These thoughts are purely the blunt, no nonsense personal opinions of the author and are not intended to be used as personal or financial advice.

FINANCIAL DISCRIMINATION OF SINGLES MUST END

(This article was originally published in a local newspaper prior to the May 5, 2015 Alberta provincial election. The ruling Progressive Conservative Party had been in power for over forty years and was ousted by the New Democratic Party on May 5, 2015)

So it is election time again. And Premier Prentice has outlined a ten year budget plan for which he is seeking voter approval. He has repeatedly stated that in order to maintain the Alberta Advantage there will be a small 1% increase in the provincial flat tax rate and no increases in corporate taxes.

Also, with one hand the PCs will be taking away an additional 1% flat tax from all Albertans and with the other hand giving tax breaks back to only Alberta working families (new supplement for families with income under $41,220 and increase of the family employment tax credit by $346-$736 per year). Individuals have been excluded from the family manna benefits. The Federal PCs have also given additional benefits to families including income splitting even though this has been shown repeatedly over and over again to benefit high-income families the most while excluding low-income, equal-income families and individuals with and without children.

In his handout, “The Prentice Plan – Choose Alberta’s Future” Prentice talks about building a future for all Albertans, but only speaks to Alberta’s working families.

(Preference here is given to the word ‘individual’ rather than ‘single’ as the word ‘single’ implies negativity simply because the societal perception is that if he/she has not yet achieved the Nirvana state of being married/partnered/widowed/divorced/separated, he/she is less of a whole person).

Individuals/singles are never mentioned in the financial formulas or political statements. In fact, they are given ‘non person’ status. Surely Nellie McClung must be turning in her grave.

Young individuals not yet married/partnered today are faced with the grim prospects of high student loan debt, low wages when starting their employment, and paying more taxes than families.

Just one example of gross financial discrimination of individuals is where individuals are forced to overpay three times for pensions. One, they pay more taxes while contributing to pension plans; two, they are forced to support the survivor manna benefits which coupled/partnered people have not paid more for; and three, on retirement they pay more taxes than coupled/partnered people, plus get less pension because they can’t pension split. The mantra for individuals is pay more, get less, pay more, get less, and pay more, get less.

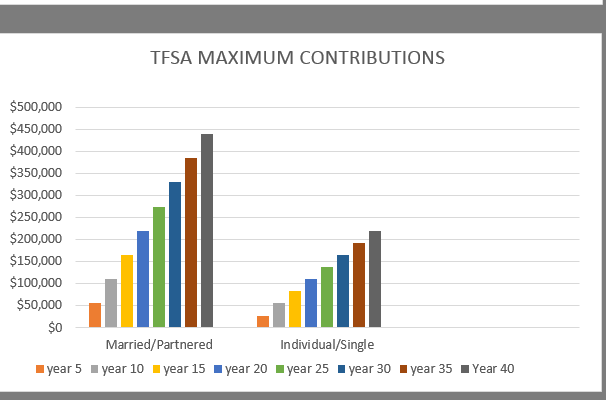

Regarding the status of individuals (especially ever singles) it is a well-established fact that individuals on their own who do not own a house require 70 to 75% of a married/partnered income to maintain a reasonable standard of living. If they own a house, then 60% to 65% of a married/partnered income is required.

It stands to reason the basic personal exemptions for individuals should be at least 60% to 70% of the combined personal exemptions for a couple.

In a stunning, eye-opening report “The Alberta Disadvantage: Gender, Taxation and Income Inequality http://www.parklandinstitute.ca/the_alberta_disadvantage by Kathleen A. Lahey soundly chastises the Alberta flat tax system for:

‘especially adversely affecting women, shifting disproportionate amounts of the provincial annual tax share to women and low income men in order to fund breaks for corporations and high income individuals’. Furthermore, ‘racialization and aboriginal heritage form further barriers to economic equality.’

Could we, please, also add financial discrimination of singles?

Alberta’s Liberals have stated gender inequality needs to change, but don’t say how change will be achieved.

And apparently Prentice prefers the recommendations of the Fraser Institute on the flat tax system.

If one carefully reviews the recommendations for a flat tax system (Alvin Rabushka and Niels Veldhuis) fraserinstitute.org/studies/-the-case-for-flat-tax-reform versus a progressive tax system (Lahey), both systems call for fairness and equity and elimination of most tax credits, deductions, exemptions and benefits; in other words

“repeal the transferability of the large dependent spouse/partner tax exemption credits and all other transferable exemption credits”.

Both systems have a personal allowance or exemption-an amount all individuals are allowed to earn tax free. Both systems state that present tax systems fail to ensure that individuals and households with similar incomes face similar tax burdens. Proponents of each system state there would be more than enough revenue generated to support infrastructure and government programs. Inequalities would be addressed with changes only to the basic personal exemption with no further tax exemptions or benefits required.

Lahey states that Alberta must enforce women’s rights and the Alberta Human Rights Account to achieve genuine economic equality. She also advocates for a living wage and subsidized, registered childcare and elder care programs. (Lahey’s entire report should be required reading for all politicians, think tank persons and those who believe basic human rights are not being violated by present tax systems, Canadian or provincial).

In our so called civilized country and province which political party (far right, far left or middle of the road as Prentice states he is) will step up to the plate and ensure financial equality and respect for all Canadians and Albertans based on gender equality, and without regard to marital status and family composition, not just high-income families?

Get out and vote! Individuals and singles of all ages, talk to your Member of Parliament about financial discrimination of singles!

The blog posted here is of a general nature about financial discrimination of individuals/singles. It is not intended to provide personal or financial advice.