Extra surcharges for cruises (can be as high as 150 to 200 %). Some cruises have now added solo cabins, some as small as 100 square feet, which shows that singles are still seen as less than equal to married/coupled persons.

- Freebies for families like free children’s meals

- Gifts – family of four as a single unit will receive more monetary value from gifts given by parents, grandparents, etc. than a single person living in a single unit. This may not necessarily be a bad thing. All that is being said is that singles over a lifetime will receive less in monetary value from gifts than families. The same can be said for giving gifts – singles may spend more in giving obligatory gifts without receiving same monetary value back.

CONCLUSION

While married/coupled people often don’t realize financial benefits they have over singles and families will argue over and over again on how expensive it is to raise children ($250,000 per child), it is also very expensive to be single when financial benefits are taken away or left out by omission for singles. Canadian singles possibly actually lose the equivalent of raising two children as seen in calculations presented above (and the list is not even complete yet)! And, in fact, many of the values are probably under reported!

This blog is of a general nature about financial discrimination of individuals/singles. It is not intended to provide personal or financial advice.

Pingback: Financial Fairness For Singles

Pingback: AFFORDABLE HOUSING FOR VULNERABLE POPULATIONS, SINGLES AND THE POOR | Financial Fairness For Singles

Pingback: FINANCIAL REPRIEVE FOR INFANT DEATHS DISCRIMINATES AGAINST OTHER FAMILY DEATHS | Financial Fairness For Singles

Pingback: IF HUMAN RIGHTS SAY THEY CAN’T HELP IN FINANCIAL DISCRIMINATION OF SINGLES, WHO CAN? | Financial Fairness For Singles