RESPONSE TO LETTERS ON UNFAIR SINGLE SENIORS TAXATION

These thoughts are purely the blunt, no nonsense personal opinions of the author and are not intended to provide personal or financial advice.

(This opinion letter was originally published in a local newspaper on September 9, 2015. Since there is a space limit for number of words that can be submitted to newspapers, additional comments that do not appear in the original published article have been added here in italics). This blog post was updated on December 1, 2017 replacing 60-70% of living costs to 1.4 equivalence scale (equivalence-scales) for singles.

Here we go again. Opinion letters from last two weeks show married/coupled people cannot put themselves into singles’ financial shoes without dumbing down singles’ opinions and sticking singles’ finances into family financial boxes. Unfortunately, singles finances don’t work that way. Following is a response to both letters.

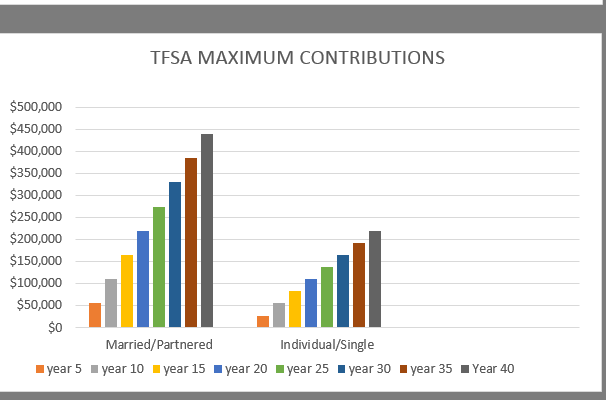

Re TFSAs (Tax Free Savings Accounts), caps must be set on TFSA amounts. Otherwise, wealth spread between married/coupled people and singles and low income people will exponentially widen with less money collected in tax systems, and ability to pay for public programs such as education disappearing. Most singles, single parent and low income families are unable to max out TFSAs at lower limit, let alone higher limit (and RRSPs-Registered Retirement Savings Plans).

Re income splitting benefits, multiple discussions show wealthy families benefit more than other families. Present format implies households with singles, single parents (don’t get to stay home to raise kids) and parents with equal incomes don’t deserve same financial equality. Re pension splitting married/coupled people already get two of everything including pensions.

You say bizarre conclusions have been reached. Let’s talk bizarre. Re Allowance Program and Credits benefits, 2009 Policy Brief, “A Stronger Foundation-Pension Reform and Old Age Security” by Canadian Centre for Policy Alternatives, page 4 policyalternatives.ca, states:

‘this program discriminates on basis of marital status as confirmed by case brought under Charter of Rights where federal court agreed program was discriminatory, and ruled it would be too expensive to extend program on basis of income regardless of marital status.’

So what is happening? Age eligibility for Allowance benefits will change from 60 to 62 beginning in 2023 with full implementation in 2029. In this democratic, civilized country let’s just ignore federal court rulings and continue a $? million discriminatory program. Article also suggests that:

‘OAS (Old Age Security) and GIS (Guaranteed Income Supplement) combined should be increased to at least bring it up to after-tax LICO (Low Income Cut Off) for single individuals.’

Why should married/coupled people get discriminatory marital status benefits where unused credits like Age Credits benefits can be transferred to spouse?

Conservatives are so proud they have initiated targeted tax relief benefit where single senior can now earn $20,360 and senior couple $40,720 before paying federal income tax. Using simple math, tax relief for single seniors is only $1,697 per month, for senior couples $3,393 per month. Rent or mortgage payment of $1,000 per month is barely covered for singles, but is amply covered for senior couple.

BMO Retirement Institute Report “Retirement for One-By Chance or Design” 2009 .bmo.com and other reports state present tax systems give huge advantages to married/coupled people with singles never married or divorced at some point throughout their entire working career usually subsidizing married/coupled people.

Russell Investments “Spending Patterns in Retirement”, February 2010, russell.com states:

‘government transfers, such as CPP and OAS are generally not sufficient to cover Essentials of Retirement. Problem is magnified for single retirees. For example, in $35,000-$60,000 income category, couples spend only about 12% more than singles on essentials, yet receive about 80% more in government transfers’.

Eighty per cent more in transfers, why can’t married/coupled people grasp this fact? Why can’t families understand that ‘ever’ singles have not used medical services for baby delivery, maternal/paternal paid LOA’s from work and many have not used any EI benefits? Instead ‘ever’ singles are financially supporting and subsidizing families.

Reader #2 letter also talks about how expensive it is to raise a disabled child. It is no different living as a disabled adult. The Assured Income for the Severely Handicapped (AISH program in Alberta) allows only $1,588 a month for an unemployed disabled person of single status.

True living costs for singles must be recognized. Using equivalence scales it is a well-established fact that living costs for singles are 1.4 to that of a couple. If married persons own their homes outright, the cost of living is even less to that of singles who rent or have a mortgage. If programs such as pension splitting and survivor benefits continue for married/coupled and widowed seniors, then at same time, singles and not widowed single seniors should get 1.4 equivalent scale enhancements through GIS and OAS relative to married/coupled persons’ baselines. Equivalence scale of 1.4 for couples to that of singles’ federal tax relief of $20,360 income should equal $28,504 ($2,375 per month) not $40,720 for couples. Why is that too much to ask?

Politicians and most families are financially illiterate in financial affairs of singles. The Conservative political parties (provincial and federal) are particularly guilty of this as many marital status benefits have been implemented under their watch.

Further advice from reader letters state singles can live with someone else when they are already living in studio, one bedroom apartments, and basement suites. Senior singles who have lived productive lives while contributing to their country want and deserve their own privacy and bathroom. Many senior assisted living dwellings have in recent years built more spaces for singles who with one income pay more for that space than married/coupled persons. Just how long should shared arrangements go on for (entire lives?) instead of correcting underlying financial issues?

Following examples show financial dignity and respect for singles (and low income families). Attainable Housing (attainyourhome), Calgary, allows maximum household income of $90,000 for single and dual/parent families with dependent children living in the home and maximum household income of $80,000 for singles and couples with no dependent children living in the home. Living Wage for Guelph and Wellington allows singles dignity of one bedroom and living wage income that is 44% of a family of 4 income and 62% of a family of two (parent and child).

Assumptions that middle class singles can live on average after tax income of $27,212 is bizarre. Suggestion of $200 food budget and $110 transportation per month for singles is unrealistic. At present gas prices, $150 per month is barely adequate for 30-40 minute drive to and from work. For comparison, Living Wage for Guelph and Wellington (livingwagecanada) (2013 living wage of $15.95 per hour), a bare bones program to get low income and working poor families and singles off the street, allows a calculated living wage income for single person of $25,099 with no vehicle, food $279, transit and taxi $221 (includes one meal eating out per month). (It should be noted that men require more calories; therefore, their budget for food will be higher. Also in 2015, the living wage for Guelph and Wellington has been set at $16.50 per hour).

Reader #2 letter seems to include expenses such as utilities, insurance, and phone bill in family expenses, but excludes them from the single person expenses. Reader #2 seems to think that $500.00 after food, transportation, clothing and rent expenses per month is ample money to cover miscellaneous expenses such as laundry, recreation and eating out plus the non-mentioned utilities, insurance and phone bill. The reader #2 letter then goes on to say: ‘And, if a single person cuts out some of the recreational activities and eating out, could break even at the lower end.’ Once again there is that assumption that singles spend too much on recreation and eating out. And, of course, there is no mention of singles having to save for emergencies or retirement.

While singles are living in their small spaces (average size of new studio, one bed and one bed/den new condo combined being built in Toronto is 697 sq. feet), majority of Canadian married/coupled people families are living in average 1950 sq. foot houses (2010) with large gourmet kitchens, multiple bathrooms, bedrooms for each child and guests, basement, garage, yard, and nice patio with barbecue, etc.

Families don’t take their own advice which they dish out to singles. Senior couples or widowed don’t want to give up their big houses, but ask for reduced house taxes and senior’s school property tax assistance programs (Calgary Herald, “Not Now” letter to the editor, August 26, 2015). If you can’t pay your house taxes, how about moving to smaller place or go live with someone (tit for tat)? If families with kids don’t pay school property taxes as seniors, then homeowners who have never had kids should not have to pay school taxes throughout their entire lives.

Financial discrimination of singles is accepted in mainstream and is, indeed, celebrated. Article like “Marrying for money pays off” (researchnews) implies married/coupled persons and families are more financially responsible.

In Calgary Herald article, August 7, 2012, Financial Post “Ten Events in Personal Financial Decathlon Success” (personal-financial-decathlon), the Family Status step says:

‘From a financial perspective, best scenario is a marriage for life. It provide stability for planning, full opportunities for tax planning and income splitting and ideally for sharing responsibilities that can enhance each other’s goals and careers. One or two divorces can cause significant financial damage. Being single also minimizes some of the tax and pension advantages that couples benefit from’.

How nice!

There is no need for another political party as stated in Reader #1 letter. In present political system, singles are losing financial ground. Words ‘individuals’ or ‘singles’ rarely come to the financial lips of politicians, families or media. What is needed is to bring financial issues of singles to same financial table as families and to make positive changes for both parties to financial formulas. Singles are not asking for more financial benefits than families, but equivalency to family benefits as applicable at rate of 1.4 to that of household comprised of two persons. They deserve this as citizens of this country.

So when singles are no longer able to live with financial dignity thus creating financial singles ghettos (financial bankruptcy because they are not included in financial formulas), just what will society do? Apparently, they are looking for people to go to Mars. Singles could always be involuntarily sent there. Out of sight, out of mind.

This blog is of a general nature about financial discrimination of individuals/singles. It is not intended to provide personal or financial advice.