AFFORDABLE HOUSING DISCRIMINATION FOR SINGLES PERPETUATED BY MISINFORMATION AND LACK OF KNOWLEDGE

(These thoughts are purely the blunt, no nonsense personal opinions of the author about financial fairness and discrimination and are not intended to provide personal or financial advice.)

This blog has posted several articles about affordable housing for singles and poor families. It is disconcerting how family and social agencies, community services continue to get the facts wrong even when presented with logical arguments about affordable housing discrimination for singles and poor families.

Recently, a local family and community services organization seeking input on housing arranged focus groups to discuss this subject.

Attendance at one of these focus groups by the author highlighted several areas of concern.

First, discussions started with presentation of a chart showing family unit description. One chart showed five stages of family unit life cycle being childhood, early adulthood, married and rearing of children, empty nest and senior stages. It was disconcerting to note that this chart did not include ever singles (never married, no kids) in the family unit. After the childhood and early adult stages, singles were not included and were, in fact, invisible in the family unit chart.

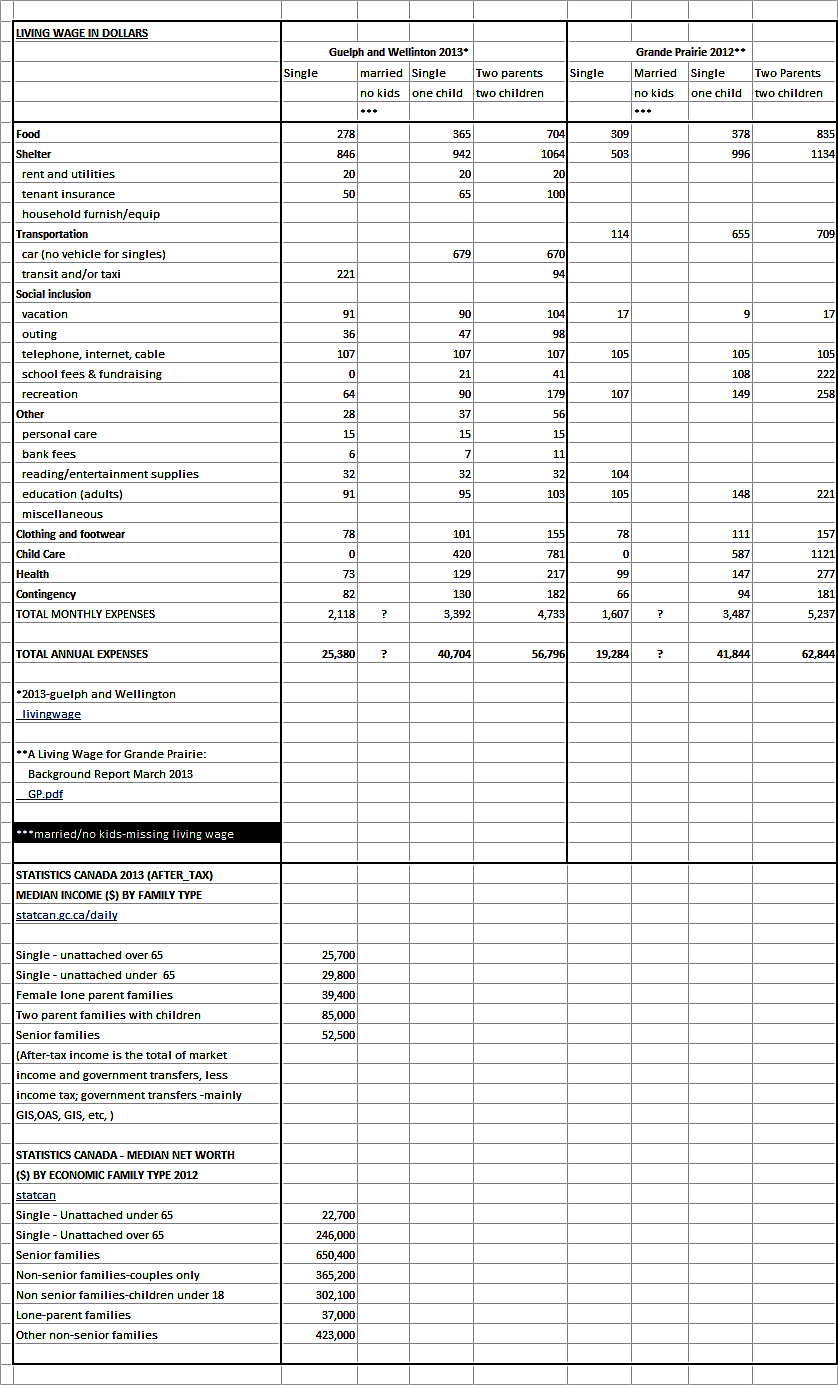

Second, regarding affordable housing and renting, discussions revealed there is an intense lack of knowledge regarding the discrimination of singles and housing issues (housing). As outlined in previous blog articles, it has been shown that singles are generally being pushed by builders, planners and government into smaller spaces while paying more for micro-condos on less space and less income.

(Examples: In same complex-1 bed, 1 bath, 1 patio micro-condos of 552 sq. ft. with starting price of $299,900. Two patio, 2 bed, 2 full bath, 2 story 1232 sq. ft. condos were already sold out so price not available. Then there were 2 patio, 3 bed, 2.5 bath, 2 and 3 story 1830 sq. ft. condos priced from $649,900 to $749,900. When price per square foot is calculated, micro-condo is selling for $543 per sq. ft. while three bed condos are selling from $355 to $409 per sq. ft.

Another example, Luxury Condos presently for sale in downtown Calgary (built in 2007)

- Sixth floor condo 1 bed, one bath 645 sq. ft. on podium level with direct access to large terraced area (no private balcony), $359,000 for $556 per sq. ft.

- Nineteenth floor 2 bed, 2 bath with den and balcony 946 sq. ft., $449,900 for $475 per sq. ft.

- Twenty-fifth floor 2 bed, 2 bath plus den, 2,119 sq. ft. (2 balconies 23 ft. X 8 ft. and 23 ft. X 16 ft.-this is Trumpian huge!), $998,000 for $470 per sq. ft.)

Ripple effects are owners (more likely to be singles or a single parent with one child) of micro-condos have to proportionately pay more house taxes, education taxes, mortgage interest and real estate fees on less house and possibly less take home pay for biggest lifetime expense. When it is sold, will seller recoup buying price?

Builders will argue that it is more expensive to develop (5 to 10 percent more per square foot) and operate (i.e., increased trash pickup because of higher occupancy, $5 more per square foot) micro-condos than conventional units because of the planning, etc. required to fit everything into the small spaces. However, this reasoning flies in the face of logic when it is known that bathrooms and large gourmet kitchens plus expensive outside amenities are some of the most expensive parts of housing. Two or two and half baths and large gourmet kitchens in a house or condo surely should balance out some of the expense of developing micro-units. Also, many more micro-units can be developed in same space occupied by average sized or large housing units.

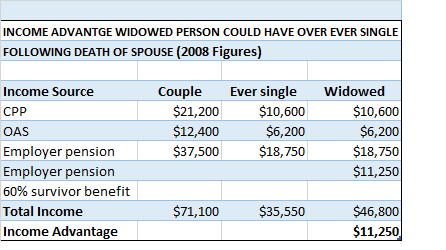

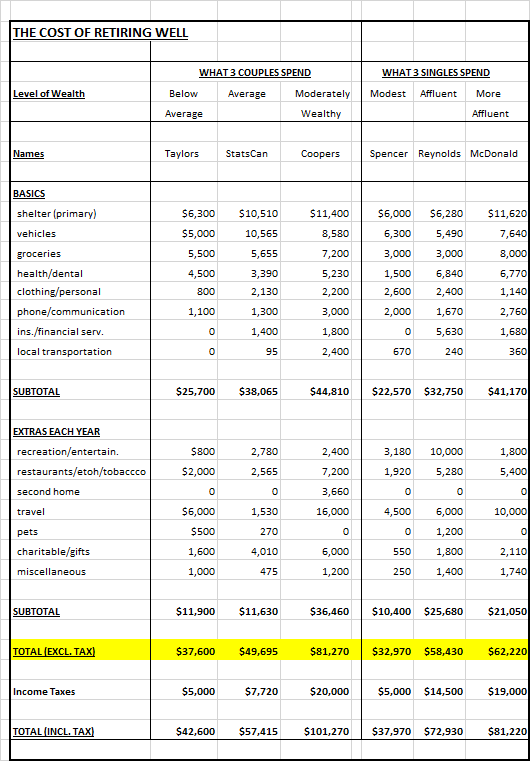

When question was asked in focus groups why senior singles have to pay more their spaces on one income than senior married or coupled persons, the answer was that singles pay more because they are using more space.

Does anyone understand the juxtaposition and absurdity of these two scenarios? First, singles are told they only need smaller spaces while paying more for them and then as seniors, they are told they are using too much space and, therefore, have to pay more for them. Singles will never achieve financial fairness for housing throughout their entire life cycle of adulthood and as seniors until criteria for housing remains the same throughout the cycle.

Same premise for pricing of housing can be applied to renting (deserve). Singles (persons more likely to rent small spaces) have to pay more for these spaces because that is what present business and societal principles dictate. The smaller the rental unit, the larger the applied dollar rental per square foot of the rental unit.

It is absurd that singles and poor families (for example, single parent with one child) have to pay more and get less for housing rentals. Even renting a room in a detached house usually is based on absurd rents ($500) charged by the owner. An outside the box, very fair solution could be to, for example, charge a set rate of $100 per 100 square feet plus utilities in proportion to amount of square footage being rented. A 250 square foot dwelling would rent for $250, and a 1000 square foot dwelling would rent for $1,000 plus utilities. Renter would pay price related to price per square foot and not the whims of the market and the greed of developers and owners. Renters of smaller units would pay a price that is much more fair in relation to renters of larger square foot units. The set price per square foot could be adjusted as required as housing prices increase or decrease.

“City Research shows gaps in housing supply” from CREB Now, March 10 to 16, 2017 issue states from the ‘Housing in Calgary: An Inventory of Housing Supply 2015/2016” report that just half of households in the city have sufficient income to buy a starter home in the condominium market. The report also showed Calgary has the highest rents in the lowest tiers of rentals, contributing to the fact that 21 per cent of households do not have enough income to rent an average apartment. Additionally, rent in senior’s housing complexes are also higher than average.

CONCLUSION

There are many more examples of financial unfairness, but just the above few show how housing world for low-income families and individuals/singles has been completely flipped upside down and topsy-turvy. Young individuals/singles not yet married are facing huge financial hurdles because of low incomes, less full time jobs, enormous education debt, and out of control housing costs. Families (parents), governments, society, corporations, businesses to date have failed to provide support and responsibility that is needed to ensure all Canadian citizens are able to financially take care of themselves without financial parental aid, inheritances of parents and without bias of gender, race, marital status or income level.

Low income families, individuals/singles and young adults not yet married who can apply simple math and critical thinking skills are in financial despair and angst knowing that they, as the most vulnerable citizens of this country, have been targeted and pawned to pay more for housing than middle class families and the wealthy. It is the duty of politicians elected by the people, for the people to represent all Canadian citizens, not just vote getting middle class families.

ADDITIONAL INFORMATION FROM MEDIA SOURCES

AFFORDABLE HOUSING WAS NOT A PART OF CONSERVATIVE PARTY DEFINITION OVER FORTY YEAR REIGN

“Calgary Herald”, June 29, 2016 “City takes aim at failing affordable housing plan” states ‘just 1,048 new affordable housing units created in Calgary over the past 14 years, the need for affordable housing was great in 2002 and it remains so today. Calgary has half the amount of affordable housing as the national average, and a total of zero affordable housing units have opened in the city in the past three years….the city wants to see 1,500 affordable housing units built in the next two years – more than the number built in the past fourteen years – and staff believe it’s a goal that’s possible given money pledged from the provincial and federal governments, both of which have recently signalled a renewed commitment to affordable housing. Housing a homeless person has been shown to save taxpayers $34,000 annually….Currently 88,000 Calgary households earning less than $60,000 are in need of affordable housing.’

Alberta Conservatives and Federal Liberals appear to be more focused on selective social democracy that is surreptitiously and purposefully eliminating the middle class and creating a class system consisting mainly of the poor, upper-middle class and wealthy with affordable housing out of reach for the poor. The housing market has been set so wealthy pay much less for their housing than do singles and poor families. Wealthy usually pay less while getting much more.

“Discerning Functional and Absolute Zero” study by Alina Turner states that there has to be a political willingness to devote more resources to affordable housing and social services that address homelessness.

Myke Thomas, “Rising costs keeping millennials out of ownership” Calgary Sun, Homes Section, March 11, 2017 states that the boomers generation are very much into home ownership, sometimes owning two or three homes, while millennials are not shying away from homeownership, so much as financial barriers are making it difficult for them to own homes. (“Beyond the Bricks: The meaning of home” study)…..The barriers facing millennials should be huge red flags flying in the faces of every level of government. Housing is a major component of the Canadian Economy and a reduction in homeownership will have an adverse effect across other sectors of the economy. It’s time governments stopped thinking of homeowners as ATM machines, as well as reassess excessive land development restrictions, punitive mortgage rules and regulations, land transfer taxes and other taxes which are contributing to a disturbing rise in the cost of homes.

(This blog is of a general nature about financial discrimination of individuals/singles. It is not intended to provide personal or financial advice.)