RETIREMENT INCOME SECURITY FINANCIALLY DISCRIMINATORY FOR EVER SINGLES AND EARLY DIVORCED/SEPARATED PERSONS

(These thoughts are purely the blunt, no nonsense personal opinions of the author and are not intended to provide personal or financial advice).

This blog post was updated on December 1, 2017 replacing 70% information with 1.4 equivalence scale for couples to that of singles, not 2.0.

So here we go again, several organizations, primarily Chambers of Commerce and financial planning and insurance associations, have taken out a full page in newspapers across the country for an article called “It’s time for national cooperation on retirement income security” and is addressed to Federal, Provincial and Territorial Finance Ministers (clhia). In this article, widowed elderly are highlighted over single elderly seniors in regards to living below the poverty level.

The article talks about being proud of Canada’s retirement system. It then goes on to say: ‘That said, there are pockets of our population who are not as well-prepared for retirement as they could be. These shortfalls are specific to certain segments of our populations. Hence, any ‘one-size-fits all’ approach could prove harmful to the economy as a whole and be unnecessary for many.We believe that the time has come to take a targeted approach to addressing any shortfalls. Such an approach should be national in scope.. It should be fair, so that it doesn’t introduce inter-generational transfers or require over-saving where it is not needed. It should be cost efficient and easy to implement. It should minimize administrative burdens for employers. And it should be good for the economy.

There are three specific segments not on track to maintain their standard of living in retirement:

- A small percentage of lower-income Canadians live below the poverty level, particularly the widowed elderly. The commitment in the federal budget to increase Guaranteed Income Supplement (GIS) payments will provide some assistance in easing this situation But more could and should be done, such as eliminating the claw-back for a surviving spouse under the Canada/Quebec Pension Plan.

- Up to 25% of modest-income Canadians (say above $27,500) are not on track, largely because they do not save outside of the public system and/or do not have workplace plans. This group could benefit most from a modest increase in C/QPP contributions that would help meet their needs.

- Up to a third of higher-income Canadians are not on track to maintain their standard of living in retirement because they do not have a workplace plan or don’t maximize their participation in one, or they do not have sufficient private savings. This group as well as all Canadians should have access to a retirement plan at the workplace, where it is easiest to save.

The undersigned urge all government to pursue a national, multi-faceted approach to improve retirement income security for all Canadians’.

The article is then signed by fifteen different organizations.

Statistics show that in 2014 there approximately 6 million seniors age 65 and over. From BMO “Retirement for One-By Chance or By Design” (bmo) in 2008, approximately 57 percent of seniors were married; of the remaining 43 per cent of single status, 30 per cent were widowed and 13 per cent were divorced/separated or never married (ever singles).

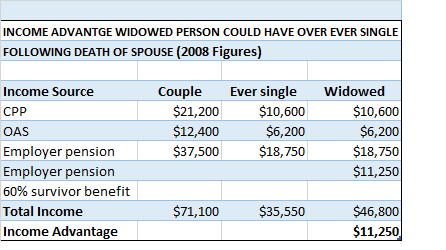

BMO goes on to say that one of the realities for ever singles is that they lack survivor benefits. The following table shows that ever singles and widowed persons, both with employer pensions will still probably have the same income. For widowers with a spouse who also had an employer pension, the widower will have a higher income level from spousal employer pension survivor benefit.

Persons who become widowed are now ‘single’ so why should they receive special privileges like no income claw back for surviving spouses? What do ever singles and early divorced/separated persons get that is comparable? Studies repeatedly show that according to equivalence scales (equivalence-scales) it costs a married/coupled person family unit without kids 1.4 times that of a single person household, not double..

This blog has published several posts where it has been shown that financial advisors have no clue about the financial affairs of ever singles and early in life divorced/separated persons. One wonders what financial experience Chambers of Commerce have that they can comment on the financial affairs of singles.

Once again, the widowed elderly have been highlighted as an area of concern while ever singles and early divorced/separated persons are left out of the financial discussion.

There is complete financial illiteracy by most people on what it truly costs to live as a single person. The post ‘Real Financial Lives of Singles’ (singles) gives five case studies, four of which contribute to employer pension plans, and one widowed person who has considerable wealth and is concerned that he can no longer pension split and may have his OAS clawed back. Even with an employer pension plan it is not easy for singles to have a decent financial life. Another post ‘Continued Financial Illiteracy of Financial Gurus Equals Financial Discrimination of Senior Singles’ (senior-singles) shows the financial silos that have been created by governments where married/coupled persons as one family unit and some widowed persons as one family unit receive more financial benefits than ever singles and early divorced/separated persons family units.

To ensure financial equality between singles, widowers and married/coupled persons, the following measures need to be taken:

- change financial formulas so that senior couples receive 1.4 equivalence scale only of whatever is given to a single senior person household as it costs more for single senior person household to live than it does married/coupled family units because of economies of scale

- financial formulas should be revised to include all senior persons regardless of marital status in one financial formula. To eliminate financial silos that benefit married/coupled persons most, delete benefits already given to married/coupled persons such as pension splitting (benefits the rich most) so that there is a level financial playing field for all regardless of marital status. (It is understood that it is expensive to raise children and benefits given for children should last for first twenty years of the life of the child. However, beyond the twenty years of the children, any other benefits given to married/coupled persons should be deleted or revised to a rate of 1.4 to that of a single person)

- create a side-by-side list of all possible benefits under categories of married/coupled, widowed and single and analyze what each category gets in benefits. Financial formulas should be created equally for all categories, not just the married/coupled and widowed.

- delete allowance benefit that has been ruled to be discriminatory by the courts

- education, education and more education on financial literacy for singles. Think tanks, financial gurus and married/coupled people need to educate themselves on what it really costs singles to live.

- financial benefits should be income-tested for all family unit types. Income testing should include housing and savings. It is likely to cost ever singles more to live as they are more likely to rent while widowers are more likely to own their own homes.

- all financial formulas for singles should include ever singles, early divorced/separated persons and widowers on an equal basis.

This blog is of a general nature about financial discrimination of individuals/singles. It is not intended to provide personal or financial advice.

RSS Feed

RSS Feed

Pingback: CAUSE AND EFFECT OF FINANCIAL POLICIES PROMOTING FINANCIAL DISCRIMINATION OF SINGLES AND THE POOR | Financial Fairness For Singles