POLITICIAN’S RESPONSE LETTER DOES NOT UNDERSTAND SINGLES’ FINANCES

These thoughts are purely the blunt, no nonsense personal opinions of the author and are not intended to provide personal or financial advice.

The post on Fort McMurray Fire Disaster relief (fort-mcmurray-fire-disaster)showed how family units comprised of singles received the lowest financial assistance of all family units. This information was sent to Province of Alberta politicians to make them aware of this situation.

One of the politician’s (right wing Conservative) response to this information is outlined here. This letter continues to show the financial misunderstanding and financial discrimination of singles in this country.

A portion of the letter is reproduced as follows:

“Data from Statistics Canada Table 203-0023 concerning total household expenditures shows that Alberta government and Red Cross financial assistance for single person households, lone parent households, and couples without children total between 50% and 63% of typical monthly expenditures for those household types. The only household type to receive financial assistance approximating their average monthly household expenditures were couples with children. The same data shows that a two person household with no children has almost twice (184%) the household expenses of a one person household.

Given that shelter, food, household operations, transportation, healthcare, and recreation are the largest components and total approximately 50% of household expenditures of all the household types, and given that most of those goods/services are provided without cost or at steep discounts to evacuees, and given that those goods/services are used in reduced amount during evacuation, the level of temporary financial support provided does not appear unreasonable. However, given that some organizations’ aid programs are focused on the needs of mothers, seniors, and other demographics, there may be an opportunity for more organizations or programs focused on single adults.

It is true that two parent families with two or more children receive more financial assistance than the other family types, however we are not aware of a compelling public benefit to reducing financial assistance to individuals living as two parent families with children on the basis of their family status.

With respect to potential human rights violations, the financial assistance appears to be provided without discrimination on the basis of any protected human rights grounds, with the reasonable exception of children who have lower financial needs than adults and seniors. As far as we are aware, “financial human rights” is an interesting concept but not currently a well-founded legal doctrine in Canada or any other jurisdiction. In order for treatment of particular social groups to amount to persecution, any alleged violation of basic human rights would need to arise out of repeated or mistreatment which causes personal harm the affected individuals. All of the available evidence suggests that the relevant governments intend to rebuild the wildfire-affected areas and to resume providing services to individuals communities in the same ways as before the wildfires.”

First, the Conservative right wing politician’s letter refers to Statistics Canada Table 203-0023 showing 2013 household expenditures for family units of one person households, lone parent with children, couples without children, couples with children as well as other family unit types. It is interesting to note that this data was based on surveys and these expenditures include tobacco and alcohol as well as games of chance. These are wants, not needs and do not deserve to be included in any discussion of fairness of financial expenditures or financial disaster assistance of family units.

Second, the letter readily admits that two parent with children family units received the most assistance. The statement also is made as follows: “we are not aware of a compelling public benefit to reducing financial assistance to individuals living as two parent families with children on the basis of their family status”. Now that is real fairness!

The statement “The same data shows that a two person household with no children has almost twice (184%) the household expenses of a one person household” is inherently false. There are many sources of information showing that it costs singles 60-70 per cent of what it costs a married/coupled family unit to live (moneysense).

For a more accurate comparison of percentage of living expenses incurred by family units, one could use living wage analysis and equivalence scales.

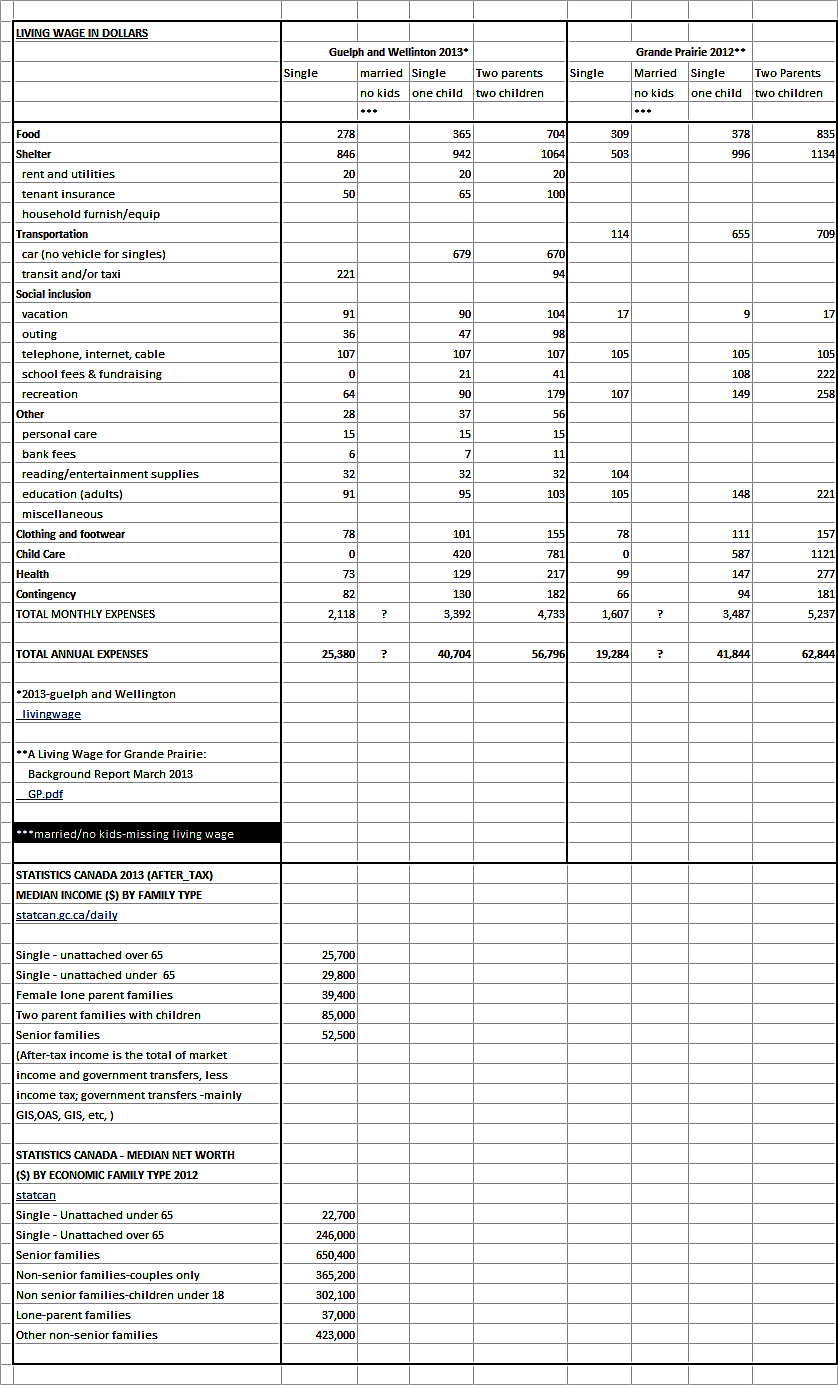

Two Living Wage studies for Canadian cities are Guelph and Wellington and Grande Prairie (table at end of post) show living expenses (not middle class living, but bare bones living to prevent homelessness). In both of these studies, it should be noted that singles are not allowed the purchase or use of a vehicle. Instead, they have to rely on transit and taxis.

The Guelph and Wellington 2013 study (livingwagecanada-FINAL) showed living expenses for singles at $25,380, lone parent with one child $40,704, and two parent family with two children $56,796. The Grande Prairie 2012 study (GP.pdf) showed living expenses for singles $19,284, lone parent with one child $41,844 and two parents with two children $62,844. Calculation of Guelph and Wellington percentages for single in comparison to lone parent with a child is 62 per cent and in comparison to two parents with two children 45 per cent. Grande Prairie percentages of single in comparison to lone parent with one child is 46 per cent and to two parents with two children 30 per cent.

(It should be noted that one of the significant differences for Grande Prairie percentages of singles to other family units is shelter where single is allowed to share a two bedroom apartment. If $859 rent is for allowed for not shared one bedroom Grande Prairie apartment to equal one bedroom apartment in Guelph/Wellington study, then the total annual expenditure becomes $29,592 or 70% of lone parent with one child and 47 per cent of two parent with two children. The percentages for singles then become more closely aligned between the two studies).

It is very difficult to find Canadian living wage statistics on married/coupled persons with no children as they are never included in these studies. If a few statistics from the USA living wage studies are used (New York 2016 (counties) example single adult $21, 382 and two adults with no children $34,582; Salem, Oregon (Salem-OR) single adult $28,140 and married couple with no children $37,536) then percentage of singles to married or coupled and no children households is calculated as 62 per cent and 75 per cent respectively.

To summarize, the Living Wage studies for Canada and USA show that percentages of singles cost of living to lone one parent one child or two person no children households ranges from 62 to 75 per cent.

The table at the end of this post using Statistics Canada data shows that singles and lone parent families are not doing very well with respect to incomes. Present median incomes are equivalent to living wage incomes (bare minimum to prevent homelessness). Likewise, median net worth shows these same households are at the bottom of the scale in comparison to households with two adults.

Equivalence scales have also been used to provide comparisons of costs of living between different family units (households). The OECD (Organization for Economic Cooperation and Development) modified equivalence scale and square root equivalence scales are two examples. The basis for equivalence scales are described as follows: The needs of a household grow with each additional member but – due to economies of scale in consumption– not in a proportional way. Needs for housing space, electricity, etc. will not be three times as high for a household with three members than for a single person. With the help of equivalence scales each household type in the population is assigned a value in proportion to its needs. The factors commonly taken into account to assign these values are the size of the household and the age of its members (whether they are adults or children).

Table for two equivalence scales:

Statistics Canada 75F0002M – Section 2 ‘The LIM and proposed Modifications’ (75f0002m) provides an excellent overview of what is happening in Canada. This paper proposes modifications to the existing LIM (Low Income Measure) methodology.

“The first is to replace economic family by household as the basic accounting unit in which individuals pool income and enjoy economies of scale in consumption. Secondly and equally if not more important, household is the international standard in comparative statistical surveys of income and well-being while the economic family concept is rarely employed by other countries. Under the proposed modification, an individual will be defined as in low-income if the household as a whole is in low-income which in turn will generate different low-income statistics. Adopting the square root equivalence scale – the square root has declining factors for each subsequent member while the LIM scale does not, and thus flattens out after the third member.. Furthermore, under the Square Root scale one needs only consider how many people are in the family whereas using the LIM scale one needs to keep in mind both the age of family members as well as whether the family is a single parent family”.

(It should be noted that there is no perfect system, however, equivalence scales system is one method that provides a decent measure of financial fairness with respect to cost of living assessments for all members of family units regardless of marital status).

Finally, in regards to the letter and human rights discrimination in relation to singles finances, singles are discriminated against every single day. This has been described in a past post. Re Allowance Program and Credits benefits, 2009 Policy Brief, “A Stronger Foundation-Pension Reform and Old Age Security” by Canadian Centre for Policy Alternatives, page 4 (policyalternatives.ca), states:

“This program discriminates on basis of marital status as confirmed by case brought under the Charter of Rights where federal court agreed program was discriminatory and ruled it would be too expensive to extend program on basis of income regardless of marital status”.

As well, the Progressive Conservative Party has been very diligent in implementing boutique tax credits which have consistently benefited families more. One major example of this is pension splitting in which senior married/couple household benefit, but singles get nothing. How is this not financially discriminatory?

CONCLUSION

- Politicians need to become more financially intelligent about what it costs singles to live in this country and the financial formulas the country is using, for example, equivalence scales.

- Financial formulas need to include singles equally to family households. Singles need to be Included in the financial family.

- All household types including singles need to be included in financial disaster recovery programs with equal dignity and respect. Singles, after all, also donated to the Red Cross program. A solution to distribute disaster monies equally could be to use household and equivalence scales formulas.

- Politicians, government, families and organizations like the Red Cross need to educate themselves on what financial discrimination is and to include singles equally in financial formulas.

- What is not needed is more ‘organizations’ and aid programs focused on the needs of mothers, seniors, and other demographics (single adults)’. (Habitat for Humanity does not include ever singles in their building program). These are only band aid solutions to what is the real problem, financial inequity of financial formulas. What is needed is for financial formulas to treat all households fairly and equally by using equivalence scales.

- How about another novel idea – treat benefits (benevolent programs) equally to expenditure programs (boutique tax credits) using equivalence scales. The Alaska Permanent Funds Dividends and Ralph buck programs (money-benefit-programs) grossly discriminated against singles by giving monies to children who have not contributed one cent to the economy. Singles paid taxes for these dollars that are distributed to children who have paid nothing.

- Regarding financial human rights and discrimination, the government has to yet provide an answer as to why the Allowance Program and Credit benefits is being continued through to at least 2029 even though the courts ruled it to be discriminatory.

This blog is of a general nature about financial discrimination of individuals/singles. It is not intended to provide personal or financial advice.