(These thoughts are purely the blunt, no nonsense personal opinions of the author about financial fairness and discrimination and are not intended to provide personal or financial advice – financialfairnessforsingles.ca).

For this discussion singles include millennials not yet married age 18 to 34, singles never married no children age 35 to 65, and early in life divorced persons with no children. Early in life divorced persons are unable to accumulate the same wealth as married persons who have two incomes and benefits times two over many years.

First and foremost, governments, society and married people have no concept about how difficult it is for ‘singles’ to live decent respectful financial lives. Canadian financial system has been setup to give benefits compounded on benefits to the wealthy and the married but leave ‘singles’ out of financial formulas and exclude them from the family definition.

SINGLES DO NOT BENEFIT FROM THEIR INCOMES IN THE SAME WAY AS THE MARRIED AND THE WEALTHY

Singles don’t get to income split, pension split, etc. so they are forced to pay more taxes. It is impossible for singles to save for retirement on a present day $50,000 income plus they are forced to live on a very frugal bare bones living wage income. A single person with a 2019 $50,000 Alberta gross income ($25/hr. and 2,000 worked hours) and $11,000 tax, CPP and EI deductions results in a net income of $39,000 ($19.50/hr.). This bare bones living wage that does not allow for savings, vacations or entertainment. It is impossible to maximize $9,000 RRSP and $6,000 TFSA contributions (35% of $39,000 with tax reductions for RRSP) even though many believe $50,000 is a good income for unattached individuals and single parents. As seniors these singles will likely be living only on CPP and OAS benefits.

Singles are only able to achieve full contributions to RRSP and TFSA with $80,000 income but only can do so while living on a bare bones living wage of $39,000, 18% RRSP of $14,400 and $6,000 TFSA contribution with RRSP tax savings of $4,400 or extra income of $366 per month.

This is completely unrealistic since both OECD and Canadian median income statistics show median incomes for unattached individuals is considerably lower than $80,000 and indeed even $50,000. The OECD calculator (oecd) shows that the median income for Canadian one person households is between $32,621 and $43,495 and income for one person households begins at $86,990 for the top 10%. Canadian median income by households in 2015 (vanierinstitute) shows the total median household income in Canada was approximately $70,300 before taxes ($61,300 after taxes), and $34,200 before taxes (just under $30,900 after taxes) for individuals. The Canadian Market Basket Measure (MBM) or OECD equivalence scales (OECDEquivalenceScales) show that it costs more for singles to live than two person households – if singles have a value of 1.0, it is only 1.4 for two person households, not 2.0.

There are many other ways in which singles are forced by government, society and families to contribute to family financial formulas without being able to benefit themselves from these contributions.

SINGLES DO NOT RECEIVE SAME LEVEL OF BENEFITS AS MARRIED/WEALTHY

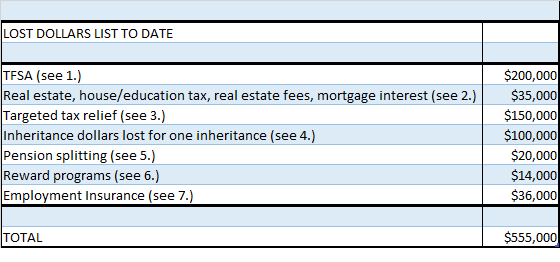

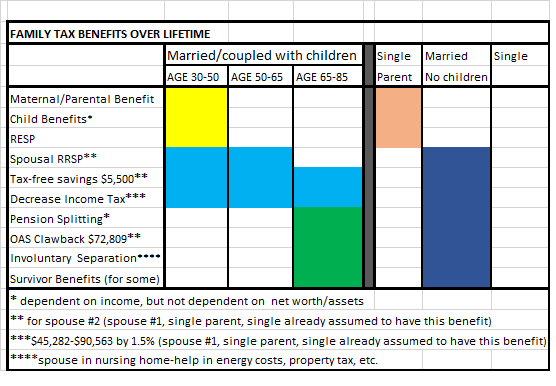

From the time a married or coupled with children family unit begins at marriage until death of one of the spouses, it is possible they will receive shower, wedding and baby gifts (there is no such thing as ‘singles showers’), maternity/paternity leaves, child benefits, TFSA benefits times two, RRSP benefits times two, RESP grants, reduced taxes, pension-splitting, no OAS clawback, Involuntary Separation payments and possible survivor pension benefits. There also are probably a great number of years where they never pay full taxes while increasing wealth and many can retire early before the age of 65. Singles are not able to achieve these same level of benefits and tax relief.

Married people fail to realize that they get two inheritances (it is quite funny watching married people struggle with this fact until you tell them one heritance comes from the wife’s side and the second from the husband’s side) Singles get one inheritance.

EI CONTRIBUTIONS AND BENEFITS

Government, families and society fail to recognize or even realize that singles often contribute to EI without ever using these benefits in their employment lifetime. Instead contributions (estimated $35,000 at $800 to $900 EI contributions over forty years – investment potential not included) are forfeited to be used by other persons particularly for maternity/paternity benefits. Singles are forced to help pay for maternity/paternity benefits for not only one generation, but possibly two generations. Question: when do EI maternity/paternity benefit payouts outpace the contributions of two working parents, especially when they retire early at age 55 and not contribute their full share to EI?

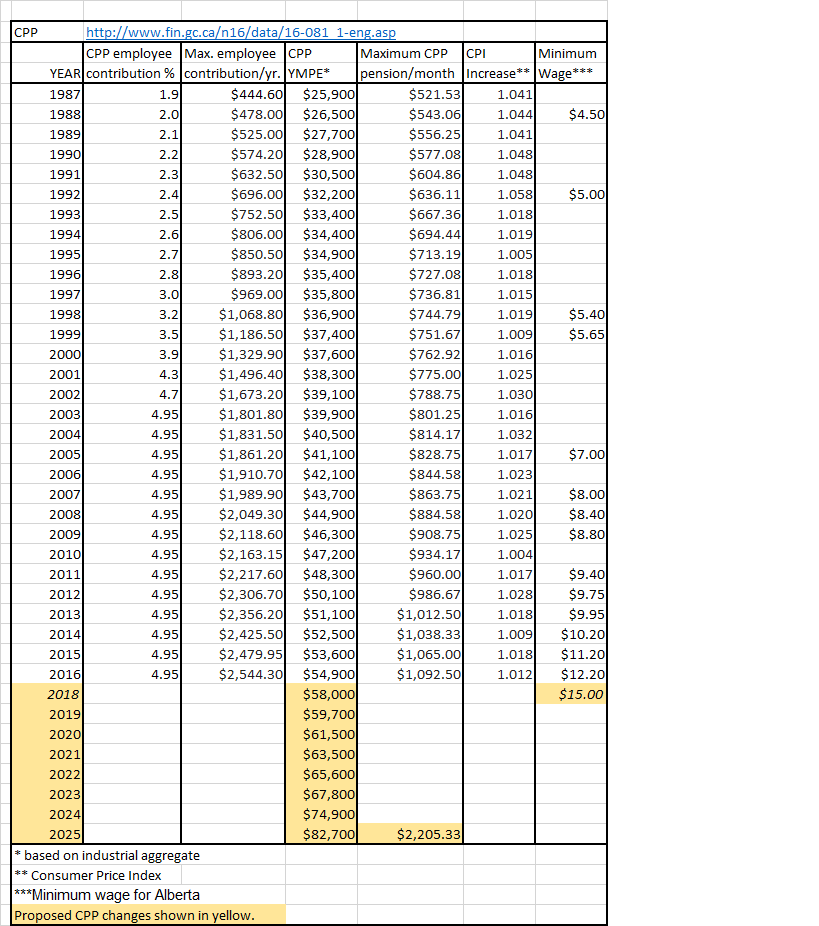

CPP CONTRIBUTIONS AND BENEFITS

The CPP death benefit is maxed at $2,500, is not indexed and not increased for many years. After forty years of employment with average $2,500 annual CPP contributions will total $100,000. If a single person dies one day after the age of 65 the deceased single person’s estate will only receive $2,500 death benefit which doesn’t even cover funeral costs. Total of $100,000 contribution is forfeited to be used by the survivors of married or coupled households.

And now Liberal Prime Minister Trudeau wants to increase surviving spousal CPP benefits by 25% while singles will not receive equivalent increase??? Conservative Party’s Motion 110 proposes investigation to ensure parents with early infant deaths do not suffer undue financial or emotional hardship due to government programming design, particularly from Employment Insurance Parental Benefits. Both Conservatives and Liberals continue to implement financial death formulas that benefit only families and the married.

SINGLES AND EMPLOYERS PENALIZED FOR OVERCONTRIBUTIONS OF EI AND CPP

When singles attempt to increase their financial worth by working multiple jobs, they will not be able to contribute to EI and CPP beyond the individual maximum limits. Meanwhile, married persons with both spouses working can contribute to maximum limits time two. This means singles will never be able to achieve the same EI and CPP benefits afforded to married households but Market Basket Measure shows it costs them more to live than two person households.

The irony of singles having to receive a rebate of EI and CPP contributions is that the rebate is paid to the employee, not the employer. In other words, the employer will have also made an overcontribution, but is not able to collect a rebate on the overcontribution. Their overpayment will be forfeited and added to benefits pot.

(Caveat: Uncertain how recent changes to CPP contributions will affect overpayment levels).

ENTREPRENEURS WHO HAVE A MARITAL STATUS OF ‘SINGLE’ WILL PROBABLY PAY MORE INCOME TAX SINCE THEY CAN’T “INCOME SPRINKLE”, etc.

Personal responsibility espoused by Conservatives equals gaslighting in its purest form.

Re small business earners, excerpt from a newspaper article states that “Small business owners, including incorporated professionals such as doctors, lawyers, accountants and others, will likely face a higher tax bill in the years ahead as a result of (Liberal) Finance Minister announcement this week targeting several common, and until now, perfectly legal, tax strategies used in conjunction with private corporations.

The strategies under attack can be categorized into three main areas: income sprinkling, earning passive investment income in a corporation and converting a corporation’s ordinary income into tax-preferred capital gains.

Among these changes, it’s the first one — income sprinkling — which is perhaps deemed the most offensive of the three and the one that will likely have the broadest financial impact on small business owners and incorporated professionals”.

What this newspaper article fails to recognize is that information is only talking about families. It fails to show how entrepreneurs who are single cannot use these benefits since they can only be personally responsible only to themselves since they have no children or spouses. They, therefore, will likely pay more taxes and will possibly be more likely to have business failures as entrepreneurs.

“Income sprinkling” describes how some families use private corporations to sprinkle income among family members. In a typical example, dividends that would have been received by the primary owner/manager of the private corporation, say, mom or dad, would instead be paid to the spouse, partner or kids of the primary shareholder, who are often in lower tax brackets than the primary owner/manager and thus the family’s total tax bill would be reduced. When it comes to income sprinkling of salary income, this rule is meant to prevent a parent who owns a corporation from paying his spouse or child an annual salary when he or she doesn’t actually perform any work or provide services to the business. In the past transferring dividends to children under the age of 18 was eliminated (this blog writer’s opinion – this was the right and fair thing to do as children would benefit from double dipping while using multiple combined medical and educational services and receiving concomitant tax free Canada Child Benefits).

Conservatives in the recent election promised to reverse some of these entrepreneurship rules changed by the Liberals, however, the election resulted in Liberals winning a minority government (example of Conservatives doing the wrong thing that would increase financial discrimination of single marital status entrepreneurs).

Since singles never married no children, millennials not yet married and early in life divorced persons without children in their financial circles can only be basically financially responsible to themselves, ‘Income sprinkling’, distribute dividends to family members, etc. is of no benefit to these entrepreneurs so they will pay more taxes. Why would singles and millennials not yet married even try entrepreneurship when they know from the get go that they will not have the same advantage, Alberta or otherwise, to married and wealthy entrepreneurs with spouses and children? Singles are forced to be more personally responsible since they do not receive equivalent benefits in financial formulas. Tax fairness needs to be ensured regardless of marital status and how income is earned.

Income, taxes and benefits, etc. define who employees are and how loyal they are to their employers. Without change to where there is fairness and equality for single employees in pay, pension, taxes, benefits, etc. the trend where young single employees have no sense of loyalty to their employers (revolving door of quitting and applying for job after job after job) will only continue and get worse. This also applies to senior single employees who have tried lobbying and using righteous anger regarding financial discrimination and singlism in the workplace and in society but get nowhere because their employers, politicians and society choose to blatantly not listen.

THE FINANCIAL HYPOCRISY, GREED, SELFISHNESS OF THE MARRIED AND THE WEALTHY AS SHOWN IN FINANCIAL ANALYSTS EVALUATIONS WHERE IMPACT ON NEVER MARRIED SINGLES IS COMPLETELY ABSENT AND INVISIBLE

Financial Post article “Couple with a big age gap forced to contemplate impact of an early death” (alberta-couple-with-big-age-gap-worry)

Article states wife (Lori) could lose $17,000 a year in income if her husband dies first since there is a ten year age difference. They have financial assets of $1,741,500 including a $650,000 house. At age 65 couple is estimated to have income of $6,000 per month ($72,000 annual net income after splits of eligible income, no tax on TFSA distributions and reduced income tax to average 15 per cent. How does single person ever only pay 15%?

If husband dies early, the financial planner estimates that Lori could lose $17,008 in gross annual income per year and potentially pay a higher tax on her remaining income. The reduced income could result from 1) loss of husband’s OAS, 2) part of two of his work pensions, 3) most of his CPP benefits and 4) the inability to split income, but 5) still have $650,000 house. All of these are not available to singles throughout their entire senior lives.

It is distressing to never married singles that this couple should be worried when it appears they are spending over $15,000 annually on travel and entertainment. If they are so worried that Lori’s standard of living will be reduced, why can’t they take personal responsibility, work till age 65, reduce some of their excessive spending and save that money to be used if husband dies early? How about paying fair share of taxes and maintaining lower standard of living that singles never married have to live every day of their lives?

It is also distressing to never married singles that Liberal Prime Minister Trudeau and other politicians are obsessing about benefits for surviving spouses. He is talking about increasing CPP benefits for surviving spouses by 25%. Twenty five percent! Will never married singles get same equivalent amount? Who is paying for this increase? Lori retired at age 55 so why should she receive an extra 25% when she hasn’t contributed to the full amount of CPP?

Michael Lewis, author of “The Undoing Project” book, describes how a Nobel Prize-winning theory of the mind altered our perception of reality. Two Israeli psychologists, Daniel Kahneman and Amos Tversky’s work created the field of behavioral economics which revolutionized thinking of how the human mind works when forced to make judgements in uncertain situations. An example is outcomes of surgery where there might be a 5% chance of death versus 95% chance of surviving the surgery. When patients are presented with 95% chance of survival rather than 5% death rate, they are more likely to go through with the surgery. The same judgement should apply to the hypocrisy of the wealthy.

For upper class and wealthy, please don’t ‘cry me a river’. Wealthy need to look at what they have left after taxation instead of what is being taken from them in taxation.

EFFECTS OF LOW INCOME ON BRAIN AND MENTAL HEALTH ESPECIALLY THE YOUNG

Government, politicians and society need to educate themselves on the effects that low income has on the brain by reducing connective white matter and increasing worse structural integrity as outlined in first article listed below. The second article outlines how Alberta university students are facing food insecurity and even homelessness. One of the reasons in particular for increased university costs is the massive increase in textbook costs – American data suggest textbook costs increased by more than 800 per cent between 1978 and 2013.

The information from the two articles has been submitted as an attachment.

1) “UNPREDICTABLE EMPLOYMENT MAY BE BAD FOR BRAIN HEALTH” by Lisa Rapaport, October10, 2019 (unpredictable-income) and 2) “FINANCIAL AND MENTAL HEALTH PRESSURES MOUNT ON STUDENTS” by Joel Schlesinger (unable to attach link).

THE CANADIAN PERSONAL FINANCIAL SYSTEM IS FRAGMENTED AND BROKEN

There is a complete fragmentation of the Canadian personal financial system where politicians through upmanship throw money at certain populations, include the wealthy but exclude certain populations such as singles, the only reason being to get votes.

Conservatives continue to talk ad nauseum about socialism of the left, but are ‘brain dead’ to the selective privileged socialism they practise every day for the wealthy.

The wealthy often aren’t employed for as many years as singles, yet they believe they should be able to get full CPP benefits and even extend these to surviving spouses (Trudeau to increase by 25% for surviving spouses) some of whom haven’t even been employed for 75% of the employment lifetime of singles.

The Canadian financial system for personal finances is broken. Continuation of overspending for the wealthy and the married will lad to bankruptcy of the personal financial system.

Solutions:

Instead of having a Minister for the Middle Class, a non partisan committee with participation by all political parties is needed to annually review financial formulas and personal benefits based on application of MBM/OECD. (See oecd for handy calculator by country and the number of persons in households). More ‘zooming out’ and balance between ‘right and left brain thinking’ (see below for explanation) needs to replace the present narrow focus of only financially privileging the wealthy and the married.

To counterbalance the net income, tax avoidance and tax free selective socialistic privileging for the married and the wealthy, it is crucial that lifetime federal and provincial income tax be immediately and exclusively completely eliminated for singles and single parents with incomes under $50,000 so they also can save for their retirements. (This change would be the equivalent of about $7,000 and would not exceed the many privileges such as CCB benefits and tax loopholes for the wealthy and the married).

Instead of singles subsidizing the married, the married should have to purchase mandatory term life insurance just like vehicle and house insurance.

The ‘financial pimping’ of singles and millennials not yet married by the married and the wealthy has to stop. Singles are tired of being financially pimped by their own wealthy parents, wealthy married siblings and wealthy married fellow employees. When singles are forced further into poverty to the point of homelessness, what will you do then?

The financial imbalance between the rich and the poor, singles and married only leads to populist anger, male millennial suicides (Alberta) and despair. There already has been created a genocide of indigenous peoples. We don’t need a financial genocide of singles.

TWO THEORIES ON WHY FINANCIAL SYSTEMS ARE FAILING AND INDEED MAY RESULT IN THE DEMISE OF CIVILIZATION

Governments, politicians, and society continue to manipulate the financial system so that selective socialistic benefits are given unequally to the married and the wealthy. Some believe continued progression of this inequality will lead to the degradation of civilization and, indeed, may even the demise of civilization. Indeed, even higher educational institutions of learning have migrated to teaching that is focused more to the narrowness of ‘left brain thinking’ (enormous capacity for denial and capacity to ignore things and keep them shut out – students specialize in narrow fields. Theories, and categories become important) and ‘zooming in’ (think smaller by focusing on vulnerability of poverty, not the wage of inequality) without ‘zooming out’ (getting people to care about problems first by ‘zooming in’ on a vivid person and then getting them to care by ‘zooming out’ from persons to systems”. To fight inequality means to change systems as a group of people).

‘Personal responsibility’ smacks of individualism instead of betterment of society as a whole.

Further explanation of the two theories outline why this may be happening.

The first is by Iain McGilchist and “The Divided Brain” from the Documentary Channel. He states that imbalance towards left brain hemisphere thinking gives narrow, sharply focused attention to detail without understanding the larger context resulting in bureaucracy, excessive concentration on money and wealth, bad politics and warped economic systems. Reduced role of right brain hemisphere thinking results in decreased ability to relate to things and understand them as a whole.

The second theory by Anand Giriharadas, “Winners Take All” says the same thing but in a different way. He refers to ‘zooming in’ and ‘zooming out’. ‘Zooming in’ causes us to think smaller by focusing on vulnerability of poverty, not the wage of inequality. ‘Zooming out’ causes us to care by ‘zooming out’ from persons to systems”. To fight inequality means to change systems as a group of people.

Both theories show how higher learning institutions have been affected by a narrowed focus on learning which then translates into a narrowed kind of thinking by politicians and society when these graduates get out into the real world.

Synopsis of Iain McGilchist and “The Divided Brain” from the Documentary Channel

The two hemispheres of the brain have styles or takes on the world, they see things differently, have different values, prioritize differently.

The left hemisphere’s goal is to enable us to manipulate things (like a calculator) whereas the role of the right brain is to relate to things and understand them as a whole ( like a tree branches growing out of the ground and sprouting out and upwards). Two ways of thinking about things are both needed but at the same time are compatible.

McGilchrist claims that the left hemisphere is gradually colonizing our experiences of the world with potentially disastrous implications. The way of thinking which is too mechanistic has taken over our way of thinking. We behave like we have right hemisphere damage. Do we pay a price for being too left brain centered? It has made us enormously powerful; it has enabled us to become wealthy, but it also means we have lost the means to understand the world.

Could the problems of the modern world be influenced by an imbalance of the human brain? And what does that imply about our future? For McGilchrist the problem is not only bad politics or a warped economic system. The problem is inside our modern brain.

Experiments showed that each hemisphere had a different way of looking at the world. The left talks and is analytical and the right pulls stuff together. Each hemisphere engages in everything, so each hemisphere, right and left, is involved in reason and language and emotion but in crucially different ways.

Why does the brain have two centres of consciousness, each capable of maintaining consciousness on its own but in a different way? The left brain will recognize parts i.e. (picture of a human cut in pieces) of a body to recognize a human , but the right brain requires the correct position of the human body to recognize it as a human. Both hemispheres are doing an excellent job and both hemispheres can contribute and both hemispheres can decide human or non human but both do it with different cognitive strategies.

He observed that the left hemisphere gives narrow, sharply focused attention to detail without understanding the larger context. It sees objects in relation to their usefulness. It is in charge of the right hand which has the power to manipulate things such as tools and to technology. As it can’t make human connections it does not not understand relationships, humor and tone of voice. Things and people are not unique and individual but groups that it can organize, sort and file in a system of rules and linear connections. On its own it has no sense of the whole. Even people are seen as body parts. The world of the left hemisphere is lifeless. It shatters the world into an assortment of bits without meaning.

The right hemisphere by contrast sees the broad view of the world. It is the master of the brain. It perceives an interconnected world. It understands relationships, body language, facial expressions and implicit meaning. The right hemisphere engages with life, understands movement, story and metaphor. It perceives how humanity fits into the whole of creation.

The divided brain give us two types of attention, two ways of engaging with the world. It has made us the most powerful species on earth.

But the left hemisphere’s narrow kind of attention reminded McGilchrist of something else. Our world! I began thinking how everything in public life has become more regulated, more rule bound, more explicit. For the last hundred years the way of thinking which is reduct to mechanistic has taken us over. It has enabled us to manipulate the world, to use resources, to become wealthy, but it has also meant we have lost means to feel satisfaction and fulfillment through our place in the world. We have created outside ourselves a world which looks very much like the interior world of the left hemisphere, rigid lines of things that were rolled out mechanically and were non unique. Bureaucracy is in its element. It depends on qualities which the left hemisphere provides: organizability, animity, standardization, uniformity, abstraction and so on. Systems designed to maximize utility with loss of cohesion socially because the left hemisphere needs control. There is a lack of trust and a lot of paranoia with the use of CCTVs and monitoring of all kinds .

The left hemisphere is the quick and dirty one because it has to make action. It likes things to be black and white. People think that, well, the left hemisphere surely is the basis for intelligence, it is the one that does all that analysis. But that is not the case. There is a lot of evidence that that the really critical one from the point of view of intelligence is the right hemisphere. Another important difference, a very important difference, is that between fixity and flow. Things in the left hemisphere are fixed whereas in the right hemisphere flow is what it sees and understands. Now that is very profound. That actually changes the whole nature of what life is. Nothing is just isolated. It is always part of a flow. Things can only be understood in context when you take them out. They change when you grab them and put them in the spotlight of attention and make them explicit.

“One of the primary features of the left hemisphere is that you find this enormous capacity for denial, this capacity to ignore things and keep them shut out. The left hemisphere that wants to slice and dice and execute quickly. To make quick decisions the left hemisphere relies on abstractions, categories and models of the world.

Economics detached from a robust resourceful picture of human well-being is very dangerous and that is what we are living with in large parts of the globe. We seem to take it as absolutely self evident that unlimited material growth is the best thing that we could hope for. The biggest single task is thinking again through that question of growth and why it is so obvious and target why some kinds of growth are privileged over the notion of growth of real human well-being and understanding.

The school curriculum moves away from the right hemisphere resulting in an imbalance between right and left hemisphere learning. In universities the learning becomes even more left hemisphere dominant. The student specialize in narrow fields. Theories, and categories become important.

McGilchrist: (Consequences- riots, protests) What certainly would not happen is that things would be calm because the left hemisphere is emotional and one emotion that lateralizes particularly clearly is anger and it lateralizes to the left. Discourse in public will become marked by anger and aggression. But, according to the right hemisphere everything is connected to everything else. It is about the relationships.

McGilchrist notes three periods where there was a flourishing of civilization in the west – Athens in the sixth century, the beginning of the empire in Rome, and early Renaissance. The civilization in these three cases showed a marvellous balance in the right hemisphere and left hemisphere ways of thinking, but in each case it ended up with a movement further and further towards the left hemisphere after which the civilization collapsed.

What McGilchrist’s work can do is point us in the direction toward a solution. If we can get better at seeing things more holistically, more specifically, more in context, if we can get better at systematically resisting attempts to turn things into algorithms, to always measure, to always quantify, if we can get better and more robust at doing that, the world will begin to steer towards a better place.

We need a better balance between the right and left hemisphere. We need to look at the world in a different way.

Einstein said the rational mind is the faithful servant, but the intuitive mind is a priceless gift. We live in a world that honors the servant that has forgotten the gift. We do need a paradigm shift, it is not about little things here and there. It is about the whole way we can see what a human being is, what the world is and what our relationship to it is.

Synopsis of “Winners Take All” by Anand Giriharadas (italics are blog author’s comments)

MarketWorld (capitalism) believes social change should be pursued through free market and voluntary actions without public life, law and reform of systems that people share in common.

MarketWorld “thought leader” thinkers (capitalists) promote so called ‘world-changing’ ideas with little risk to themselves. Their ideas cause us to “zoom in” and think smaller by focusing on vulnerability of poverty, not the wage of inequality. They don’t like “social justice” and “inequality” words, but rather use “poverty” and “fairness” while speaking of “opportunity”.

“Public intellectual” thinkers (conscious capitalists) counterbalance this thinking and change the trajectory of MarketWorld “by getting people to care about problems first by ‘zooming in’ on a vivid person and then getting them to care by ‘zooming out’ from persons to systems”. To fight inequality means to change systems as a group of people.

“Thought leaders” have permeated higher learning institutions by purposefully changing the language in which public spheres think and act. Young people are taught to see social problems in a “zoom in” fashion by confining questioning to what socially minded businesses they can start up like “buy one, give one”, but not inequality.

To counteract and provide balance to MarketWorld “our political institutions–laws, constitutions, regulations, taxes, shared infrastructure: these million little pieces provide a counterbalance to help hold democratic capitalistic civilizations together.”

Blog author’s thoughts on this theory: The one-sided financial hegemony of MarketWorlders has created the present day ‘graft and greed’ college financial scandal, FAA allowing Boeing to “self-inspect” and SNC Lavalin corruption.

One word comes to mind–brainwashing, or at the very least gaslighting. MarketWorlders have done a very good job of gaslighting the political, financial and higher learning powers that be.

(This blog is of a general nature about financial discrimination of individuals/singles. It is not intended to provide personal or financial advice).