BIG LITTLE LIES OF SIMPLE (FLAT) TAX RATE

(These thoughts are purely the blunt, no nonsense personal opinions of the author about financial fairness and discrimination and are not intended to provide personal or financial advice.)

This blog post was prompted by a right wing think tank article that once again promotes a flat tax and big little lies that it is already progressive and should replace the progressive tax system. It was submitted to a local newspaper in shortened format, but was not published.

The article ‘Many misconceptions surround single tax rate’ is reprinted in its entirety at the end of this post along with reader comments.

EVALUATION OF SIMPLE (FLAT) TAX

This right wing author says he is the originator of the simple tax. In fact, he has changed the name of the flat rate to the simple tax as per explanation given in article as reprinted at the end of this post. The simple tax of 10% was adopted by the Alberta Conservative Government in 2001.

While it is true the personal exemption rate was increased during implementation of the simple tax, during their forty year Alberta reign the Conservatives failed to raise the minimum wage to meaningful levels. (Reality check: The wealthy also get to use the personal exemption rate.) One of the best big little lies or gaslighting of this author occurs when he fails to tell the truth that during the implementation of this simple tax the tax rate for lower income persons was changed from 8% to 10%. There was no Alberta Advantage for lower income earners as a result of the tax rate being increased at the same time personal exemption rate was increased.

He once again spews lies on single tax being progressive. He says tax paid by the wealthy are a gift to those who pay little or not tax. Oh, puh-leese.

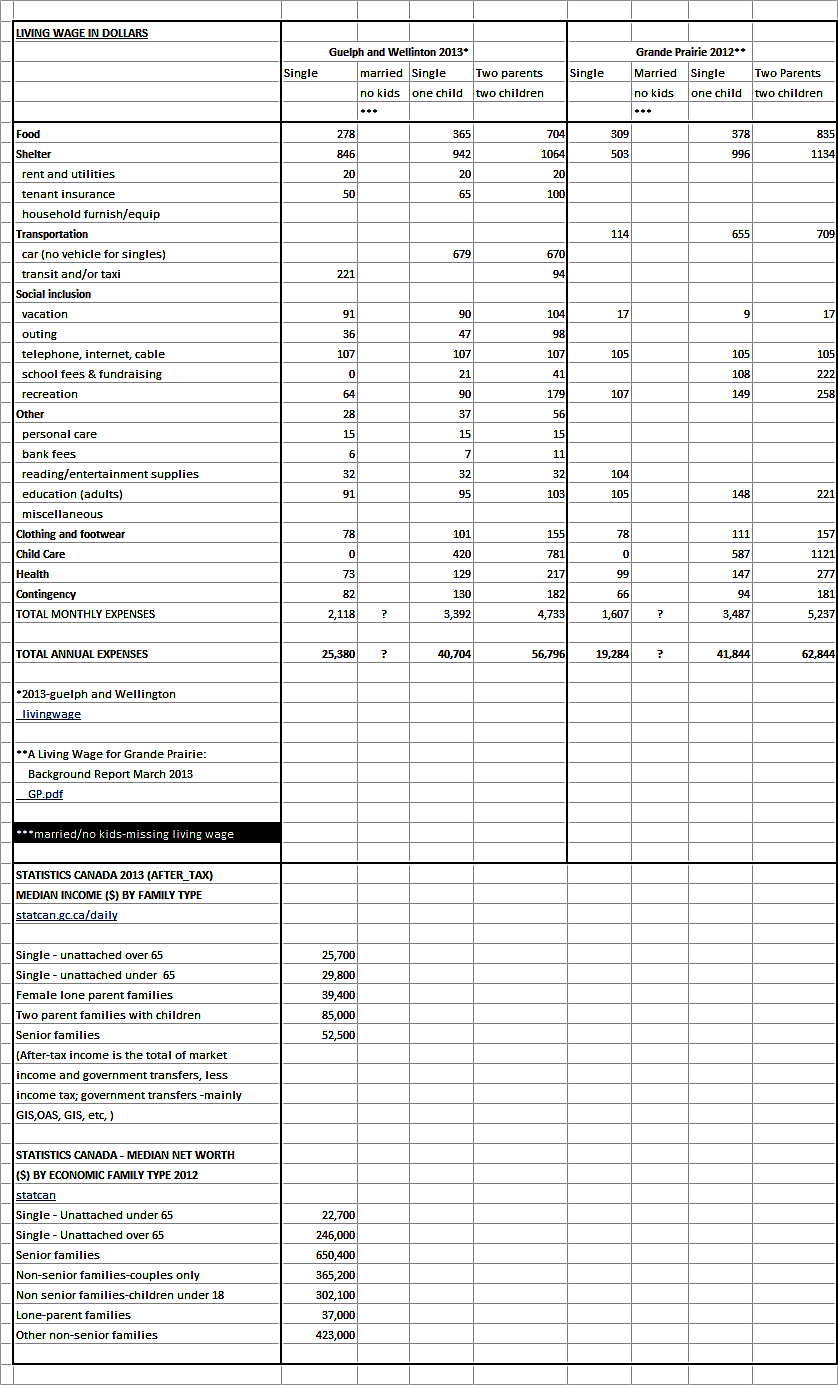

He states low income earners pay no tax, but fails to mention wealthy never pay their fair share. He fails to mention the many tax federal and provincial tax loopholes and benefits which filter down to the wealthiest taxpayers.

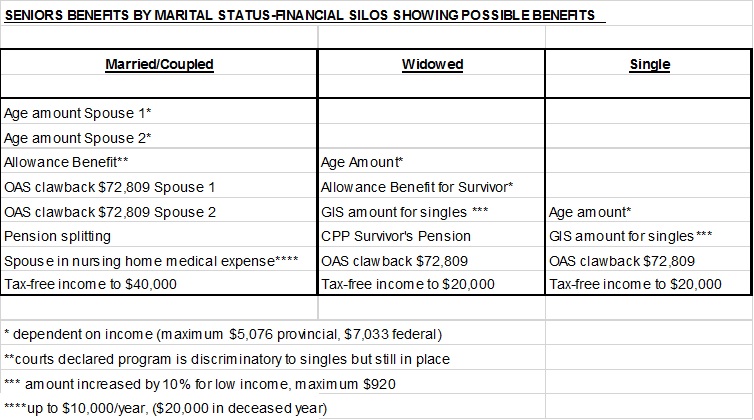

The wealthy, for example, put their Old Age Security (OAS – a poverty reduction pillar that is only clawed back on top two percent) into TFSAs that are not declared as income. Forty per cent of Canadians have net worths over $750,000.

The poor pay plenty by suffering financial and mental stresses while trying to pay for basic human necessities on provincial minimum wages which remained static for many years. Low income earners cannot take advantage of tax loopholes and benefits because they do not have the income to do so.

CONCLUSION

Instead of ‘Conservative gaslighting pants on fire’ half truths, he needs to speak full truths on tax loopholes, benefits and minimum wages. Progressive versus simple tax and ‘taxes explained in beer’ provides further discussion on fallacies of the simple tax for low income earners (tax-system-explained-in-beer-analogy). (End of post).

Reprint of simple tax article is given below.

‘MANY MISCONCEPTIONS SURROUND SINGLE TAX RATE’, Mark Milke, May 12, 2018 (https://www.pressreader.com/canada/calgary-herald/20180512/281702615355933)

Alberta’s cancelled single tax rate is in the news again after the United Conservative Party passed a policy resolution wanting it back.

That was followed by Twitter wars, interviews and commentaries about that tax, much of it uninformed or making obvious points.

I know something about the single rate tax system. I wrote about it in a 1998 submission to the Alberta Tax Review Committee, which recommended it be adopted, which it was in 2001. I favour its return one day, but when spending is controlled and the budget is balanced.

Class warfare warriors have long mischaracterized Alberta’s single rate tax, so let’s clear up some misconceptions.

Let’s start with why it is called a single tax and not a flat tax. Because a true flat tax system would mean that no basic exemption exists — that everyone pays the same proportion of tax relative to income. That would be a bad idea. But that was never Alberta’s tax system. It is also why the political and media myth that the single tax was not progressive is nonsense.

In 2014, the last year the single-rate system was in effect, Alberta’s basic provincial personal exemption was $17,787. Income earners below that paid nothing in provincial income tax. As for everyone else, at $25,000 in income, 2.9 per cent went to provincial income tax. At $50,000, the rate was 6.4 per cent. A $100,000 income was taxed 8.2 per cent. The single tax system was progressive.

Next up, the silly notion that the single rate tax was a giveaway to the wealthy. Note the language. It assumes money belongs to government and not those who earn it. In that view, any tax relief is a gift. That inverts a more sensible view from citizens to politicians: We will pay reasonable and justifiable taxes, but don’t assume our earnings are your property.

A relevant fact: Higher- and middle-income Albertans pay most of the income tax, not those with lower incomes. That is why the former and not the latter would gain in any tax relief scenario.

For example, using tax data from 2014, those earning under $50,000 counted for 57.3 per cent of all tax filers and paid just 7.6 per cent of all provincial income tax. Of note, almost 1.8 million Albertans were in that under $50,000 group in 2014, but nearly half (845,690 Albertans) quite properly paid nothing in tax due to low incomes. (Another 8,290 at higher levels also did not pay provincial income tax for various reasons, such as maximizing previously unused RRSP deductions.) Those who earned between $50,000 and $100,000 counted for 27 per cent of all tax filers and paid 30.6 per cent of all provincial income tax.

Albertans whose incomes were more than $100,000 accounted for 15.7 per cent of Alberta’s tax filers; they paid 61.8 per cent of all provincial income tax. Point: If one’s argument is that the wealthy should pay a hefty share of Alberta’s income tax burden, the $100,000-plus crowd in Alberta already did (a proportion higher both of tax filers and of total taxes paid than in any other province). Thus, any substantive tax relief will naturally benefit that group.

Here’s the summary: Even when the single rate tax was in effect, Alberta’s over $50,000 tax filers already paid 92.4 per cent of all provincial income tax. And even for those who earned less than $50,000, more than half — more than 920,000 Albertans — paid all the income tax collected from that group.

When someone claims a single tax is a giveaway to higher incomes, the rhetoric has it backwards: The gift is actually from more than 2.2 million Albertans at all income levels in 2014, to the more than 850,000 Albertans who quite properly, mostly due to low incomes, paid nothing for the cost of government.

READER COMMENTS

#1 – Don’t bother with hard numbers Mark. It doesn’t fit the left wing rhetoric. Math is too hard for them. Lies and innuendo is the tool of the left. And 100k + income earners only paying 62% of the tax. No, Canadians want those earning more than 100k a year to pay 100% of the tax. That way, they get closer to their dream of equality of outcome. The last thing you want to do is stump a Canadian with real facts.

#2 – Your most salient point is that money belongs to those who earn it….not the government. I accept that if we want the social services we now enjoy taxes must be collected. But it must be fair and not punitive, which it is right now.

#3 – Whenever taxes are reduced, the high tax payers will always get the biggest break. Usually the biggest complainers of this move, are the socialists who pay very little tax. When Alberta implemented the single tax rate they increased the personal exemption, if the provincial or federal governments really wanted to help low income earners, just raise the exemption Trump increased the personal exemption for everybody, which means the low wage earners got a major tax break from trump. Currently are personal taxes are twice as high as the US, so why would any professional want to live in Canada compared to the US from a tax perspective. (End of article).

(This blog is of a general nature about financial discrimination of individuals/singles. It is not intended to provide personal or financial advice.) This is a WordPress blog designed by a hired individual.