FINANCIAL FAIRNESS FOR SENIOR SINGLES NOT PART OF PLAN

(These thoughts are purely the blunt, no nonsense personal opinions of the author and are not intended to be used as personal or financial advice).

This article was published in a local newspaper on August 19, 2015. The Conservative Party was in power federally at the time. In the October, 2015 federal elections the Conservatives were ousted by the Liberal Party. Proper names have been removed.)

In the midst of a Federal Election the financial rhetoric continues. The Conservative Member of Parliament, Wildrose, in his latest mailbox flyer, states that Conservatives have been committed to helping provide Canadian seniors with a secure and dignified retirement. The reality is that married/partnered people stand to gain much more from the Conservative Action Plan 2015 and other Conservative financial initiatives than individual/single seniors.

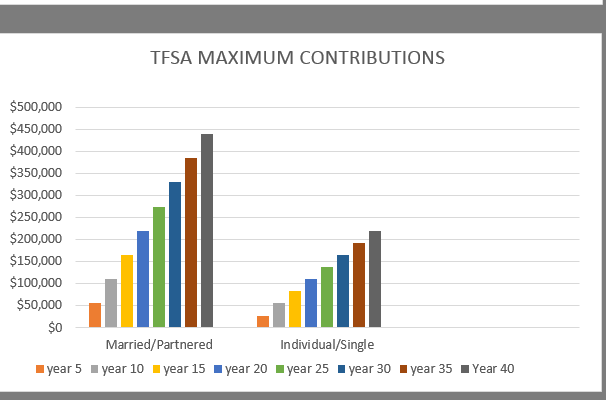

First, increases in the contribution limits of the TFSA account favors married/partnered people as the contribution limit per person is doubled. (The doubling of the TFSA was rescinded by the Liberals when they came into power in the October, 2015 federal election).

Second, pension splitting benefits applies only to married/couple people, not singles.

Third, the Age Credit benefits initiative increased by an amount of approximately $1,000. This benefit is incrementally reduced by 15% of net income exceeding approximately $35,000 and is eliminated when net income exceeds approximately $80,000. Any unused portion of the Age Credit can be transferred to the individual’s spouse or common-law partner. Comparable benefit of unused portion to individuals/singles without a spouse/common-law partner is zero.

Fourth, in the targeted tax relief benefits a senior couple can earn $40,720 without paying income tax (marital manna benefit), while a single senior can only earn $20,360 before paying income tax.

Fifth, Allowance for people ages 60 to 64 benefits are available to the spouses or common-law partners of GIS recipients. The spouse, age 60 to 64, of a senior with a single income of less than $31,584 may receive an allowance of $1,070.60 per month. This is an additional $12,000 per year. Furthermore, this benefit may also be available to immigrant married/coupled people who have been in the country for only ten years. Canadian-born and immigrant individuals/singles have nothing comparable to this benefit.

These are just a few of many more examples.

The following tables showing the income and net worth/wealth of unattached individuals versus families of two or more have been taken from MoneySense, The All-Canadian Wealth Test, January 2015 (moneysense) (based on Statistics Canada 2011 data)

____________________________________________________________________

INCOME TABLE

______________________________________________________________________________

INCOME

HOW DOES YOUR PAY STACK UP

_____________________________________________________________________

Quintiles Unattached Individuals Families of Two or More

Bottom 20% $0 to $18,717 $0 to $38,754

Lower-Middle 20% $18,718 to $23,356 $38,755 to $61,928

Middle 20% $23,357 to $36,859 $61,929 to $88,074

Upper-Middle 20% $36,860 to $55,498 $88,075 to $125,009

Highest 20% $55,499 and up $125,010 and up

______________________________________________________________________________

NET WORTH TABLE

____________________________________________________________________

NET WORTH

ARE YOU RICH?

______________________________________________________________________________

Quintiles Unattached Individuals Families of Two or More

Bottom 20% Negative to $2,468 Negative to $67,970

Lower-Middle 20% $2,469 to $19,264 $67,971 to $263,656

Middle 20% $19,265 to $128,087 $263,657 to $589,686

Upper-Middle 20% $128,088 to $455,876 $589,687 to $1,139,488

Highest 20% $455,877 and over $1,139,489 and up

______________________________________________________________________________

An individual/single person who has an income of more than $55,000 is considered to be in the top 20% ‘wealthy’ category, but has great difficulty living a ‘wealthy’ lifestyle on $55,000 especially if they have a mortgage or need to pay rent in their senior years (meanwhile wealthy family income is $125,000 and up). Women between ages 45 and 64 earn on average $23,000 less than men.

What is even more revealing is the net worth of unattached individuals compared to families of two or more. The MoneySense article makes the following comments:

“The collective net worth of the lowest 40% of individuals wouldn’t match the poorest 20% of families. Families can build wealth faster than individuals because they can pool resources, which enables them to pay down debts faster and make larger purchases. And what a difference it makes: between ages 55 and 65, families are worth, on average, a whopping $670,000 more than unattached individuals in the same age group”.

(It should be noted that the net worth is probably even higher for families of two or more, since it appears that single parents with children are included in families of two or more statistics. Single and divorced/separated parents of children, especially if younger in age, should excluded from families of two or more and placed into their own category for more accurate statistics -added January 20, 2016).

It is always prudent to have more than one source for verification of facts, so here are another two.

The “Current State of Canadian Family Finances 2013-2014” report by the Vanier Institute of the Family vanierinstitute.ca states that

“between 1999 and 2012 the net worth of families advanced more than it did for unattached individuals”.

The 2009 “Report of the National Seniors Council on Low Income Among Seniors” (seniorscouncil) states that:

“between 1980 and 2006, the unattached have the highest incidence of low income of any group, with 15.5 percent of unattached seniors living below LICO in 2006, a rate 11 times higher than that of senior couples (1.4 per cent)”.

So how can married/coupled people continue to demand more financial benefits? How can governments continue to increase the financial means of married/coupled people at the expense of unattached individuals/singles? And, how expensive is it really to raise children when families can achieve so much more net worth than singles? Financial fairness requires balance and elimination of unfair benefits such as income/pension splitting and ability to transfer credits from one spouse to another.

The Conservative MP claims to “stand up for Canada’s seniors who have helped make Canada the strong and prosperous country it is today”. However, this holds true more for married/coupled people in Canada than it does for individuals/singles. In his flyer, the Conservative MP wants feedback on the question “Am I on the right track to deliver support to seniors?” For senior individuals/singles the answer is a resounding and unequivocal “NO”.

Individuals/singles need to stand up, speak out and make facts such as the above known to their members of Parliament, those with decision-making power, and families. Individuals/singles need to decide which political parties are detrimental to their financial health and vote for the party which best meets their financial needs in the Federal election. They need to demand financial sensibility and equality. Financial discrimination of one segment of the population over another is a blatant violation of human rights and civil rights.

(This blog is of a general nature about financial discrimination of individuals/singles It is not intended to provide personal or financial advice.)