POLITICAL STATEMENTS AGAINST THE NDP PARTY ARE BLATANTLY FALSE AND FINANCIALLY DISCRIMINATORY

(These thoughts are purely the blunt, no nonsense personal opinions of the author about financial fairness and discrimination and are not intended to provide personal or financial advice).

A recent opinion letter in a local newspaper prompted this blog post. The letter again targets the Alberta NDP party for socialism of the rich instead of the Conservative party. “Westhead must be too busy to read history books” (since) he states: ‘Albertans do want to return to the past; but not to this misfit ideological premise about socialism for the rich and austerity for everyone else that the NDP conjured. While Mr. Westhead mistakenly believes there was socialism for the rich in Conservative Alberta, his solution is a failing socialist ideology for all. Your government has downloaded a debt, taxes and policies that are a burden to families….voting Conservatives in again in 2019 – Alberta will return to the free enterprise, socially reliable province it once was”. He is referring to many Harper oil pipelines (good) and NDP carbon tax (bad).

Re statements on socialism and left-wing politicians, analysis shows federal and provincial Conservative and Liberal policies surreptitiously and purposefully eliminate the middle class, thus practising selective social democracy (socialism). Advertently or inadvertently, future class system will consist mainly of the poor, upper-middle class and wealthy while favouring married or coupled family units with multiple ‘marital manna benefits’.

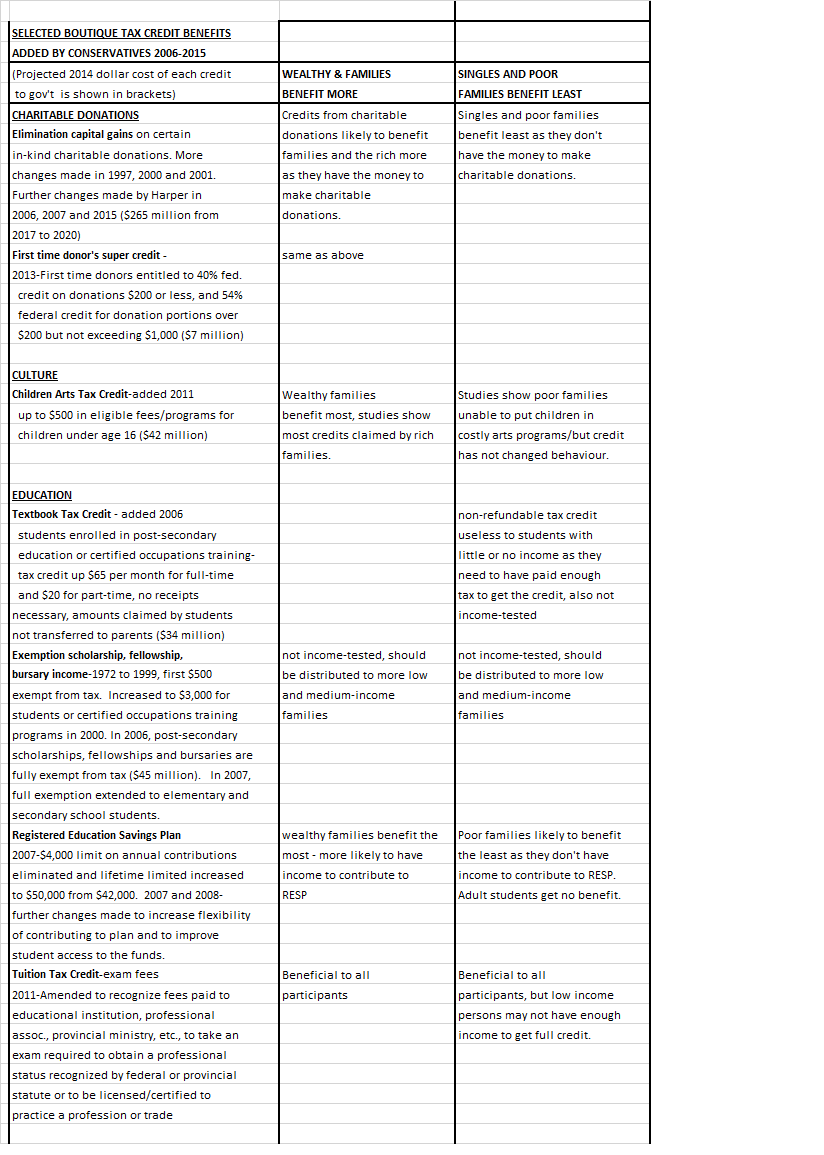

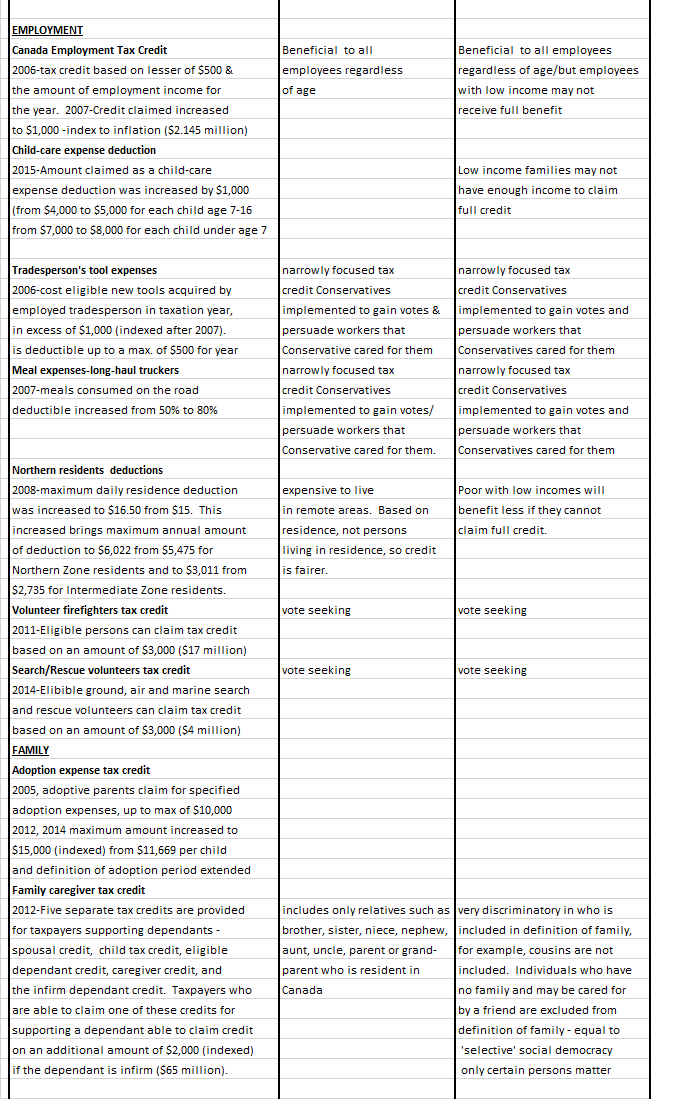

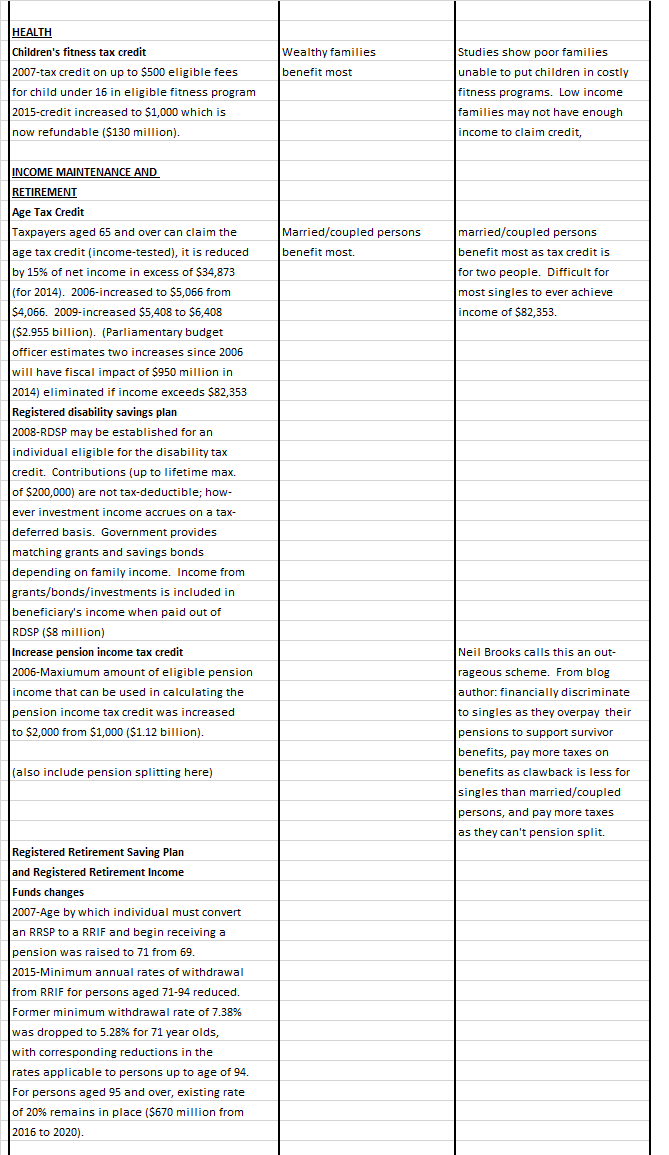

During federal Conservative and Liberal party reigns, even while reducing social programs helping vulnerable populations of aboriginals and veterans, introduced programs like TFSAs (Harper 2009) pension splitting (Harper 2007) and OAS clawback (Harper 2011) particularly benefit the wealthy and married or coupled family units. In OAS clawback only about five percent of seniors receive reduced OAS pensions, and only two percent lose entire amount. Why should married or family units who have never had children (double income, possible double TFSA and RRSP) be able to ever use pension splitting, no OAS clawback plus tax avoidance schemes for couples while singles get nothing comparable?

During provincial Conservative party forty year reign and oil boom, just 1,048 new affordable housing units in Calgary were built over the past 14 years. Two thirds of shelter beds in Canada are filled by people who make relatively infrequent use of shelters and are more likely forced into shelters by economic conditions (due to structural factors, the state of housing and labour markets that destine the very poor to be unable to afford even minimum-quality housing). In 2001, Alberta Conservatives brought in 10% flat tax, raising the tax rate from 8% to 10% for lowest income Albertans. There never has been an Alberta Advantage for the poor.

Federal Liberals have continued Conservative benefit programs like Canada Child Benefit in perpetuity which is based on income and number of children, but not net worth and assets, so families may receive large tax free child benefits and continue increasing wealth even while already having huge assets.

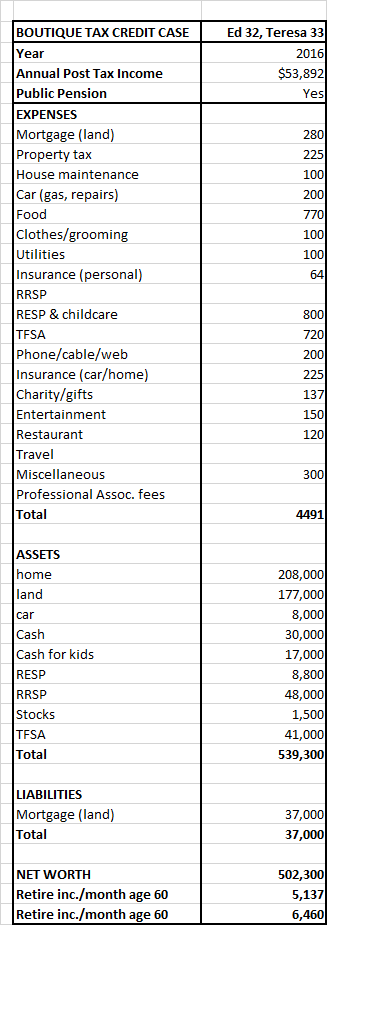

Elimination of the middle class is also evident in Liberals’ proposed Canada Pension plan enhancements without an increase in minimum wage (canada-pension-plan). Persons with highest YMPE of $82,700 (massive jump from 2016 $54,900) and forty years of contributions may receive 33 percent CPP benefit or about $2,300 per month, while those making a minimum wage of $15 per hour, $30,000 annual income with forty years of contributions may receive about $800 per month. CPP pensions are dependent on salaries. CPP contributions are not collected on boutique tax credits. Low salary equals low CPP retirement pensions.

Calculations of a simplistic nature on $10 minimum wage and 2,000 hours shows that Alberta family with two children and each spouse earning $20,000 without any other deductions or benefits will pay about 15% Federal tax and 10% AB tax for a total of $5,000 each and receive full Canada Child Benefits (CCB) of $12,800. Family income will equal about $42,800. CPP pension at age 65 in 2016 dollars may equal about $5,000 per person annually. If $15 minimum wage or $30,000 each is applied, total Federal tax and AB tax will be $7,500 each. Family income will equal $57,800 with full CCB $12,800 benefits since reductions only begin at $30,000. CPP pension might equal about $7,500 per person.

Above calculations easily show increased minimum wage income for a poor family benefits everyone through collection of increased taxes, less dependency on government handouts, greater financial well being and CPP retirement benefits for the income earner, and the economy through increased spending on goods and services.

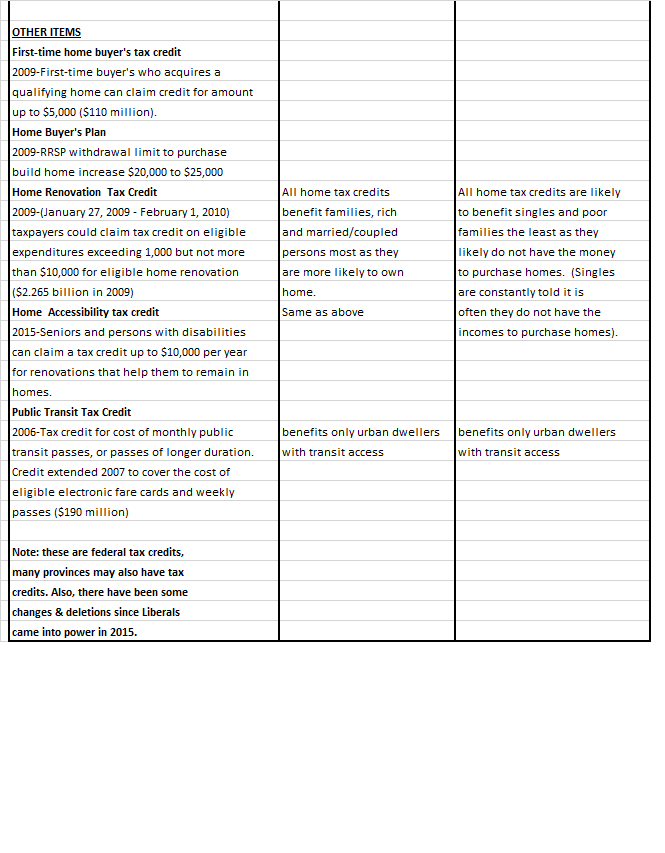

Schizophrenic political systems exist where CPP pension enhancements are controlled federally, but minimum wages are controlled provincially. The continued unwillingness of government and business to promote minimum wage increases to indexed living wages means the poor will remain in poverty even with pension systems that are supposed to improve financial quality of life as seniors. The new NDP childcare program is the right thing to do, but it should be balanced by reductions of other boutique credits. However, this is impossible, again because of provincial versus federal control. Continuing to add monetary programs for select family groups will continue to drain the financial system if boutique tax credit programs and tax avoidance schemes where upper-middle class and wealthy benefit the most are not eliminated in their entirety. Net worth and assets need to be included in any financial program so that the poor and lower class benefit the most from these programs.

The effects of this ‘income redistribution’ and ‘culture of dependency’ that the right claims they are not guilty of will result in future generations being ridden with high taxes because of high debt level to service these programs. Where are the economists and financial advisors for the government so that outside the box solutions for financial equality of Canadians regardless of marital status and using a balanced approach so that all financial programs are reviewed against each other for financial validity and fairness? Canadians deserve much better financially from their political parties.

Upside-down financial systems and marital manna benefits have created a nanny state where families want it all and once these benefits are in place, it is very difficult to eliminate them because of voter entitlement. Upper middle class and wealthy married/coupled persons have been made irresponsible by their own politicians and government. The right keep talking about overspending, but they fail to mention that their boutique tax credits have resulted in upper-middle class and wealthy not paying their fair share of taxes.

Financial silos (tax-credit) are filled to the brim for families and married persons, but remain empty for singles and the poor. Pipelines and boutique tax credits without steady rise of minimum wage and greedy oil salaries without tax avoidance capabilities means less tax revenue to fill financial coffers, less food on the table and demeaningly low CPP pensions in retirement for the poor. Every political party has been guilty of vote getting tactics. Canadians are fed up and disheartened by the divisive nature of politics which seems to serve only the political parties and their wealthy constituents.

(This post was updated on November 30, 2016).

(This blog is of a general nature about financial discrimination of individuals/singles. It is not intended to provide personal or financial advice).