AFFORDABLE HOUSING FOR VULNERABLE POPULATIONS, SINGLES AND THE POOR

(These thoughts are purely the blunt, no nonsense personal opinions of the author about financial fairness and discrimination and are not intended to provide personal or financial advice.)

The following discussion (about 15 pages in length) on affordable housing was submitted in response to a request for input to a national survey on affordable housing. The link for ‘Let’s Talk Housing’ survey is included at the end of this post.

It appears that some of points from this discussion were included in the final results of the survey such as

- Including singles in definition of family by using specific wording of “individuals and families” not just “families”

- Including affordable housing as a human rights issue

- Including quality of life such as laundry facilities.

Issues that appear to not having been addressed are single seniors having own bedroom and bathroom that doesn’t cost more for them than for married or coupled seniors.

There still seems to be a mentality for seniors to age in place even with expensive houses that they can’t afford (tax credits on home renovations and assistance in paying house taxes). Those with considerable net worth and assets should be excluded from housing subsidies of any kind.

NATIONAL AFFORDABLE HOUSING STRATEGY

TO: National Housing Strategy Team, Canadian Mortgage and Housing Corp., 700 Montreal Road, Ottawa, ON K1A 0P7

To Whom It May Concern:

First of all, thank you for the opportunity to respond to your housing strategy. In this response, two categories that have been identified will be addressed – Affordable Housing and Vulnerable populations.

CATEGORY – AFFORDABLE HOUSING

Blog “financial fairness for singles.ca” talks about affordable housing. One of the reasons for unaffordable housing is what author calls UPSIDE DOWN HOUSING. Excerpt from blog is as follows:

UPSIDE DOWN HOUSING

Why does it seem more difficult for individuals/singles and low income persons to purchase affordable housing? For possible reasons why, consider the following scenarios.

One example, condos presently being developed in Calgary by a developer in one housing complex includes 1 bed, 1 bath, 1 patio micro-condos of 552 sq. ft. with starting price of $299,900. Two patio, 2 bed, 2 full bath, 2 story 1232 sq. ft. condos were already sold out so price not available. Then there are 2 patio, 3 bed, 2.5 bath, 2 and 3 story 1830 sq. ft. condos priced from $649,900 to $749,900. Apparently, ultra-deluxe model has master bedroom suite covering entire third 600 sq. ft. floor. The third floor bedroom is bigger than total square footage of $299,900 condo. When price per square foot is calculated, micro-condo is selling for $543 per sq. ft. while three bed condos are selling from $355 to $409 per sq. ft.

So who is more likely to buy micro-condos? Possibly low income couples, single parent with one child, or environmentally conscious, and probably an individual/single person. Who gets to pay $150 to $200 more per square foot for two-thirds less space? Ripple effects are owners of micro-condos have to proportionately pay more house taxes, education taxes, mortgage interest and real estate fees on less house and less take home pay for biggest lifetime expense. When it is sold, will seller recoup buying price?

While singles are living in their small spaces (average size of new studio, one bed and one bed/den new condo combined being built in Toronto is 697 sq. feet), majority of Canadian married/coupled people families are living in average 1950 sq. foot houses (2010) with large gourmet kitchens, multiple bathrooms, bedrooms for each child and guests, basement, garage, yard, and nice patio with barbecue, etc.

To further magnify the issue, lottery in major northern Alberta city has first grand lottery prize of $2,092,000 for 6,490 sq. ft. house ($322 per sq. ft.), second grand prize of $1,636,000 for 5,103 sq. ft. house ($321 per sq. ft.), and third grand prize of $1,558,000 for 5,097 sq. ft. house ($306 per sq. ft.). First house has elevator, games/theatre area, kid’s lounge, gym, and music room. Second house has hockey arena with bleacher seating, lounge and bar. Third house has spa, gym, yoga studio, juice bar and media room. The wealthy get all the extras and pay only $306 per square foot. This is upside down housing. Need anything more be said about the wealthy? They usually get more while paying less and acquiring choicest spots. (Another example is penthouse suites that sell for proportionately less dollars per square foot than a small condo unit on lower floors of a building).

Average square footage of Canadian house is 1950 sq. ft. (2010) so how can a developer socially, morally and ethically justify charging $150 to $200 more per square foot for two-thirds less space? “CREB now”, Aug. 28 to Sept. 3, 2015, page A5, talks about Calgary developer selling 440 sq. ft. condos in north inner city tower for $149,000 ($339 per sq. ft.) in 2012 and 440 sq. ft. condos in south inner city tower for $219,000 ($498 per sq. ft.) in 2015. Two and three hundred sq. ft. condos are now being sold in Vancouver and Toronto for around $250,000 ($1250 and $833 per sq. ft. respectively). In many cases salaries for low income and singles has not risen to same level, nor has Canadian housing prices for the middle class and rich ($400,000 and up).

How is any of this different than loan-sharking or pay day loans where targeting of the most vulnerable occurs? Does no one see a pattern here where the wealthy pay $300 to $400 per square foot, but singles and poor families are forced to live in smaller spaces while paying more per square foot for them?

Further financial unfairness occurs when individual/single homeowners without children are forced to pay education taxes, but parents pay only fixed rate based on value of their home regardless of number of children. For ‘nineteen kids and counting’ it is possible parents are only paying a few cents a day for their children’s education. Some married/partnered seniors with kids are looking to have education tax payments eliminated from their house taxes. For families with children, logic implies parents should pay education tax throughout their entire lifetimes, or individuals/singles without kids should not have to pay education tax ever. However, families don’t seem to be able to apply financial logic of their own finances equally to the financial realities of their single children. And, many families do not want to pay school fees.

There are many more examples of financial unfairness, but just the above few show how financial world for low-income families and individuals/singles has been completely flipped upside down and topsy-turvy. Have governments, society, and our publicly and privately funded education systems failed us so miserably and family/corporate greed taken over with critical thinking, social/ethical responsible thinking sinking to all-time lows? Since when is it okay under present financial system for families to accumulate wealth and huge inheritances while their low income and single children are not able to support themselves on a day to day basis?

Young individuals/singles not yet married are facing huge financial hurdles because of low incomes, less full time jobs, enormous education debt, and out of control housing costs. Families (parents), governments, society, corporations, businesses to date have failed to provide support and responsibility that is needed to ensure all Canadian citizens are able to financially take care of themselves without financial parental aid, inheritances of parents and without bias of gender, race or marital status.

In this so called civilized, enlightened country of ours, it appears that citizens of value are only upper middle-income families and the wealthy while individuals/singles with and without children are being annihilated from financial, political, and everyday living scenes (MADE INVISIBLE). If families have such high family values, shouldn’t family values and moral social values take precedence instead of being trumped by almighty dollar greed and philosophy of charging what the market can bear and more?

Low income families, individuals/singles and young adults not yet married who can apply simple math and critical thinking skills are in financial despair and angst knowing that they, as the most vulnerable citizens of this country, have been targeted and pawned to pay more for housing than middle class families and the wealthy. It is the duty of politicians elected by the people, for the people to represent all Canadian citizens, not just vote getting middle class families.

OUTSIDE THE BOX SOLUTIONS FOR PRICING OF AFFORDABLE HOUSING

Solution 1 – for a housing complex as identified in the above outrageous pricing example, prices should be set where the base price of the unit with the smallest square footage cannot be more than the base price of the unit with largest square footage within the complex. Any changes and upgrades by the buyer would be added to the base price. (In the above example the base price of the 552 square foot condo could only be $355 per square foot to match the cheapest price of the biggest per square foot unit in the complex). Should there be laws and fines applied for these outrageous prices?

Solution 2 – Charges for house taxes, education taxes, and real estate fees should be balanced between square footage and price of the housing unit? Where housing prices follow a fair pricing formula as shown in Solution 1, this could provide financial fairness where fees are based on largest unit and become proportionately less on smaller units.

Solution 3– charge a fee such as a carbon tax fee for units greater than a certain number of square feet. For example, allow a maximum size of 2500 square ft. for a housing unit (assumption is that there is no need for excessive amounts of square footage in housing). For anything greater than 2500 square feet, charge an extra fee to the buyer with an incremental increase in the fee for every additional 500 square feet of space. (The wealthy have been paying less and getting more square footage while using non-renewable resources plus water at an alarming rate, i.e. 5000 square foot log cabin using twelve logging trucks filled with harvested logs and a showhome that has seventeen sinks). The monies collected from these fees could be used to build more affordable housing.

As stated in a recent real estate article, Watermark, a deluxe complex in Calgary is selling an ‘inspired’ (so stated in article) 8,644 sq. ft. estate home and its guest house for $3.45 million or $399 per square foot which is less per square feet than 600 square foot condo mentioned above. Article goes on to say that beyond homes, Watermark garners interest with both natural and manmade beauty. It has 17 cascading ponds and more than five kilometers of interconnected walking and bike trails. Then there’s the central plaza with its 1,000 sq. ft. pavilion, kitchen, barbecues, a sports field and NBA-sized basketball court. One family’s daughter is looking forward to booking the plaza and using the outdoor kitchen for her birthday party. The family goes on to state that space between homes and low density was also very important so they weren’t looking into someone’s back yard. This same complex has a show home with 17 sinks.

Another real estate article talks about another family with three children moving from 1900 sq. ft. house to a 2,837 sq. ft. house with price starting from $900,000s. They are moving because they need more room for the kids as they grow. Their new house will provide 567 sq. ft. per person at a starting price of approximately $317 per sq. ft. Yet again other articles state that owners are happy they don’t have condos in their backyard (NIMBYism) and their children can experience nature from their own bedrooms.

Further advice usually given by married people states singles can live with someone else if they can’t afford housing when they are already living in studio, one bedroom apartments, and basement suites. Senior singles who have lived productive lives while contributing to their country want and deserve their own privacy and bathroom. Many senior assisted living dwellings have in recent years built more spaces for singles who with one income pay more for that space than married/coupled persons. Just how long should shared arrangements go on for (entire lives?) instead of correcting underlying financial issues?

Following examples show dignity and respect for singles (and low income families). Attainable Housing http://www.attainyourhome.com/, Calgary, allows maximum household income of $90,000 for single and dual/parent families with dependent children living in the home and maximum household income of $80,000 for singles and couples without dependent children living in the home. Living Wage for Guelph and Wellington livingwagecanada allows singles dignity of one bedroom apartment and a living wage income that is 44% of a family of 4 income and 62% of a family of two (parent and child).

While singles are living in their small spaces (average size of new studio, one bed and one bed/den new condo combined being built in Toronto is 697 sq. feet), majority of Canadian married/coupled people and families are living in average 1950 sq. foot houses (2010) with large gourmet kitchens, multiple bathrooms, bedrooms for each child and guests, basement, garage, yard, and nice patio with barbecue, etc.

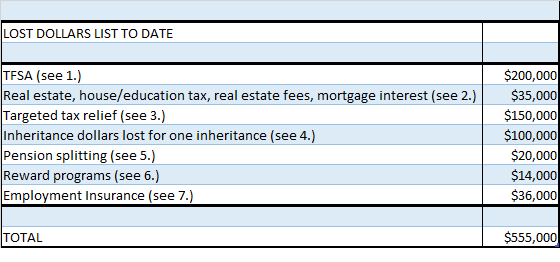

Above mentioned blog has also tried to attach lost dollars that singles face directly every date in relation to married and coupled family units with and without children. The following lost dollar value is in relationship to housing.

LOST DOLLARS VALUE LIST

For a 700 square foot condo where price is $50 more per square foot than lowest price of largest condo in complex, it can be assumed that the purchaser will be paying $35,000 more than purchaser’s base price of largest condo, if the price per square foot is $100 more per square foot then purchaser will be paying be paying $70,000 more, if the price per square foot is $150 more per square foot then purchaser will be paying $105,000 more and so on. The amount of house and education taxes, real estate fees and mortgage interest will also incrementally increase.

Our Lost Dollar Value List in blog (lost-dollar-value) – when lost dollar value for real estate is added to the list, $50 was used as the example not including gestimate loss for taxes and real estate fees, interest charges based on $50.00 per sq. ft.

APPROPRIATE HOUSING DEFINITION

Singles are often told they can always go ‘live with someone’ if they have problems with affordable housing. The CMHC should be aware of the following definition of appropriate housing. Housing dignity and respect as well as quality of life according to this definition specifies that singles deserve a bedroom of their own. (One bedroom actually meaning one bedroom, not just a murphy bed in a 200 square foot condo, shows dignity and respect for singles). It is the belief of this author that appropriate housing for a senior single means senior singles deserve a bedroom and a bathroom of their own. After working for forty years for their country without the marital manna benefits given to married or coupled family units, senior singles deserve at least this much.

Appropriate Housing definition is stated as follows – Under the Social Housing Accommodation Regulation (alberta page 11), such housing is considered overcrowded if more than two people must share a bedroom, with at least one individual in each of the other bedrooms, and if an individual over 18 “must share a bedroom with another member of the household,” or someone over the age of five has to share a bedroom with “an individual of the opposite sex.” (Spouses or partners sharing a bedroom don’t count)…..”Affordable housing is intended to be appropriate housing-appropriate to needs of families. If children age in place or additional children are welcomed into a family, they can transfer within the system…subject to availability.”

Blog “financialfairnessforsingles.ca”also addresses psychological impact where appropriate. The following discusses the psychological impact for housing.

PSYCHOLOGICAL IMPACT

There seems to be very little understanding of the psychological impact that decision makers and policy makers have on singles regarding housing.

Many families live in houses where their young children have separate bedrooms, and likewise, there is a trend towards ‘man caves’ and ‘she sheds’ so family members can have ‘alone’ time, but when children become single adults, singles are consistently told that they can live with someone if they have financial problems with housing while paying more.

And, of course, singles never have claustrophobia, so it is okay to stick them in small spaces for which they have to pay more. And singles never have problems with noise, so it is okay for them to live in small units in less desirable areas close to airports and railway tracks, etc. (As one single person moving from one unit to another stated in a real estate article “I was very impressed with the pricing and the fact that they’re doing concrete floors and walls “. Concrete is said to restrict noise. “I work on Saturday mornings and a lot of people like to stay up a little later on Friday and Saturday nights”. With thinner walls, he adds, it is easier to hear “people in the hallways coming and going. It is not the end of the end of the world, by any means, but I am looking forward to something quieter above and below”. But for this person, the decision was less about sound and more about getting something larger, with better specifications and closer to work-moving from 615 sq. ft. two bedroom condo to 715 sq. ft. two bedroom condo. “The bedrooms are a little bit bigger with an ensuite. I really liked that and I liked the fact that it has a washer and dryer so I don’t have to go to the laundromat.”

Singles deserve same standard of living as married/coupled persons, i.e. having washer and dryer in their own home instead of having to go down a dark hall or to basement in complex to do laundry or paying outrageous prices per load at a laundromat.

When reading or listening to articles on housing for families, families will always talk about how important their housing is for them in regards to creating memories for their children, entertaining and maintaining close ties to friends and families, but apparently adult singles don’t have friends and families or dreams, so it is okay for them to live in micro condos, some as small as 200 square feet, where it is pretty much impossible to entertain or have friends and families stay with them except maybe by having a bunk bed chained from the ceiling.

SOLUTION

Singles and low income persons need to become more aware of financial unfairness by taking pricing down to the lowest common denominator, i.e. price per square foot and speak out about the financial atrocities being directed towards them. They need to start questioning why they are being targeted to pay more while getting less. (While it is recognized that it is expensive to raise children, adult to adult it is also unfair to make one segment of the population like singles and the disadvantaged pay more than another segment).

By your own definition in ‘Let’s Talk Housing”, you state -” Zoning by-laws that encourage affordable, mixed-income and mixed-tenure communities are one way to ensure the inclusion of all Canadians in a variety of social, economic and cultural opportunities”. So how about putting ‘money where your mouth is’ and eliminating financial housing discrimination for singles and the poor that is upside-down and by truly making the wealthy pay their fair share?

CATEGORY- VULNERABLE POPULATIONS

SINGLES/INDIVIDUALS ARE RARELY INCLUDED IN FINANCIAL DISCUSSIONS AND FORMULAS

By your own definition in ‘Let’s Talk Housing”, you state vulnerable populations include seniors, persons with disabilities, victims of domestic violence, newcomers, homeless, lone parent families, indigenous households, youth, veterans.

Why are singles never included today in financial discussions and formulas? Families are only mentioned. What this means is that singles are discriminated against by virtue of exclusion and invisibility. As stated by your definition in sentence above, singles are not included except if they fall into categories of disabilities, homeless, or youth. Into which of these populations do singles between the ages of 25 and 65 fall? Your own definition of vulnerable populations does not include them.

SINGLES ARE INAPPROPRIATELY CLASSIFIED

Singles are inappropriately classified when the ‘catch-all’ word ‘singles’ is used to include single parents, widowers, ever singles (never married, no kids), early in life divorced and late in life divorced singles all in one word. Canada Revenue Agency has clear definitions for singles and widowed persons. Yet, financial planners, government agencies, businesses often consider widowed people to be singles when they are not. Single parents do get some government transfer benefits, which is as it should be. Widowed persons are given benefits, while ever singes are rarely given any benefits except in abject poverty. Widowed persons are more likely to own their own homes and have more net worth than ever singles. Early in life divorced persons are less likely to be able to accumulate net worth and wealth than late in life divorced persons.

Blog article “False assumptions – ‘Four Ways Senior Singles Lose Out’ – December 2, 2015” is a perfect example of how a financial analyst has inappropriately talked about singles in his article when he is actually talking about widowed persons. Widowed persons are often perceived to have more social value simply because they were married and have produced children in comparison never married singles and early in life divorced singles without and without children. This discrimination often leads to never married and early divorced in life singles being left out of financial decisions because they have been made to be invisible.

FINANCIAL ILLITERACY AND IRRESPONSIBLE CONCLUSIONS OF DECISION MAKERS IN HOUSING SOLUTION

Who Really Owns Homes

In your information, you say 69% of Canadians own their own homes, but what you don’t say is the majority of home ownership is by married or coupled family units. The sad reality is that singles are less likely to own their own homes because they simply can’t afford it. You say that seniors are a part of the vulnerable population. In reality, senior singles (not widowed persons and married or coupled persons) are more likely to be part of the vulnerable population.

According to Statistics Canada 2011 articles “Living Arrangements of Seniors” and “Homeownership and Shelter Costs in Canada” (12.statcan) and (12.statcan.gc) ‘approximately 56.4 per cent of the senior population (5 million total seniors in 2011) live as part of a couple and about 24.6 per cent of the senior population live alone (excludes those living with someone else, in senior citizen facilities and collective housing).

Approximately 69 per cent of Canadians own their own home. About four out of five (82.4%) married/coupled people own their own home, while less than half (48.5%) of non-family households (singles) own their dwellings. Just over half (55.6%) of lone-parent households own their dwelling. “ (It stands to reason that more senior married/coupled and widowed persons will own their own homes, while senior singles–‘ever’ single and early divorced–are more likely to have to rent placing them in greater income inequality and a lower standard of living and quality of life). Regardless of housing tenure, the proportion of non-family households and lone-parent households that paid 30% or more of total income towards shelter costs was about twice the proportion of the couple-family households’.

We are going to repeat this statement again: Regardless of housing tenure, the proportion of non-family households and lone-parent households that paid 30% or more of total income towards shelter costs was about twice the proportion of the couple-family households’. This very statement reinforces the fact that singles need to be included in the definition of vulnerable populations.

Singles are constantly told to ‘go live with someone’ when they have difficulties paying for housing; meanwhile married/coupled and widowed persons may be living in their big houses (enjoying the same lifestyle they had before pre-retirement) and seeking help with paying their taxes while refusing to move to a less expensive dwelling when they have financial difficulties.

Seniors who own their homes want to remain in their homes as long as possible versus renters

You state in your information that seniors want to remain in their homes as long as possible. You also state renters, on the other hand, can benefit from lower monthly costs and more flexibility when they want to move.

Several comments – there are many seniors who have huge net worth in their homes, can’t afford to live in them, and yet want to remain in them. They have such a sense of entitlement that they are seeking help with paying house taxes, and now politicians are looking to give them financial help with upgrading their homes. The above statements show no regard for the psychological impact of renting for singles and the poor. Just how long do you think renters should stay in one place – ten, twenty, thirty years- for example, as seniors without renovations and upgrades taking place in their rental units? The likely answer that you and everyone else will give to this is that they can always move. Moving in psychological impact is stressful, plus moving is expensive (your statement regarding ‘flexibility to move for renters’ is a negative, not a positive).

Families don’t take their own advice which they dish out to singles. Senior couples or widowed don’t want to give up their big houses, but ask for reduced house taxes and senior education property tax assistance programs (Calgary Herald, “Not Now” letter to the editor, August 26, 2015). If you can’t pay your house taxes, how about moving to smaller place or go live with someone (tit for tat)? If families with kids don’t pay education property taxes as seniors, then homeowners who have never had kids should not have to pay education taxes throughout their entire lives.

Financial analysts and decision makers have in their end points created such a sense of entitlement and greed that many believe home equity should not be treated as an asset and, even more ludicrous, as a retirement asset.

Blog post ‘Continued Financial Illiteracy and Creation of Financial Silos Benefitting Married/Coupled Persons Equals Financial Discrimination of Senior Singles-Part 2 of 2’ (part-2-of-2) is author’s response to one such article: February, 2016 the Broadbent Institute in Canada and Richard Shillington of Tristat Resources published the report: “An Analysis of the Economic Circumstances of Canadian Seniors” (broadbentinstitute)

Quote from report : ‘ …..Many of those who argue that there is no looming pension crisis have included home equity as a liquid asset. This analysis has not treated home equity as a retirement asset because the replacement rate analysis has as its objective an income that allows one to enjoy a lifestyle comparable to that which existed pre-retirement. We do not include home equity here because we accept that the pre-retirement lifestyle for many middle- and moderate-income Canadians include continued homeownership”, (Page 19)’.

(blog author’s response to this statement) ‘It is ludicrous that this report does not treat home equity as a retirement asset. Those who have to rent are at a much greater financial disadvantage than those who own their own home’.

Singles with mortgage or rent face serious financial obstacles regardless of what age they are. Young are facing outrageous housing and mortgage costs. Senior singles who have to rent face serious quality of life issues when their rent is beyond what they can afford. Also, financial analysts state that most singles cannot have a mortgage and save at the same time, they only can do one or the other.

What some politicians’ and other responses have been so far

Blog author has been blogging about financial discrimination of singles for almost a year and has been attempting to contact government and politicians regarding this issue. Here are a couple of absurd responses received so far (none have been positive).

One politician said that if singles are having problems with affordable housing, they can seek assistance. Community Housing in Alberta is a subsidized rental program, but to qualify assets and belongings cannot exceed $7,000. Really, $7,000? (Assets in pension funds, registered retirement savings plans, or registered retirement income funds are not included in calculation of assets. So this means, subsidized housing can be given to those with considerable assets). Another answer stated that maybe charitable and social agencies need to include singles in assistance that is already provided to low income persons and single parent families. Really? This is another slap in face answer that does nothing to solve the affordability housing problem for singles.

Singles continually get told by married or coupled persons that singles can go live with someone if they have problems with being able to afford housing. At a session on affordable and inclusive housing, blog author was told as much by one gentleman from around Springbank (one of most expensive areas to live in Canada) who was so proud that he was able to winter every year in Arizona.

When reading or listening to articles on housing for families, families will always talk about how important their housing is for them in regards to entertaining and maintaining close ties to friends and families. They talk about about how their ‘hearts are eternally and inexplicably changed’ when bearing their children, but same hearts appear to become ‘hearts of stone’ when these same children become adult singles, low income or no income persons and families.

It often appears that desired results have been achieved for what married/coupled persons and families think are appropriate for singles. Singles can now sleep in spaces that are two hundred square feet in size. It seems these same people no longer consider singles to be their children or part of the family. Instead, the state of business has overtaken the value of family to the point of unadulterated greed.

Singles deserve better in affordable housing solutions. When they talk to government, decision makers and families about lack of affordable housing, they are met with anger, shunning and deaf ears. They are given the response that it is ‘what the market can bear’.

Every adult with marital status of being single deserves a living wage and a dignified place to live that is equal to adults in families. Every adult with marital status of being single deserves to be included in financial formulas that are equal in benefits to adults in families. Every adult with marital status of being single children of families deserves to treated with same financial dignity and respect as married/coupled children in same family.

Single employables (singles and single parents) deserve the same financial dignity and respect as married/coupled persons with and without children. Singles and single parents (white, aboriginal and of immigrant status) deserve to be included in financial formulas at the same level as married or coupled persons with and without children.

Financial discrimination of singles is accepted in mainstream and is, indeed, celebrated. Article like “It Pays To Be Married” (marrying-for-money-pays-off) implies married/coupled persons and families are more financially responsible. From “Ten Events in Personal Financial Decathlon Success” (financialpost), the Family Status step says: ‘From a financial perspective, best scenario is a marriage for life. It provide stability for planning, full opportunities for tax planning and income splitting and ideally for sharing responsibilities that can enhance each other’s goals and careers. One or two divorces can cause significant financial damage. Being single also minimizes some of the tax and pension advantages that couples benefit from’. How nice!

CONCLUSION

- It is morally, ethically and socially reprehensible and irresponsible when government, businesses and families don’t recognize singles and continue to violate one of the basic principles of Maslow’s Hierarchy of Need, that is shelter.

- It is morally, ethically and socially reprehensible and irresponsible when government, businesses and families don’t recognize singles and continue to violate what has been deemed by international organizations to be a violation of the Human Rights of all Canadian Citizens, that is housing.

(From Wikipedia) “The right to housing is recognised in a number of international human rights instruments. Article 25 of the Universal Declaration of Human Rights recognises the right to housing as part of the right to an adequate standard of living. It states that:

| “ | Everyone has the right to a standard of living adequate for the health and well-being of himself and of his family, including food, clothing, housing and medical care and necessary social services, and the right to security in the event of unemployment, sickness, disability, widowhood, old age or other lack of livelihood in circumstances beyond his control. | ” |

Article 11(1) of the International Covenant on Economic, Social and Cultural Rights (ICESCR) also guarantees the right to housing as part of the right to an adequate standard of living.

In international human rights law the right to housing is regarded as a freestanding right. This was clarified in the 1991 General Comment no 4 on Adequate Housing by the UN Committee on Economic, Social and Cultural Rights. The general comment provides an authoritative interpretation of the right to housing in legal terms under international law.”

OTHER CONSIDERATIONS

- It is morally, ethically and socially reprehensible and irresponsible when government, businesses and families continue to be uneducated (illiterate)and completely unaware of what it costs singles to live in comparison to families in relation to equivalence scales.

- It is morally, ethically and socially reprehensible and irresponsible when government, businesses and families discriminate based on marital status. Discrimination based on marital status is a also a violation of human and civil rights.

- It is morally, ethically and socially reprehensible and irresponsible when government, businesses and families continue to exclude singles from financial formulas and housing solutions. Singles need to be included in all financial formulas.

- Equivalence scales (equivalence-scales-in-relation-to-cost-of-living) – if there anything that is can be so eye-opening in describing how financially disadvantaged singles are in comparison to families for cost of living, it is equivalence scales. Member of National Housing Survey need to educate themselves in this regard.

- Real estate fees have reached an outrageous level of unaffordability. These fees, in addition to outrageous housing prices, need to be addressed.

In present political system, singles are losing financial ground. Words ‘individuals’ or ‘singles’ rarely come to the financial lips of politicians, families or media. What is needed is to bring financial issues of singles to same financial table as families and to make positive changes for both parties. Singles who have worked for forty years, never used EI and helped to support families through wedding and baby gifts, education taxes and other taxes so that families can have maternity and parental benefits, child benefits, widow and survivor benefits, etc. deserve same financial respect as families. Singles never get any thanks and are never recognized for their contributions. The only benefits singles ever receive is if they are in abject poverty. Singles are not asking for more financial benefits than families, but equivalency to family benefits as applicable as shown in equivalence scales. They deserve this as citizens of this country.

Quite frankly, with all the rhetoric, surveys, solutions and bafflegab, this author is very pessimistic and believes CMHC and others involved in this project are going to fail, and will fail miserably. Unaffordable housing will not be resolved UNLESS THE MINIMUM WAGE IS RAISED TO A LIVING WAGE AND TO A LIVING WAGE THAT IS INDEXED TO INFLATION. Success will only be achieved if innovative solutions AND a living wage occur simultaneously. Everything that occurred in the last decade by government, businesses, and families in regards to financial solutions has benefitted only the upper middle class families, not singles and the poor. (Blog post on CPP enhancements, August 31, 2016 further supports how lack of minimum wage and schizophrenic programs further discriminate against singles and the poor-CPP a federal program while minimum wage is a provincial program).

List of some of the blog posts regarding housing and financial discrimination of singles and the poor:

- False assumptions – ‘Four Ways Senior Singles Lose Out’ (false-assumptions)- December 2, 2015 -describes how one financial analyst shows singles lose out on married or coupled family unit tax advantages, lose out on tax and pension systems tilted to benefit couples, lose out on benefits, face higher tax bill, and face OAS recovery tax. The sad fact is that this financial analyst was talking about widowed persons, not ever singles.

- Senior Singles pay more – Parts 1 to 4 – December 5 (senior-singles), Dec. 9 (part-2), Dec. 12 (part-3), and Dec. 22, 2015 (part-4), – show the many ways that senior singles pay more and get less over their married or coupled family unit counterparts.

- To rent or own affordable housing – that is the question January 10, 2016 (to-rent-or-own-affordable-housing)

- Continued Financial illiteracy of financial gurus equals financial discrimination of singles – Part 2 February 28, 2016 (financial-illiteracy) – blog author’s perspective on yet another financial analyst (Broadbent Institute) providing incomplete facts about what it costs singles to live, inappropriate classification of singles, and not including home equity as a retirement asset.

- Incomplete reporting of news and media articles promote financial inequality of singles to married/coupled persons March 24, 2016 (financial-inequality-of-singles-to-marriedcoupled-persons) – inability to say the word ‘single’ or ‘individual’ promotes financial discrimination of singles.

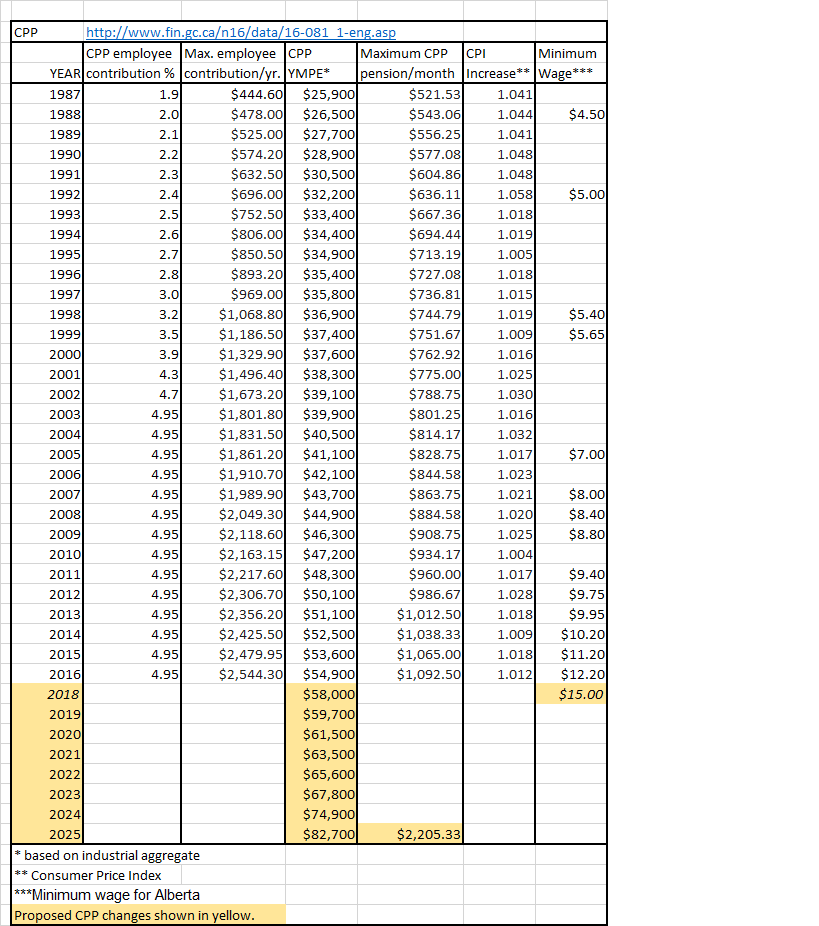

- Lost dollar value list to date – April 10, 2016 lost-dollar-value-list) (attached table – please see article for full description of items)

- Singles deserve affordable housing and financial fairness for singles April 13, 2016 (singles-deserve-affordable-housing)– talks about a San Francisco single person who created a private sleeping space in the living room of an apartment he shares with other roommates (one bedroom apartments rent for $3,670 a month). He sleeps in a wooden box (he calls it a ‘pod’) that is eight feet long, four and a half feet tall and probably about five or six feet wide)

- Rental or affordable housing – misconceptions about psychological impact on singles April 20, 2016 (affordable)

- Real financial lives of singles April 24, 2016 (real-financial-lives-of-singles-and-financial-discrimination-of-singles) – shows financial profiles of three married or coupled family units and three ‘singles’ from various backgrounds

- Homelessness in Canada bigger problem for singles and poor single parent families May 23, 2016 (homelessness-in-canada-bigger-problem) – study on single employables comprised of singles and single parents and how they are having a very difficult time surviving on low wages and lack of affordable housing

- Affordable housing not party of Conservative Party definition July 17, 2016 (affordable-housing-not-part-of-conservative-party-definition) – appropriate housing definition and how Conservative party after 40 year reign in Alberta contributed very little to affordable housing during the oil boom)

- Improper definition of single status promotes financial discrimination August 7, 2016 (improper-definition-of-single-status-promotes-financial-discrimination)

- Equivalence scales August 17, 2016 (equivalence-scales-in-relation-to-cost-of-living see article for further description of scales and application in Canada)

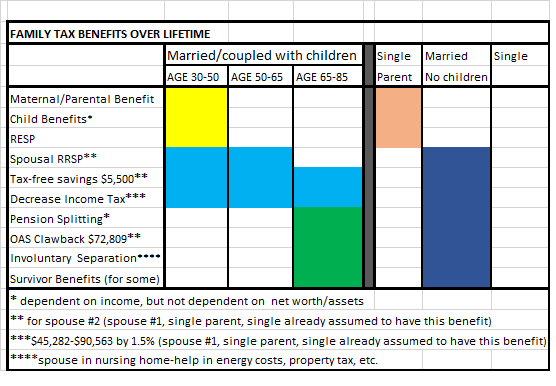

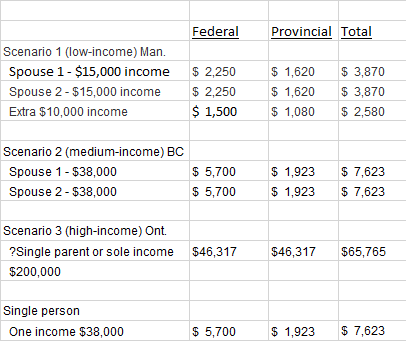

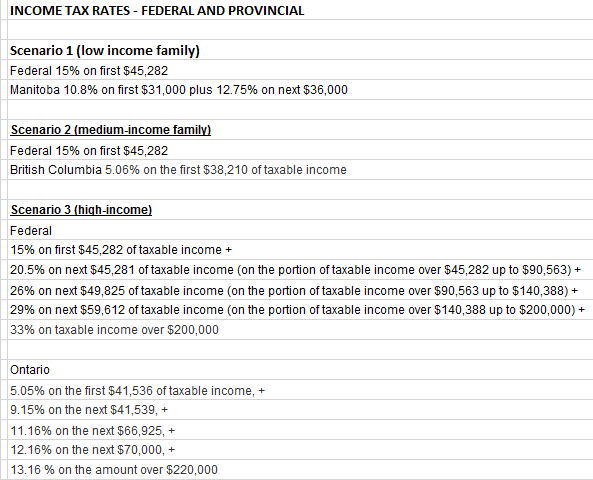

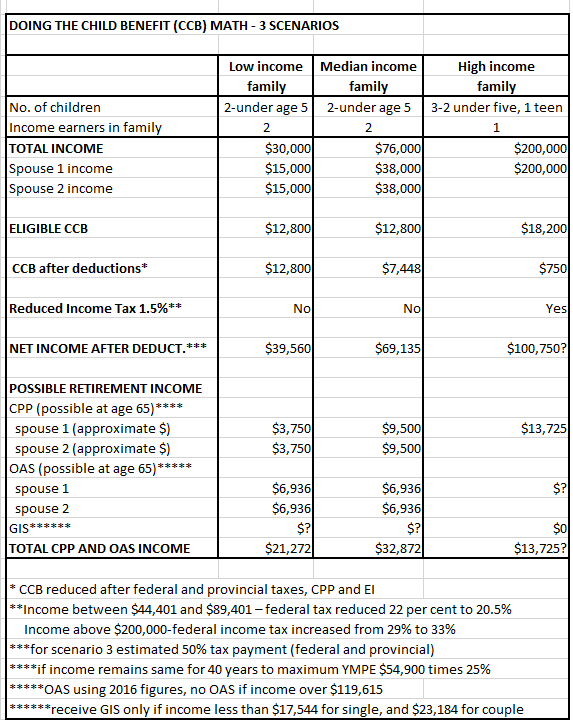

- History of family tax credits over decades are financially discriminating to singles Part 2 of 2 August 23, 2016 (history-of-family-tax-credits-over-decades table – see article for full description)

The above table shows benefits available to a married or coupled family units with children from time they are able to use maternal and parental benefits to time of death of one spouse (yellow, blue and green fill in). Single parents only have benefits related to their children (orange fill in). Married or coupled family units without children have all the benefits related to having a spouse or partner (navy fill in). Ever singles and early divorced singles have none of the benefits available to married or coupled family units (fill in is blank because they have none of the benefits of spouse #2. In addition, they are often are unable to max out RRSP and TFSA contributions). (While late in life divorced singles have none of the benefits for spouse #2, they may have been able to accumulate more net worth and assets while they had a spouse or partner).

15. Boutique tax credits pushing singles into poverty Part 1 of 2 June 23, 2016 (boutique-tax-credits) and Part 2 of 2 July 3, 2016 (part-2-of-2) – shows how family tax credits given to families with high net worth (brought in by Liberal party this year) are financially discriminatory to singles and are actually pushing them into poverty

16. Six Reasons Why Married/Coupled Persons are Able to Achieve More Financial Power (Wealth) than Singles (six-reasons – see article for further description – for marital manna benefits an example of a gourmet ice cream cone where married/coupled persons get additions of chocolate sauce and sprinkles, but singles only get the ice cream and cone)

“LETS TALK HOUSING” survey link (letstalkhousing)

(This blog is of a general nature about financial discrimination of individuals/singles. It is not intended to provide personal or financial advice.)