(These thoughts are purely the blunt, no nonsense personal opinions of the author about financial fairness and discrimination and are not intended to provide personal or financial advice – financialfairnessforsingles.ca).

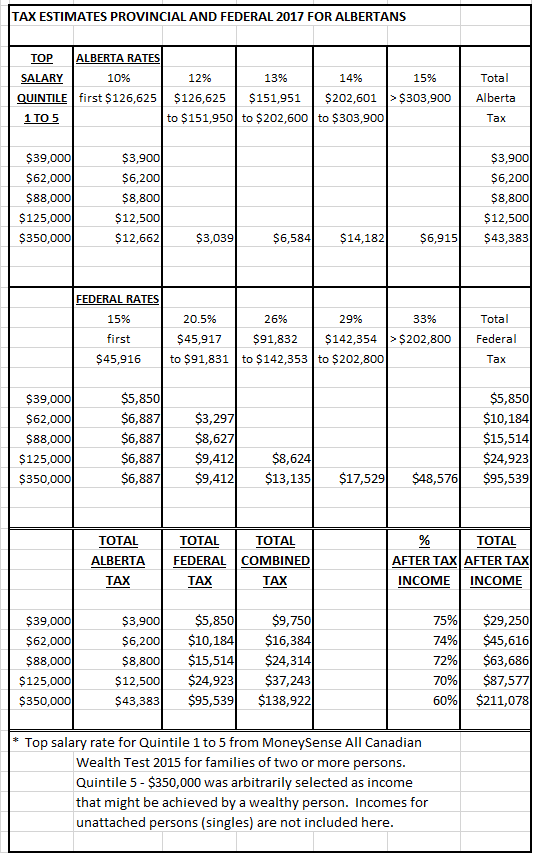

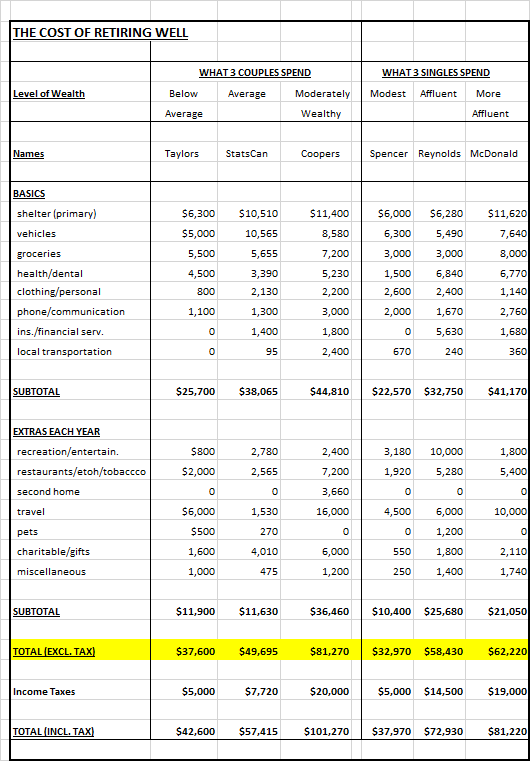

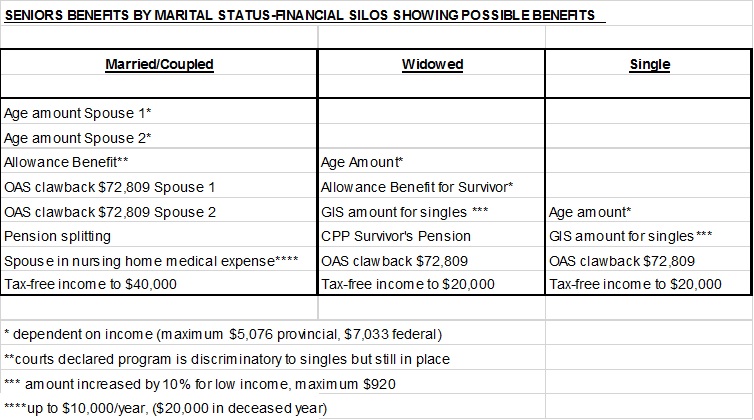

It is a known fact, as presented by the experience of this blog author, that present tax systems benefit the wealthy and married while compromising low income families and singles. However, most political parties fail to acknowledge this and/or fail to do anything about it.

The following two excellent articles describe different aspects of the Canadian tax system problem. In addition as to why tax systems disparage certain groups, particularly low income families and singles, it may be that political parties unknowingly leave out certain groups because they don’t do the necessary work or have tunnel vision about including, for instance, singles in their financial formulas.

Article #1: ‘Panel process obscures what need to be done’ by Joel French, Executive Director of Public Interest Alberta (panel-gives-political-cover-to-public-service-cuts)

“With much fanfare, Alberta’s UCP (United Conservative Party) government has appointed the Blue Ribbon Panel on Alberta’s finances to recommend a path to balance its budget. Unfortunately, the entire project is compromised from the outset because the panel’s mandate ties one of its hands behind its back.

Budgets have two components: revenue and expenses. However, the panel’s mandate specifically excludes any consideration of changes necessary to the way our government generates revenue — which means that its job is restricted to recommending cuts to Alberta’s public services…..

The panel is designed to provide a rigged rationale for making big cuts to public services, by not even considering the better alternative of paying for our public services through the kinds and levels of taxation that all other provinces use for that purpose…..(Alberta is the only province without a provincial tax)…..

The Kenney government’s plans….. have already adopted a massive tax cut for Alberta’s largest and wealthiest corporations, making our government’s significant shortage of tax revenue even worse. Our tax system was already by far the least effective in the country at raising revenue, to the extent that adopting the tax system of any other province would raise between $11.2 and $21.5 billion in additional revenue every year, which would more than cover our current deficit of $6.7 billion and allow for much-needed quality improvements to health care, education and other services…..

The inescapable truth is that this panel is nothing but a political gimmick to give the UCP government a pretext to make deeply unpopular, ideological cuts to the public services we all need and value.

Obviously, more services will be turned over to the whims of private corporations. Other services and programs will disappear from public budgets altogether, but we all know the real costs never disappear. Instead they are shifted to the pocketbooks of Alberta families and paid for individually rather than collectively through our tax system.

How our government decides to handle its budget situation is a choice. They can fix our deficient revenue system so we can properly fund our services, or they can make deep cuts. The mandate of the panel makes it abundantly clear that the UCP government has already decided on the latter and simply appointed the panel to tell it what it wants to hear.

Albertans should reject this panel’s biased mandate, hold Premier Kenney to his word that more funding — not less — will be allocated to the front lines of our public services, and demand a process that fairly considers the alternative of revenue reform to properly support and enhance our public services.”

Article #2: ‘This election campaign, let’s own up to Canada’s two-tiered tax system’ by Norm McKee (this-election-campaign-lets-own-up):

“Why is no political party talking about the Panama Paper and Paradise Paper tax disclosures?

“Because something is legal does not mean it’s not a scandal.”

If there is a serious problem, and no one acknowledges it, does the problem really exist? And why is no political party talking about the Panama Paper (2016) and Paradise Paper (2017) disclosures in this federal election campaign, which is only 10 weeks away?

All political parties are mute about the thousands of affluent Canadians who continue to legally use tax havens to avoid paying their fair share of taxes. The estimated $5 billion annually, or $25 billion over five years in lost revenues through “individual” tax avoidance practices, are staggering amounts. When affluent Canadians do not pay their share of taxes, as per Revenue Canada’s published tax schedules, Canadians must make up the difference.

It’s important to be clear. The use of tax havens by individuals to avoid paying taxes is not about greed or any person breaking the law. Despite what our federal government says, it has nothing to do with tax evaders, complex tax scams, tax audits or the CRA getting more money to combat tax cheats. This is a political issue about Canada’s two-tier tax system that benefits the rich while doing immense financial harm to other Canadians, and that diminishes the quality of life for all.

Silence by political parties should not be an option. Canadians should demand that political parties engage in a frank and open discussion about “individual” tax avoidance prior to the October election. The cost to Canadians is too high to wait four more years until the next federal election.

We did not have the benefit in the 2015 federal election of the Panama and Paradise Paper disclosures that identified thousands of Canadians who used tax havens. We have this information now. The 2019 election is an opportunity for Canadians to realize tax reform that prohibits affluent Canadians from using tax havens to avoid paying their fair share of taxes.

Failure to address this issue now will mean four more years of great disparity in Canada’s tax system.

It’s worth noting that U.S. citizens cannot legally use tax havens for the purpose of avoiding taxes. In the U.S., “individual” tax equality is sacred. This is not the case in Canada, where past governments have encouraged Canada’s financial élite to legally use tax havens to avoid paying taxes.

No one has anything good to say about tax avoidance, specifically tax havens used by affluent Canadians. Yet no political party or politician is doing anything about it. This can only change if “average” Canadians link the federal election with the funding of Pharmacare, economic, environmental and social initiatives, with new monies via tax reform. We need to pressure all political parties to address this scandal.

Historically, tax avoidance has been a taboo subject for all political parties. No political party was pleased by the Panama and Paradise Paper disclosures. Instead of changing tax laws to abolish Canada’s two-tier tax system, the government response is increased funding to the CRA to address tax evaders, tax cheats and tax scams. Although these actions should be applauded, they do nothing to fix the root problem.

Canadians don’t like to think current and past government favour the financially privileged. That would be a serious violation of trust. But the evidence is clear that this is happening, and will continue, unless we make our voices heard before the October election.

The goal of The Grassroots Coalition for Tax Reform, http://www.betteroutcomes.ca, is to pressure political parties to address tax avoidance in their election platforms, specifically affluent Canadians who use tax havens to avoid paying taxes.”

CONCLUSION

What the above two articles do not convey is the anger and despair that certain Canadian groups feel about the tax avoidance that the wealthy and married can carry out within legal limits of the law and financial formulas. Those disadvantaged by tax avoidance are damn tired of subsidizing the wealth of the elite and the married. The following is an opinion letter by this blog author that may or not be published in a local newspaper.

“POLITICAL PARTIES DON’T CARE ABOUT SOCIAL JUSTICE AND FINANCIAL EQUALITY

Recent opinion letters in local newspapers talk ad nauseam about faults of one political party over the other.

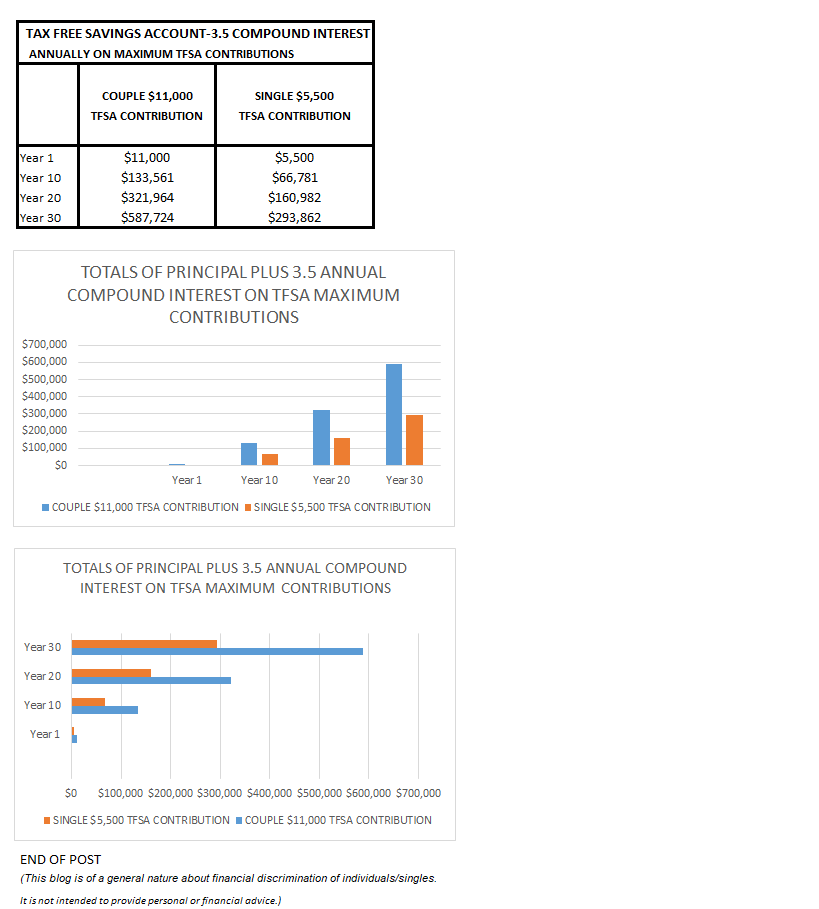

Politicians are only interested in vote getting. Far right wing Conservatives and Christian right ‘sell their souls to the Devil’ so they can get their agendas passed even if it is not the will of the majority. Liberals play their ‘one upmanship’ over Conservatives by continuing unfair Conservative financial formulas such as TFSAs (TFSA ABUSE OF THE PLAN) by not making changes to the formula so that financial abuse of TFSAs cannot occur. Libertarians talk about personal financial responsibility but never unfair financial practices.

Conservative Jason Kenney attacks lowly wage earners (teens) and reverses anything and everything Rachel Notley put in place including replacing Notley merit based appointees with his cronies. Conservative Stephen Harper TFSAs benefit wealthy to point where they may be able to claim GIS intended for low income persons because TFSA investments are not declared as income. Conservative Blake Richards has initiated Motion 110 as a proposed financial reprieve for parents who lose infant to death, but other parents, siblings and persons who experience tragic deaths such as losing someone to gunshots, etc. don’t get an equivalent benefit.

Conservative Andrew Scheer has proposed tax free EI maternity benefits but families already receive tax free CCB benefits and likely have one spouse working. Seriously, you want to give tax free EI maternity benefits but jobless singles and single parents have to pay taxes on their EI benefits????

Liberals line wealthy family pockets by calculating tax free CCB benefit clawback for $30,450 to $65,976 net income portion and two children at 13.5%, but only 5.7% for portion over $65,976 and up to approx. $188,000.

Elizabeth May, Green Party applauds social justice but has lobbied to repeal legislation that denies pension benefits to spouses who have married after the age of 60 or retirement even though these newly married spouses haven’t contributed one dollar to that pension plan.

Major theme of the above is that all political parties have implemented ‘gaslighting financial formulas they say help the middle class’ but instead promote socialism for the wealthy and married (LOST DOLLAR VALUE) while pushing low income families and singles further towards poverty, ensure young persons likely will never be able to leave their parents’ homes with home ownership being a major obstacle.

This blog author’s federal vote will be submitted as a spoiled ballot as there is not one political party who gives a damn about social justice and financial equality.”

(This blog is of a general nature about financial discrimination of individuals/singles. It is not intended to provide personal or financial advice).