FEDERAL BUDGET TOPICS: MIDDLE CLASS TERMINOLOGY, INDEXED LIVING WAGE, SELECTIVE SOCIAL DEMOCRACY, BANKRUPT COMPANY PENSIONS

(These thoughts are purely the blunt, no nonsense personal opinions of the author about financial fairness and discrimination and are not intended to provide personal or financial advice).

The January, 2018 blog post addressed the first part of the budget proposal for a housing allowance as one solution to the housing crisis. This blog post is the second part of a Federal Budget proposal as presented to a Conservative Member of Parliament .

TANGIBLE VERSUS INTANGIBLE TERMINOLOGY OF MIDDLE CLASS AND FAMILIES

All political parties and society spew terminology of middle class (who-is-the-middle-class) and families ad nauseum. Middle class and families are intangible terms. Nobody, including political parties, can define what ‘middle class’ is and ‘families’ politically is an emotional term, often excluding singles (never married, no kids) from the definition. Singles are basically invisible. Many of the wealthy think they are middle class. For God’s sake, stop talking about the middle class (middle quintile) if you are not going to include the poor (bottom fourth and fifth quintiles), and replace ‘families’ with ‘household’ terminology. The word “household” includes everybody, even singles.

INDEXED LIVING WAGE

Fact Check: Recent Liberal revision of Canadian Pension Plan will increase CPP pensions for the wealthy, but not for the poor, because the minimum wage is not increasing proportionately to CPP increases. Schizophrenic political financial formulas will ensure increasing disconnect between CPP increases and minimum wage because CPP is controlled federally, but minimum wage is controlled provincially. TFSAs are indexed but not minimum wage.

LICO for 2015 (statcan.gc.ca/census-recensement/2016/ref/dict/tab/t4_3-eng.cfm) as defined by Statistics Canada shows Low Income Cutoff of $20,386 (equivalent to $11 minimum wage per hour for 35 hour workweek) for one person household, $24,811 for two persons household, $30,895 for three persons household and $38,544 for four persons household for large urban centre population centres 500,000 persons or more.

However, Living Wage studies show it is impossible to live a decent and respectful lifestyle on $11 minimum wage per hour.

The time has come for governments to stop handing out giveaways to the wealthy and surreptitiously making singles and poor families even poorer. Implementation of an indexed living wage financial formula based on equivalence scales or Low Income Measure (LIM) would ensure greater financial fairness for all Canadians.

Nobody says this better than Andrew Coyne in excerpt from “Why Minimum Wages are Harmful:

‘Rather than blithely decreeing that employers must pay their employees an amount the rest of us think appropriate, and hoping it all works out for the best, the option is open to us as a society to put our money where our mouths: to finance a decent minimum income for all with our taxes – which unlike wages are not so easily avoided. Maybe this latest increase in the minimum wage will prove less harmful than feared, but it is certain to be more harmful than the alternative: a minimum income, socially guaranteed and socially financed.’

An indexed living wage could be financed if government benefit programs such as Guaranteed Income Supplement (GIS), Old Age Security (OAS), child benefit and pension splitting programs were replaced with a guaranteed living wage program based on equivalence scales or LIM along with elimination of financial loopholes such as Tax Free Savings Accounts (TFSA) for the wealthy.

SELECTIVE SOCIAL DEMOCRACY

All political parties continue to practice selective social democracy (selective) benefitting the upper middle class and wealthy most.

Supporting documentation:

https://www.statcan.gc.ca/pub/75-006-x/2015001/article/14194-eng.htm Changes in wealth across the income distribution, 1999 to 2012

Assets and wealth – In 2012, families in the top fifth income quintile held 47% of all wealth held by Canadian families (and the 5% of families located at the top of the income distribution held 21%). Families in the fourth quintile held 23%, while middle income quintile families in third quintile held 16%. The second income quintile held 10% of total wealth, while families in the bottom quintile held 4%. (Fourth Quintile average wealth $641,000 and median wealth $388,200. Fifth Quintile average wealth $1,300,000 and median wealth $879,100.) In other words, about 40% of Canadian families held 70% of all wealth. Governments keep talking about the middle class (20% of population), but never talk about the bottom two quintiles or 40% also known as the poor.

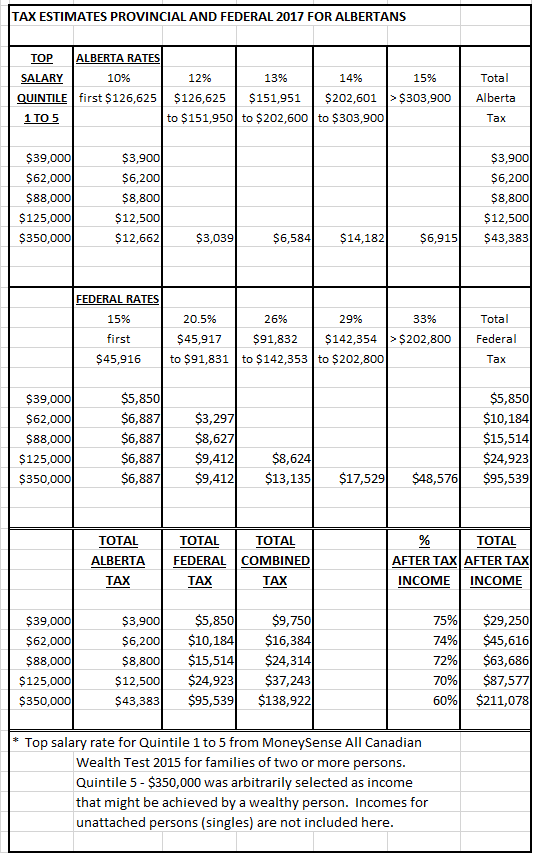

Many Canadians are fed up with the selective social democracy practised by both Conservatives and Liberals which benefit wealthy, upper middle class and married over single marital status persons and poor when they don’t need it. The fourth and fifth quintiles or 40% of Canadians have assets and wealth over $750,000 (about $650,000 in 2012), yet they are able to still get OAS, max out TFSA accounts, pension split, and have huge inheritances while paying less tax. Once again, the poor and many singles are being forced further towards poverty because they cannot achieve the same levels of wealth. Self serving Conservatives accuse the Liberals of social democracy when Conservatives are guilty of the same selective social democracy.

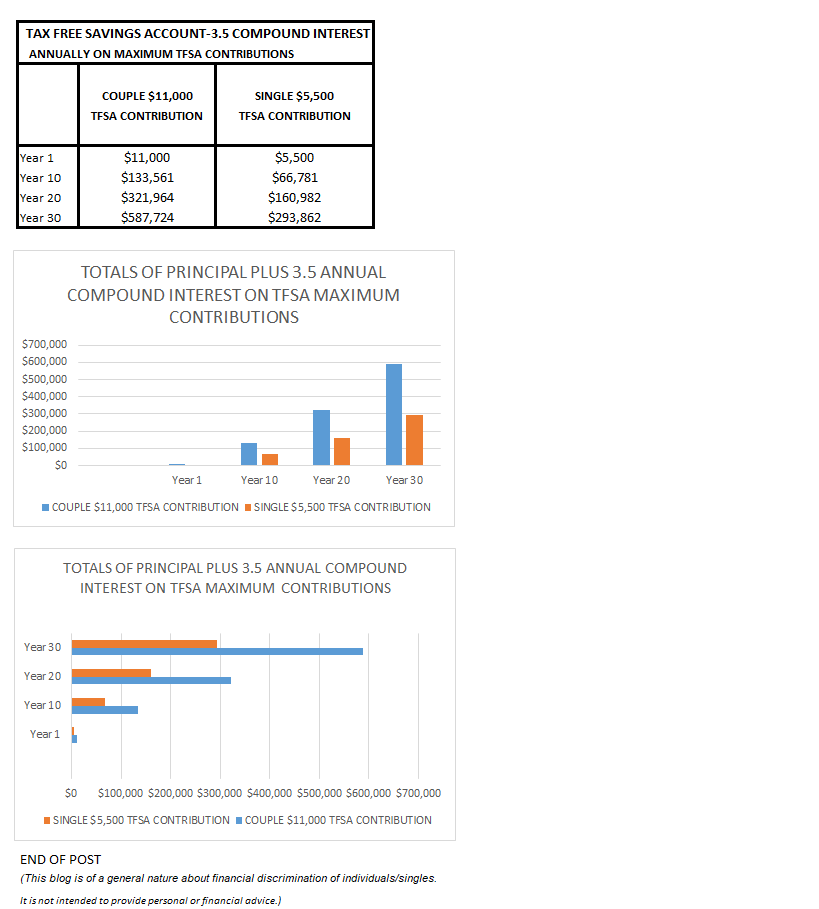

When handing out benefits assets and wealth, not just income levels, need to be included in financial formulas. Income levels are already a part of income tax returns. It would be very easy to add question about assets, wealth and home ownership (i.e. five broad categories) in income tax returns and adjust financial benefits accordingly. (TFSA is an egregious program which benefits wealthy the most. In thirty years and 3.5 percent compounded interest return, couples will have $600,000 in their financial portfolios, all tax free, and that is just TFSAs. TFSAs are not included in income, so a person with a $600,000 TFSA can claim poverty and receive GIS and OAS. A limit needs to be placed on TFSA assets and TFSA assets need to be counted as income).

Example of selective social democracy (boutique-tax-credits) – Family with four children has paid for house and one spouse working. These parents in their thirties already have a net worth of $500,000. They are able to receive Canada Child Benefits to the point where they can fully contribute to Tax Free Savings Account and increase their wealth. Why is this family receiving child benefits without income plus assets and wealth being taken into consideration? Poor families should be the only ones entitled to child benefits when they do not have the assets and wealth that this family has.

Poor families and singles have been made to be financial scapegoats and sugar-daddies to the upper middle class and wealthy by the Conservatives and the Liberals.

PROTECTION OF PENSIONS IN BANKRUPTCIES

If corporations and private enterprise cannot control their own financial affairs and shareholder greed during hard times and bankruptcies so that their employees are the biggest losers, then governments need to take responsibility to implement procedures and policies to offset employee losses (pensions). And governments need to stop bailing out corporations like Bombardier.

“Workers Deserve Better” by Hassan Yussuff (federal-government-can-and-must-put-pensioners-first)

‘The aftermath of 2008 financial crisis and recession has been littered with the shaken futures of those who once worked for seemingly unshakeable Canadian…..icons like Sears…..We hear lots in the news about these giants, but pensioners are losing out when smaller companies shut down, too.The lesson from every one of these examples is clear: workers and pensioners should not and must not be at end of the line when companies go under.

All of these workers have every right to feel betrayed by their former employers. Especially when they see executives walk away with rich bonuses, their careers, savings and retirements intact. But it isn’t just the companies who have betrayed these workers and so many thousands before them, it’s the federal government.

The federal government can and should be doing more for pensioners. For starters, it can support legislation being proposed by the NDP that recommends changing bankruptcy laws so that pensioners are first in line, not last, when it comes to paying down creditors. The same has been proposed by the Bloc Québécois. Critics argue that putting pensioners first in line would leave lenders less inclined to help companies in crisis. But that argument isn’t good enough given how many people’s futures have been shattered. It also ignores the reality that lenders have ample resources to inform the risks they take. Workers, on the other hand, have no option but to trust that their employers won’t just walk away from their obligations to employees.

The federal government can and must ensure bankruptcy laws put pensioners at the front of the line. And it can go one very important step further: working with the provinces and territories to create Canada-wide mandatory pension insurance. Such a system would guarantee monthly pensions up to $2,500 whenever an employer with an underfunded pension plan, like Nortel or Sears, files for bankruptcy. It would be paid for by pension funds, a fair trade-off, given their tax-exempt status.

Pension insurance isn’t just about protecting pensioners. It helps companies with no prospects of recovery or needing temporary help. It’s not a new idea. The United States and the United Kingdom are among other countries with nationwide mandatory pension insurance. Today, in Canada, only Ontario has a mandatory fund. Created in 1980, it guarantees pensions to a maximum of $1,000 per month. That’s expected to increase to $1,500 per month.

Mandatory insurance is required for most of the important assets Canadians have. We are required to insure our vehicles, our homes, and even our jobs — employers must pay into Employment Insurance and Workers’ Compensation to operate. Mandatory insurance exists because some things are critical to protect. And as Canada’s unions have long argued, pensions are among the most critical assets anyone will ever have.

The federal government must demonstrate it has the courage to stand up for pensioners. Thousands dedicate their working lives to trying to make the companies they worked for successful, and they deserve to be treated with respect and dignity, not told they’ll have no choice but to work through retirement and turn to government services for support.’

“Sears Canada Legacy: private profits and socialized losses” by Jen Gerson (sears-canada):

‘While Sears’ shareholders pocketed payouts of $3.5 billion, the chain’s pension plans remained underfunded to the tune of $270 million…..

Instead,…. Sympathies (are) reserved for the likes of….the 72-year-old retiree is now pulling shifts at Home Depot after working for 35 years selling appliances for Sears. Thanks to the nature of bankruptcy, his defined benefit pension is likely to be cut by as much as 20 per cent — although the lawyers and actuaries are still working out the details.

While Sears’ shareholders pocketed payouts of $3.5 billion, the chain’s pension plans remained underfunded to the tune of $270 million. While its executives enjoyed dividends, they also accepted multi-million dollar retention bonuses in the company’s closing months. Maybe those incentives weren’t quite high enough. In the end, they didn’t seem to do much good. Regardless, none of them now need worry about how to make ends meet…..

However, if fair-minded businesses wish to reduce the cries of more onerous regulation, stories like senior employees don’t play well. Every senior pensioner who must trek back to Home Depot in his twilight years is going to raise questions about whether or not treating pensioners as secondary to other kinds of creditors in cases of bankruptcy is a fair ordering of priorities.

It’s not hard to imagine a world in which executive retention bonuses and dividend payouts are made contingent on fully funding pension plans, for example. If corporate boards are not willing to hold their executives to account, they should not be surprised to find a government eager to do so.

Ontario has attempted to ameliorate the plight of bankrupt pension plans by creating the Pension Benefits Guarantee Fund, which guarantees the first $1,000 of pension income lost in such a case; that figure has been set to rise to $1,500…..The PBGF strikes me as well-intentioned, but still fundamentally problematic. It’s using taxpayer funds to secure individual benefits at the expense of a province that is already deeply indebted.

Further, it gives us yet another example of privatizing profits and socializing losses; of placing those who were least responsible for Sears’ decline—( employees) on the hook for his bosses’ failures.

In the end, that could be what defines Sears’ legacy, far more so than mouldering catalogs and storied corporate histories.’

POSITIVE GOVERNMENT ACTIONS

It is only fair that if criticisms are doled out, then positive government actions should also be acknowledged where due.

Income sprinkling – The federal Liberals have done the right thing by modifying the income sprinkling loophole. For example, dividends that would have been received by the primary owner of the private corporation, would instead be paid to the spouse, partner or kids of the primary shareholder, who are often in lower tax brackets; therefore, the family’s total tax bill would be reduced. Since singles in their financial circle are basically financially responsible to themselves,‘Income sprinkling’ is of less benefit to single marital status entrepreneurs so they will pay more tax. Singles get nothing that is comparable. Modification of income sprinkling ensures financial fairness for singles.

Increasing the GIS supplement for single seniors is a positive, but still not enough – As the Conservative MLA knows, this author has lobbied for financial fairness and inclusion of singles in financial budgets. The federal Conservatives did propose an increase for poverty stricken single seniors, but then were voted out and replaced by federal Liberals.

The Liberals in Budget 2016 proposed to increase the GIS top-up benefit by up to $947 annually for the most vulnerable single seniors starting in July 2016, which will support those seniors who rely almost exclusively on OAS and GIS benefits and may therefore be at risk of experiencing financial difficulties.

This enhancement more than doubles the current maximum GIS top-up benefit and represents a 10% increase in the total maximum GIS benefits available to the lowest-income single seniors. This measure represents an investment of over $670 million per year and will improve the financial security of about 900,000 single seniors across Canada.

While this is a step in the right direction, poverty stricken senior singles will receive only $947 annually while families with children are receiving Canada Child Benefits sometimes equaling thousands of dollars annually. Financial fairness for all Canadians regardless of marital status with and without children would be ensured by having housing allowance and indexed living wage programs based on equivalence scales as outlined above.

CONCLUSION:

It is time for governments to stop the selective social democracy where the upper middle class and wealthy receive benefits and tax breaks they don’t need. Assets and wealth in addition to income need to be included in financial formulas when handing out government benefits. Corporations need to be held to greater accountability regarding bankrupt pensions and low income levels of their employees.

A housing allowance, indexed living wage, and government subsidized child care (as well as paid for first and second year of post secondary education- added Feb. 26/18) would help to alleviate the housing crisis and poverty resulting in singles and poor families being pushed even further into poverty.

(This blog is of a general nature about financial discrimination of individuals/singles. It is not intended to provide personal or financial advice).