INCOMPLETE REPORTING OF NEWS AND MEDIA ARTICLES PROMOTE FINANCIAL INEQUALITY OF SINGLES TO MARRIED/COUPLED PERSONS

These thoughts are purely the blunt, no nonsense personal opinions of the author and are not intended to provide personal or financial advice.

While it is recognized that news and media articles are limited by space, often what is left unsaid promotes financial inequality of singles in comparison to married/coupled persons. Also, the misinformation of research and studies is perpetuated by other organizations picking up the misleading information and reprinting it.

Examples are as follows:

“Four Ways Senior Singles Lose Out” by Ted Rechtshaffen (outlined in Dec. 2, 2015 blog post /false-assumptions/). Rechtshaffen’s article left ‘ever’ singles and early in life divorced/separated persons out by exclusion because the definition of single status was incorrectly used. Instead, the ‘singles’ he referred to are actually widowers. He stated how widowed persons financially lose out in tens of thousands of dollars because they are no longer part of a couple. He suggests that tax systems should be made fairer, but only mentions widowed and later in life divorce/separated persons. There is no mention of tax systems including ‘ever’ singles and early in life divorced persons.

This article was republished by CARP carp/ (Canadian Association of Retired Persons) and was sited in other news media outlets such as Financial Post financialpost, and National Bank Clear Facts clearfacts.

“An Analysis of the Economic Circumstances of Canadian Seniors” by Richard Shillington of Tristat Resources and the Broadbent Institute (February 28, 2016 blog post continued-financial-illiteracy-of-financial-gurus) was sited in several news articles as follows:

Huffington Post, Daniel Tencer, February 16, 2016 “Are Canadians Ready for Retirement? Not Even Close, Broadbent Institute” (huffingtonpost.) states:

‘Half of Canadians aged 55 to age 64 who don’t have an employer pension have less than $3,000 saved up for retirement.

Nearly half (47 per cent) of Canadians aged 55 to 65 without an employer pension and earn $50,000 and $100,000 a year have saved an average of $21,000.

Among those who earn $25,000 – $50,000 and don’t have an employer pension, the average savings is a paltry $250.

Median Income for single seniors-At the same time, the study says social support for retirees has become less generous. Old Age Security (OAS) and the Guaranteed Income Supplement (GIS) have fallen behind over the decades, and now give seniors just 60 per cent of median income, down from 76 per cent in 1984.

The report comes as the federal government launches pre-budget consultation hearings. Though the study doesn’t delve into specific policy options, it says the Liberals’ plans to increase the GIS for singles retirees will make little dent in senior poverty.

The plan “should remove 85,000 senior singles from the poverty rolls — leaving 634,000 seniors living in poverty,” the left-leaning Broadbent Institute said in a statement.’

Globe and Mail, Shawn McCarthy, February 15, 2016 “Many Canadians entering retirement with inadequate savings, study (theglobeandmail) says:

‘Income trends suggest the percentage of Canadian seniors living in poverty will increase in the coming years, especially for single women who already face a higher than average rate, the report said. The poverty rate for seniors will climb at the same time as a sharply rising number of Canadians hit retirement age in the next two decades; more than 20 per cent of the population will be older than 65 within 10 years.

Ottawa’s pledge to increase by 10 per cent the guaranteed income supplement – paid out to the poorest seniors – would cost $700-million and remove 85,000 single people – mostly women – from the poverty rolls. But that would still leave 634,000 seniors living below the poverty line. And that number will grow dramatically in the coming years.’

Global News, Monique Muise, National Online Journalist, February 16, 2016 “Canadians nearing retirement with ‘totally inadequate’ savings (globalnews): study” observations are much the same as outlined above.

creb now (Calgary Real Estate Board) February 19 to 25, 2016, “Canadians ill-prepared for retirement” (crebnow) study observations are much the same as above, but also adds statement:

‘Already, the spread between the OAS/GIS guarantee levels and the low-income measure for 2015 – the spread that seniors need to fill using the Canada or Quebec Pension plans (CPP/QPP), private pensions and private savings – is about $5,600 for single seniors and $4,700 for couples. The overall median value of retirement assets of those aged 55 to 64 with no accrued employer pension benefits (representing 47 per cent of this age cohort), is just over $3,000.’

Also in big letters ‘Amongst Canada’s single persons without pension income, the median income in under $20,000’.

Not one of these articles mentions from the Broadbent Institute study that when using LIM the poverty rates for singles seniors is nearly 30 per cent. Also, the proportion of the population receiving the GIS (Guaranteed Income Supplement for Canadians in poverty) is higher for senior singles (including widowed) living alone than couples, and higher for single women (between 44 per cent and 48 per cent) than for single men (between 31 per cent and 37 per cent). It also does not mention that reliance on the GIS is greater for single seniors that it is for senior couples across all age ranges.

In addition there are 719,000 seniors living below the poverty line. This total includes 469,000 senior singles and 250,000 living in an economic family. This is 65 per cent of singles in comparison to 35 per cent living in an economic family! Sixty-five percent of singles, why is this never reported? Why is the full information of singles finances never worthy enough to report with same equality as families?

Some of the articles above also mention the the new GIS increase of 10 per cent for single seniors “should remove 85,000 senior singles from the poverty rolls — leaving 634,000 seniors living in poverty.” Statement with full truth should read: “should remove 85,000 senior singles from the poverty rolls – leaving 634,000 seniors (384,000 senior singles and 250,000 living in an economic family)”. This still leaves more senior singles in poverty than those living in an economic family! ‘Half truths’ reporting sometimes is almost as good as telling a lie!

What also is not mentioned by the media is that the Broadbent Institute study does not treat home ownership as a retirement asset. The report states:

‘This analysis has not treated home equity as a retirement asset because the replacement rate analysis has as its objective an income that allows one to enjoy a lifestyle comparable to that which existed pre-retirement. We do not include home equity here because we accept that the pre-retirement lifestyle for many middle- and moderate-income Canadians includes continued home ownership’.

Home ownership is a big factor in determining the standard of living for seniors in their retirement years. Statistics Canada 2011 shows approximately 69 per cent of Canadians own their own home. About four out of five (82.4%) married/coupled people own their home, while less than half (48.5 per cent) of singles own their home. Paying rent will have much more impact on poverty than owning a home outright.

CONCLUSION

To provide the real truth about singles’ poverty all it would have taken is the addition of 10 – 20 words to the articles (719,000 seniors live below the poverty line. This total includes 469,000 senior singles and 250,000 living in an economic family. The GIS increase for senior singles still leaves 634,000 seniors – 384,000 senior singles and 250,000 living in an economic family in poverty).

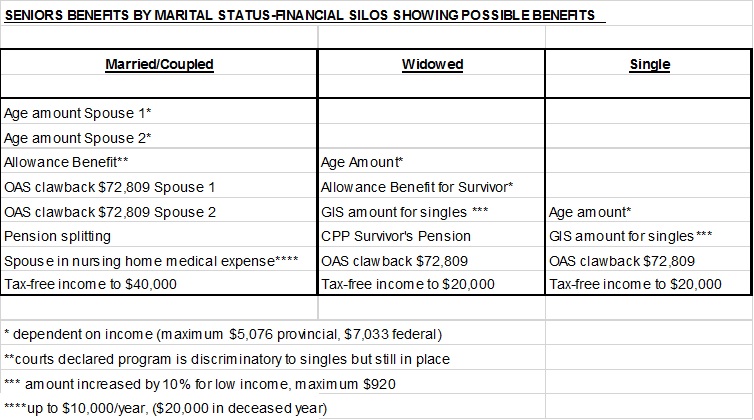

The GIS increase of 10 per cent for senior singles is a paltry amount compared to all the marital manna benefits that has been given to married/coupled persons like pension splitting.

The sad reality is that by omission of singles from the conversation true facts of singles finances are never fully reported; therefore, there is little understanding on the part of married/coupled persons, families, government, businesses, and decision making bodies on what it truly costs singles to live. Singles need to be included in financial formulas at the same level as married/coupled persons and families.

This blog is of a general nature about financial discrimination of individuals/singles. It is not intended to provide personal or financial advice.