SENIOR SINGLES PAY MORE – Part 1 of 4

These thoughts are purely the blunt, no nonsense personal opinions of the author and are not intended to be used as personal or financial advice.

(The next four posts will consist of four parts. Parts 1 and 2 will be two published Opinion letters, Part 3 will be two Opinion letters published by readers in response to letter in Part 2. Part 4 will be author’s response to the two reader letters in Part 3.)

(This Opinion letter was published in a local newspaper on June 24, 2015. The Conservative party was ousted by the Liberal party in the October, 2015 election. Proper names have been removed. Since published letters are restricted to number of words that can be published, some additional information is added in italics to this article.)

In the June 17, 2015 edition of a local newspaper, a Conservative Member of Parliament states that the Conservatives remain committed to seniors through various measures they have implemented since 2006. This includes targeted tax relief where a single senior can now earn $20,360 and a senior couple $40,720 before paying federal income tax. He states that approximately 400,000 seniors (or 7 to 8% of total Canadian seniors) have been removed from the tax rolls altogether, (he neglects to state federal tax rolls only). This year, he says there is more good news for seniors by reducing the minimum withdrawal for RRIFs (Registered Retirement Income Funds) and introducing a new Home Accessibility Tax Credit (this neglects to recognize that not all seniors own homes).

The above so called tax relief benefit for seniors allows federal tax relief for senior singles equal to $1,697 per month and for senior couples $3,393 per month. The tax relief for senior singles hardly covers a rent or mortgage payment of $1,200 and $250 for food per month (Maslow’s Hierarchy of Need), but amply covers this amount for a senior couple. For a couple $1200 for rent or mortgage and $500 for food leaves $1693 (or 50% of $40,000) for other necessities and maybe even a nice little vacation all tax free.

The BMO Retirement Institute Report-Retirement for One-By Chance or Design 2009 bmo.com/pdf and cifps.ca/Public/Media/PDF states the following:

‘the present tax system is set up to give a huge advantage to married/coupled people with singles who were never married or were divorced at some point throughout their entire working career usually subsidizing married/coupled people’. (It is interesting to note that this statement in the original article appears to have been removed and is no longer present in URL shown above).

From Russell Investments ‘Spending Patterns in Retirement’, February 2010 russell.com it is stated that:

‘government transfers, such as CPP and OAS are generally not sufficient to cover the Essentials of Retirement-less than 70% coverage for the average retiree, and as a little as 30% for higher-income retirees. This problem is magnified for single retirees. For example, in the $35,000-$60,000 income category, couples spend only about 12% more than singles on essentials (i.e. food, housing, and clothing), yet receive about 80% more in government transfers’.

The senior population includes about 13% of ‘ever’ single seniors (never married, divorced or widowed) and divorced single seniors (the younger persons are when divorced, the more likely they are to be poor as seniors) and about 43% widowers, (who receive marital manna benefits like pension splitting while married and survivor pension benefits). It is a well-documented fact that singles require 60 to 70% income of married/coupled people depending on whether they rent or own a home with 70% likely being the more accurate figure (Moneysense, BMO Retirement Institute Report-Retirement for One-By Chance or Design, etc.).

So how does the Conservative tax relief program for seniors help ever-single seniors? It doesn’t. Instead, with the addition of marital manna benefits such as pension splitting and survivor benefits, individuals/singles are financially made to be not even 50% worthy of total married/coupled tax relief, but rather less than 50% of married/coupled tax relief. And immigrant families are also financially made to be more income worthy than Canadian-born and immigrant senior individuals/singles.

Governments, businesses and society all talk about ‘family, family, family’, but singles continue to be ‘kicked out’ or deemed ‘less worthy’ than married/coupled people in the ‘family’. The Conservative Prime Minister, Finance Minister, and Members of Parliament remain financially illiterate in individual/singles financial affairs.

The continued financial discrimination of singles must be eliminated by recognizing what it truly costs for ever-singles and divorced/separated senior singles to live in this country. If programs such as pension splitting for married/coupled seniors and survivor benefits for widows continue to be added, then at the same time, ever-single and divorced single seniors must be given equal financial status through enhanced programs such as GIS and 60-70% enhancement of singles’ income baselines over married/coupled person’s and widow baselines. Sixty per cent of couples’ tax relief $40,720 income equals $24,432 ($2,036 per month) and 70% of $40,720 equals $28,504 ($2,375 per month).

The Conservative Member of Parliament’s article is titled ‘Seniors play an increasingly important role in our society’. Unfortunately, married/coupled and widowed seniors are deemed to play a more financially important role than ever-singles or divorced/separated early in life singles even though singles have supported married/coupled and widowed persons throughout their lifetime through contributions by paying more taxes and getting less in benefits.

The senior population of Canada includes only about 13% of singles and divorced/separated persons, while widows comprise 43% of the senior population. If the marital manna benefits were taken away from the widowed persons (who by the way could now be considered to be living a ‘single’ lifestyle since they are now technically ‘single’) they would be on a more equal instead of a greater financial footing to ever singles and divorced/separated persons. Or, if looked at from another perspective since ever singles and divorced/separated persons comprise only 13% of the senior population, would it really cost that much more to give them the same financial benefits as widows? As citizens of this country senior ever singles and divorced/separated persons deserve and should be treated with same financial respect as widowed seniors.

To continue the common sense and critical thinking of this article, a simple rephrasing of the information is as follows: Governments need to top up tax free amount for ‘ever’ singles and early divorced/separated senior persons to from $20,0000 to $28,000 (70% of $40,000) plus give to ‘ever’ singles and early divorced/separated persons 70% of whatever benefits are given to widowed persons. To do nothing or less than this only continues the financial discrimination already been committed against ‘ever’ singles and divorced/separated persons.

LOST DOLLARS LIST’

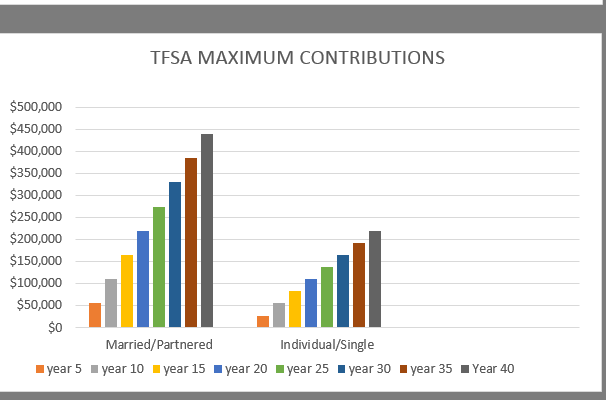

Since it costs ‘ever’ single and divorced/separated seniors with rent or mortgage about 70% – 75% of married/couple seniors’ income, lost dollars of 70% for $20,000 extra that married/coupled seniors get tax free or $6,000 per year (age 65 to 90) will be added to the list. Total value of dollars lost will be $150,000 ($6,000 times 25 for years age 65 to 90).

The blog posted here is of a general nature about financial discrimination of individuals/singles. It is not intended to provide personal or financial advice.