BOUTIQUE TAX CREDITS PUSHING SINGLES INTO POVERTY-Part 2 of 2

These thoughts are purely the blunt, no nonsense personal opinions of the author and are not intended to provide personal or financial advice.

six-reasons-why-married-coupled-persons-are-able-to-achieve-more-financial-power-wealth

(The last two posts discussed how detrimental boutique tax credits can become to the financial well-being of a country and its citizens. These were based on ‘Policy Forum: The Case Against Boutique Tax Credit and Similar Expenditures’ by Neil brooks (abstract).

This post itemizes four personal finance cases showing how certain family units may benefit far more than other family units like ever singles and singles with children).

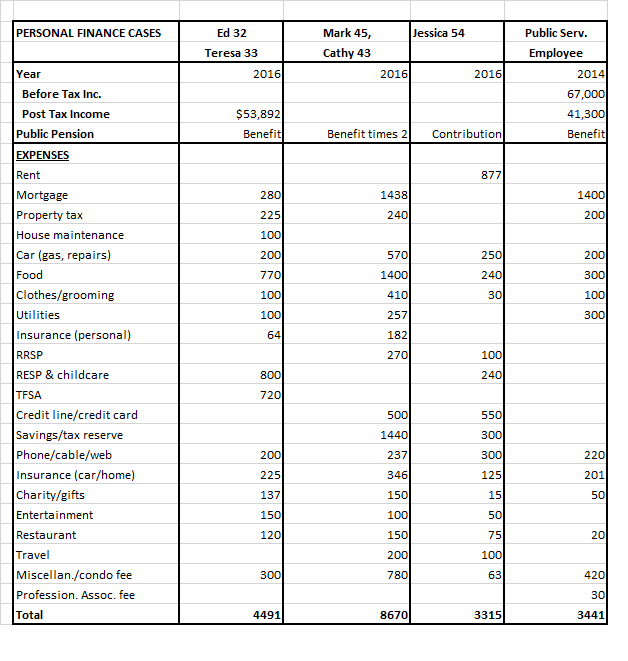

CASE 1 – Financial Post Personal Finance Plan, June 11, 2016 – ‘Farm Plan Risky for Couple with 4 Kids’ (financialpost)

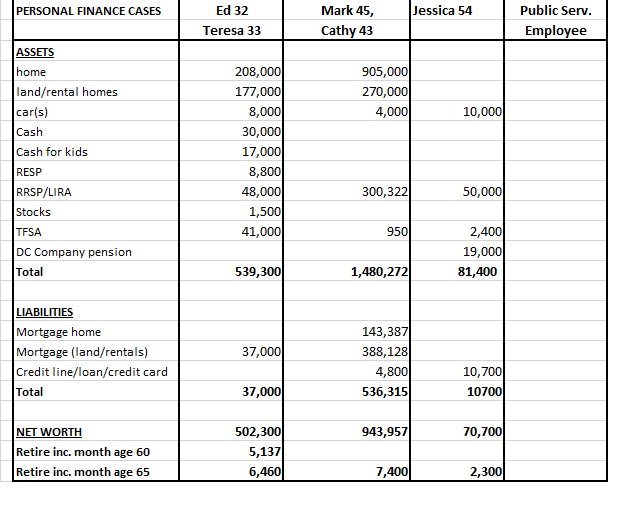

Ed age 32 and Teresa 33 have four children ages 5, 3, 1 and newborn in British Columbia. Ed works for a government agency, Teresa is a homemaker. At age 32 and 33, already have a net worth of $502,000 ($208,000 home not in the Vancouver area fully paid and $177,000 land with $37,000 (21%) mortgage. They would like to sell their house, move out of town and set up a small farm. Ed would give up his government job and secure income by selling eggs and produce. Would like to retire with about $4,000 in present-day dollars and after tax.

Ed brings home $2,680 per month plus tax-free Canada Child Benefit (CCB) $1,811 for their four children, all under the age of 6 for total family disposable income to $4,491 per month (CCB is about 40 per cent of take-home income. (When all four children are ages 6 to 17, the CCB will be $1,478 a month based on 2016 rates).

Financial Planner’s Recommendations – Maximize Registered Education Savings Plans (RESP), so they can capture Canada Education Savings Grant (CESG) of $500 per beneficiary for total of $7,200 (three per cent annual growth after inflation would generate about $270,000 or about $67,500 per child for post secondary-education). Advice is that Ed continue working until the age of 60 and when the youngest child is 18. Advice is also given for purchase of the farm, details of which will not be discussed here. Each spouse would add $5,500 to their TFSAs for every year until Ed is age 60.

At retirement, if Ed retires at age 60 and Teresa continues as a stay at home spouse, in 2016 dollars they would have a total pre-tax income of $68,495, or $5,137 per month to spend after 10 per cent tax and no tax on TFSA payments. At age 65, they would have total income of $86,163 with no tax on TFSA payouts and pension and age credits or $6,460 a month to spend.

If they follow financial planner advice for retirement at age 60 and maxed out contributions of RESPs and TFSAs, rough calculations show they will have received approximately $339,000 child benefits, $308,000 tax free TFSA savings and $28,800 RESP government grants for total $675,800. This does not include all possible benefits from other sources such as provinces, GST/HST credits and interest generated from investments. If Ed is deceased before Teresa, as a widower Teresa will receive even more benefits as a survivor with survivor pension benefits.

All things remaining the same their assets at age 60 with farm/house $485,000, RRSP $48,000, and TFSA $349,000 will equal a total of $882,000. So, at age 60 they will have assets close to millionaire status while paying very little in taxes. (Financial Post rating – two stars out of five).

CASE 2 – Financial Post Personal Finance Plan, March 24, 2016 ‘Couple sick of existing like college student are living below their means, but could still use a financial tuneup’ (financialpost)

Ontario couple Mark 45 and Cathy 43 have two kids 9 and 12 and bring home $8,670 per month ($7,000 from jobs and net rent income $1,670 from two rental properties that produce good income in North). At ages of 45 and 43 they already have assets of $1,480,272 including RRSPs of $300,322, liabilities of $536,315 for net worth of $943,957. Their two cars are 10 and 15 years old. They feel like they are living like college students. Mark’s job is not secure and produces a lot of stress. They have not contributed to children’s RESP and 130 year old house requires repairs.

Financial planner advice is to restructure their finances, put money into RESPs for children and maximize RRSPs. Both spouses have defined benefit pension plans from past employment..

At retirement pensions, RRSP, rental income and CPP/OAS at age 65 would generate pre-tax income of $105,672. After age and pension splitting, after-tax income at 16% tax would be about $7,400 a month. Financial planner states they would have surplus income for travel and pleasure which they now forego, (plus they will still have assets of home and rental properties). (Financial Post rating – four stars out of five).

CASE 3 – Financial Post Personal Finance Plan, May 21, 2016 ‘Home Ownership Possible but Tight’ (financialpost)

Jessica, age 54 lives in Ontario and has three grown children. She would like to buy $150,000 house in small town Ontario. Assets are $40,000 LIRA, $2,400 in TFSA, $10,000 RRSP and $19,000 in company defined contribution pension plan, car $10,000 and debts of $10,700 for $70,400 net worth total. Her take home pay is $3,315 per month. She puts $240 in TFSA, $100 in RRSP and $300 in non registered account per month. “Her outlook is to retire in 10 years, but that will be struggle. She has to make a middle income (so stated) go a long way”.

Financial planner advice is to pay off debts in nine months. Advice is given for purchase of a home with three per cent twenty five year mortgage and saving for retirement but it will be on a financial shoestring. At retirement and after age and pension credits and 10% tax, she should have take home pay of $2,300 per month. Final comment: “her retirement will be hostage to unexpected expenses. But she will have the security of a home of her own”. (Financial Post rating two stars out of five).

CASE 4-Public Service Canadian employees

In same job/wage categories with 2013 annual income around $67,000 for never married singles, no children (calculations may vary slightly in provinces regarding tax and other deductions) approximate payroll deductions include income tax $11,000, CPP and EI $3,200, union dues $900, public pension contributions $5,300, RRSP deductions $3,500, parking $1,200, health premiums and insurance $600, for total of $25,700. This leaves $41,300 take home yearly income or $3,441 per month.

CONCLUSION

The above four cases show four distinctly different cases, two family units with children, one single parent family unit with children and one family ever single family unit.

- It is astounding how two parent family units with children can accumulate wealth while single parent and unattached person family units struggle to live on on $3,300 and $3,400 after tax dollars per month or $39,600 and $40,800 annually while working and into their retirement years.

- It is absurd that tax credits should comprise 40 per cent of a family’s income when they have the ability to become wealthy enough to not have to pay mortgage or rent. In some provinces, singles cannot have assets of more than $7,000 to get affordable housing, so why should families have assets of half a million dollars and still get full child tax credits?

- It is absurd that a family unit never pay full taxes at any time during child rearing years only to have the ability to retire early at age 60 and have more retirement income than they had during child rearing years and have paid little or no taxes.

- It is absurd to claim poverty because of what it costs to raise children when in age thirties and forties family units with children already have assets of half a million dollars and higher.

- It is absurd that married/coupled family units with children in retirement pay less than 20 per cent in taxes on very healthy retirement incomes because of pension spitting and other credits. Where is fairness when they pay same or less level of taxes as singles on lower incomes?

- Financial planner calls Jessica’s income middle class, but she has difficulties living on it.

- Married or coupled family units possibly have a much better retirement life than singles in family units with and without children. (Singles with children generally have the greatest financial struggle).

- Life during working years is just as difficult for singles as it is for married or coupled family units.

- Government, politicians and families need to consider all family units in financial formulas. These should be based on equivalence scales to provide financial fairness for all family units. Financial fairness should include not only income, but also assets.

- It should also be stated that when examining many of the Financial Post profiles for divorced persons with children, particularly those beyond child rearing years, many appear to have assets beyond $750,000. How is this possible? One reason might be inherited wealth. Second reason which has been stated over and over again in this blog is the ability for married/coupled persons with children family units to gain wealth and, therefore, already have considerable wealth when they are divorced later in life.

LESSONS LEARNED

IT IS INHERENTLY WRONG FOR GOVERNMENTS TO NOT INCLUDE ASSETS AS WELL AS INCOME WHEN DOLING OUT TAX CREDITS. THESE CREDITS SHOULD BE GIVEN TO THE POOR, NOT THOSE WITH LOW INCOME AND WEALTHY ASSETS. BETTER YET, TAX CREDITS SHOULD BE COMPLETELY ELIMINATED AND REPLACED BY TAXES WHICH ARE BASED ON INCOME AND ASSETS.

(This blog is of a general nature about financial discrimination of individuals/singles. It is not intended to provide personal or financial advice).