TFSA BOONDOGGLE FOR SINGLES AND LOW -INCOME CANADIANS

These thoughts are purely the blunt, no nonsense personal opinions of the author and are not intended to be used as personal or financial advice.

Comment: This article was previously published in a local newspaper and is available on the internet. There were 51 recommends for this article. The final outcome (dependent on the results of the October 2015 Canadian Election) was that proposed changes to increase the TFSA to $10,000 by the Conservative party election promises was reverted back to $5,500 by the successful Liberal Party under Prime Minister Justin Trudeau . Regardless of what the TFSA limit is, with no cap on the contribution amounts, individuals/singles will still be at a significant financial disadvantage to married/coupled persons. Wording has been slightly changed from the original publication but does not change the thought content of the original publication (changes and additions to wording have been italicized).

The Federal Progressive Conservatives had in their infinite wisdom proposed in an election promise that the Tax Free Savings Account (TFSA) limits be changed from $5,500 to $10,000 per year.

To show the effects of having just $5,500 as a contribution amount for married/partnered versus individual/single Canadians, everybody sharpen your financial pencils and dare to do this simple math exercise-calculator not required.

Step 1 – Create two columns, one labelled married/partnered, the other individual/single. In each column for year 1 enter $11,000 for highest possible contribution for both spouses, and $5,500 for a single. Continue up to year 5 or up to year 40 (suggested number of income producing years). Then total the amounts in each column. At year 5 married/partnered total will be $55,000, single amount will be $27,500.

Step 2 – Now using the ‘Rule of 72’ https://en.wikipedia.org/wiki/Rule_of_72 -calculate the amount of possible compounding interest, investment income that can be generated from amounts in each column. Rate of return of 7 per cent will double the bottom line amount in 10 years and double again in 20 years and so on. Okay, you can use a calculator for this step!

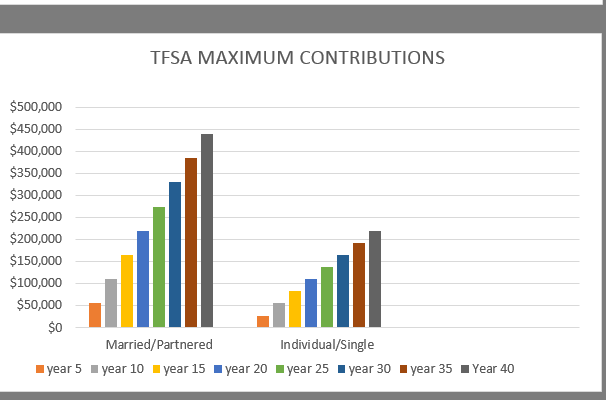

Step 3 – Create a graph for amounts in each column, one for married/partnered totals, another line for individual/single totals. Each step in the graph could be shown for every five years up to forty years.

Results for $5,500 contribution (not including investment or interest amounts) amounts are shown in table below:

TFSA MAXIMUM CONTRIBUTIONS PER YEAR FOR MARRIED/PARTNERED VERSUS SINGLES

NOTE: Does not include potential compounded interest/investment income

TFSA TOTAL Married/Partnered Individual/Single

Year 5 $ 55,000 $ 27,500

Year 10 $110,000 $ 55,000

Year 15 $165,000 $ 82,500

Year 20 $220,000 $110,000

Year 25 $275,000 $137,500

Year 30 $330,000 $165,000

Year 35 $385,000 $192,500

Year 40 $440,000 $220,000

This simple math exercise, which takes TFSA financial amounts down to the lowest common denominator, shows the proposed $10,000 yearly TFSA (all tax free!) would exponentially increase the wealth of married/partnered and high-income Canadians, while flat-lining the wealth of singles and low-income Canadians.

Add in Registered Retirement Savings account (RRSP) amounts with potential investment growth and wealth spread becomes even wider.

Thank you, Progressive Conservative Party for failing this simple math exercise, lining your own pockets just because you are married/partnered and wealthy, lining the pockets of married/partnered and high-income Canadians to levels of untold wealth while kicking off the financial bus individuals/singles and low-income Canadians who are unable to max out TFSA and RRSP contributions or make contributions to both programs.

Shame on Finn Poschmann, V.P. and Director of Research, C.D. Howe Institute for also failing this simple math exercise. In the Calgary Herald, “Popularity of TFSAs could mean lifetime cap in the future”, April 23, 2015, page D3 and business.financialpost.com/personal-finance he states:

“That is absolutely fantastic, when you picture a world where a huge share of Canadians are retiring and living for a very long time, knowing that they have significant savings on hand. And there will less draw on public support programs which is also great….” He further goes on to state: “When TFSAs do become big, they may be a political target, and a financial target for government. However, it would be morally wrong for government to turn course, then, and go back on the commitment made to savers when they are doing their saving. So changing the tax rules retroactively would be very, very bad”.

Who are your financial advisors that would lead you to such an off-balanced decision and statement? Why would think tank persons, who are supposedly critical thinkers, and politicians make such a morally unfair decision to increase TFSA amounts without a cap in the first place and then think it is morally wrong for government to change course after the morally unfair decision has been made? This decision does nothing to erase the use of public support programs as only the wealthy will benefit from raising the TFSA amount.

It is no wonder that Canadian individuals/singles with and without children and low-income persons are in financial despair, repeat, financial despair. With governments, businesses, society and families giving financial preference and perks to married/coupled people and full complement families with two heads of households, individuals/singles are repeatedly having to pay more and get less and can’t even remotely begin to ever ‘catch up’ or be on an equal playing field with married/coupled Canadians.

Financial discrimination and violation of the human rights of individuals/singles and low income people must stop. There must be a cap on TSFA amounts and the cap must be put in place right now rather than later. It is socially, morally and ethically reprehensible, irresponsible and shameful to consciously make the already wealthy even wealthier at the expense of the poor.

Political parties who fail to use simple math formulations to avoid financial discriminatory policies and promises don’t deserve to be in power. Get out and vote! Individuals/singles and low income Canadians, contact your Members of Parliament regarding the financial discrimination of singles and low income persons! (Election took place in October, 2015 with the Liberal party winning a majority and TFSA amount remaining at $5,500).

Lost Dollars Value List

Stay tuned, this is a work in progress and will hopefully appear in future blog entries.

(This paragraph on lost dollar value for TFSA was added April 10, 2016 – If age 25 to age 65 or forty years and annual contribution of $5,000 is calculated for maximum contribution of TFSA that can be used by spouse number two, then calculated lost dollar value equals $200,000 – $5,000 times 40 years. This does not include amounts lost through compound interest and investment potential.)

The blog posted here is of a general nature about financial discrimination of individuals/singles. It is not intended to provide personal or financial advice.

Pingback: LOST DOLLAR VALUE LIST TO DATE AND FINANCIAL DISCRIMINATION OF SINGLES | Financial Fairness For Singles

Pingback: ANALYSIS OF “THE TAX SYSTEM EXPLAINED IN BEER” ANALOGY | Financial Fairness For Singles

Pingback: TAX FREE SAVINGS ACCOUNT (TFSA) DESIGNED TO MAKE MARRIED AND WEALTHY EVEN RICHER | Financial Fairness For Singles

Pingback: TFSA (CANADA) – RAMIFICATIONS OF FINANCIAL DISCRIMINATION AND ABUSE OF THE PLAN | Financial Fairness For Singles