DOING THE MATH ON FAMILY TAX CREDITS SHOW FINANCIAL DISCRIMINATION OF POOR, LOWER MIDDLE CLASS FAMILIES AND SINGLES-Part 1 of 2

(These thoughts are purely the blunt, no nonsense personal opinions of the author about financial fairness and discrimination and are not intended to provide personal or financial advice.)

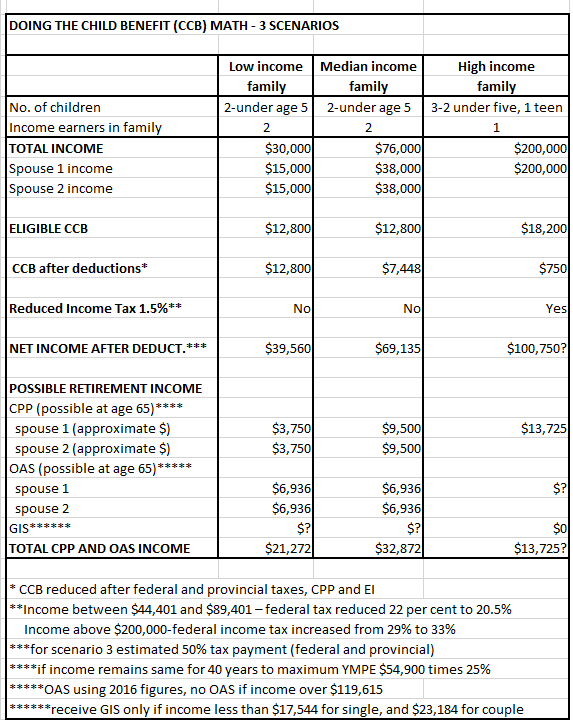

The Canada Child Benefit (CCB) consists of tax-free monthly payments that began in July, 2016 and provide maximum annual benefit of up to $6,400 per child under the age of six, and up to $5,400 per child ages six through seventeen. This benefit is income-tested (but not net worth and assets tested), such that the amount depends not only on the family income, but also on the number of children and their ages. (These amounts start being reduced when the adjusted family net income (AFNI) is over $30,000 and also is dependent on number of children in the family. On the portion of adjusted family net income between $30,000 and $65,000, the benefit will be phased out at a rate of 7 per cent for a one-child family, 13.5 per cent for a two-child family, 19 per cent for a three-child family and 23 per cent for larger families. Where adjusted family net income exceeds $65,000, remaining benefits will be phased out at rates of $2,450 and 3.2 per cent for one-child family, $4,725 and 5.7 per cent for two-child family, $6,650 and 8 per cent for three-child family and $8,050 and 9.5 per cent for larger families on the portion of income above $65,000).

The following scenarios from “Doing the child benefit math” by Jamie Golombek (financialpost), Financial Post September 30, 2016 shows financial evaluation performed by Jay Goodis from Tax Templates Inc. This evaluation shows the impact of CCB on various levels of income in 2016, the after-tax cash they would keep along with their effective tax rates.

Scenario 1 – Low-income family

A Manitoba family has two kids under five and two working parents, each earning $15,000 of employment income. They are eligible for the entire CCB of $12,800; after paying CPP, EI, and a bit of tax, they net $39,560 of cash.

What would happen if one parent was able to work more, or was to get a higher paying job, such that she now made $25,000 — an increase of $10,000? While she’s still in the lowest federal and Manitoba tax brackets, once you factor in the loss of CCB, the additional tax, CPP, and EI, her take-home extra cash is only $5,563, resulting in an effective marginal tax rate of a whopping 44 per cent (39 per cent if you ignore the additional CPP and EI contributions.)

As Goodis observed: “The CCB skews the progressive tax system and imposes a high effective tax on low income earners with children.”

Scenario 2 – Median-income family

A British Columbia couple has two children under the age of five. Their family’s income, consisting solely of employment income, is $76,000 split equally between each spouse. Their $12,800 of CCB is reduced to $7,448; and after federal and provincial taxes, CPP, and EI, the family nets $69,135 of cash. In other words, even with the clawback of some of their CCB, the couple has kept 91 per cent of their earned income.

Scenario 3 – High-income earner

Finally, consider an Ontario professional with three kids, two under five and one teen, earning $200,000 annually. His CCB will be about $750 for the year. If he were to earn an extra $1,000 of income, he would keep only just under $400 of it, resulting in an effective marginal tax rate of just over 60 per cent once the loss of the CCB is taken into account. (His status is not stated, assume he is a single parent?)

ANALYSIS

With a fuller analysis of the information the following assumptions can be made:

- Minimum wage-most minimum wages in provinces range between $10 and $11 per hour, so it is hard to imagine that family in scenario 1 (low-income family) only makes combined income of $30,000. At 2,000 annual hours of work per year per person, each person’s hourly rate only equals $7.50. One must assume they are working part time jobs and are unable to find full time work. Net income after deductions and with CCB of $39,560 still equals net hourly wage of only about $10 per person. (The other possibility is that this family is wealthy by having huge net worth and assets that are not considered in the CCB and, therefore, do not need to work at full time jobs). For scenario 2 (medium-income family) the net wage after deductions and with CCB earned per hour equals about $17 per person. For scenario 3 (high-income earner) and assumed 50% tax plus $750 CCB on $200,000 the net wage earned per hour equals about $50 per person.

- Income tax reductions-in scenario 1 (low-income family) get none of the 1.5% Liberal tax reduction because each of their incomes do not fall in the $44,401 and $89,401 range. The same applies to scenario 2 (medium-income family). Scenario 3 (high-income earner) gets the 1.5% tax deduction for income between $44,401 and $89,401. Only upper middle-class families with individual spouse’s income over $44,401 to $89,401 would quality for income tax reductions in these scenarios.

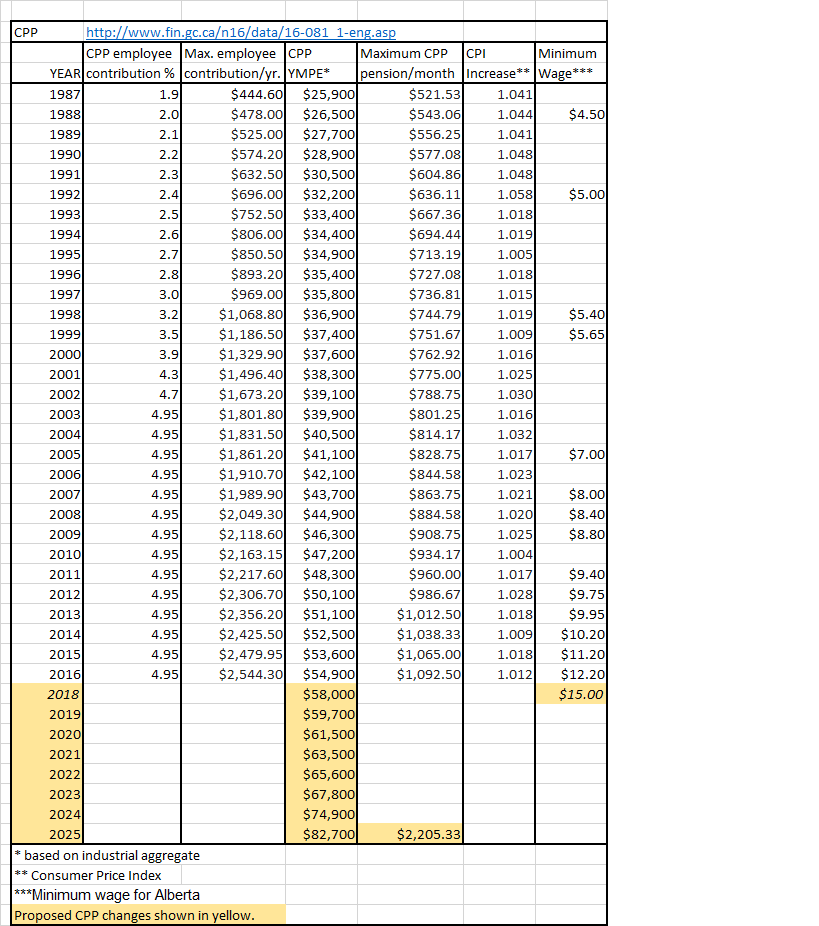

- Canada Pension Plan (CPP)-both scenario 1 and 2 families will not receive maximum CPP retirement benefits because their individual incomes fall below the 2016 YMPE $54,900 individual income level. In scenario 3 (high-income earner), he will earn full CPP benefits. (Fact: Canada Child benefit tax-free income will not require CPP contributions, so income excluding CCB was used for calculation of CPP retirement benefits.

- Canada Child Benefit (CCB)-For scenario 1 (low-income family) this family receives full Canada Child Benefits. For scenario 2 (medium-income family) reduction is $4,275 and 5.7% for $76,000 income for total $5,352 CCB reduction. Reduction for scenario 3 (high-income earner) is $18,200 minus $6,650 and 8% for $200,000 income which equals total $17,450 CCB reduction.

- Understanding other calculations-For scenario 1 (low-income family) it is stated that an additional $10,000 in income would ‘produce take-home extra cash of only $5,563, resulting in an effective marginal tax rate (tax rate paid on last dollar of income and rate likely to be paid on next dollar of income-it is usually more than what is actually paid because basic exemptions, etc. have not been taken into consideration) of a whopping 44 per cent’. (Fifteen percent federal income tax on $10,000 equals $1,500, about 12% Manitoba provincial tax equals $1,200 and 13.5% Canada Child Benefit reduction on $10,000 equals $1,350 for a total of $4,050 not including additional CPP and EI payments).In scenario 3 (high-income earner, ?single parent) it is stated that with only an additional $1,000 income he would keep just under $400 of it, resulting in an effective marginal tax rate of just over 60 per cent once the loss of the CCB is taken into account. When one takes into account that he is possibly taking home over $8,000 per month, it is likely that he will be able to max out his RRSP and TFSA accounts and will have maximum CPP benefits on retirement at age 65 if he works 40 years as well as RRSP and TFSA accounts to supplement his retirement income).

- Under-reporting of actual benefits received-Marginal tax rate-Since Canada operates on tax brackets, taxpayer will pay more tax when more is earned. However, it’s worth noting that tax rate paid is based on the income in each bracket. So the marginal tax rate doesn’t reflect the total that is paid on income. In fact, what taxpayer actually ends up paying, in terms of a percentage of income, is probably going to be lower than the marginal tax rate. It should be noted that further possible provincial child assistance and family employment, GST rebate benefits and basic exemptions are not included in these examples. Therefore, each scenario likely has more benefits than have been described in the examples.

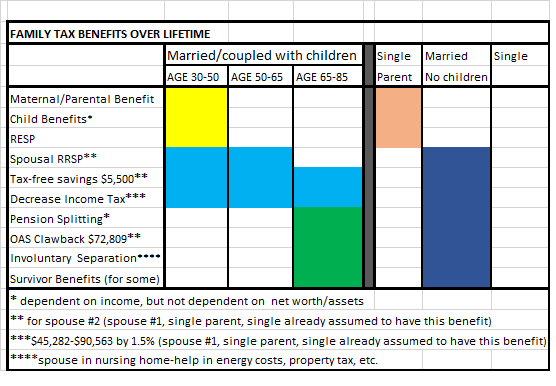

CONCLUSION

As stated above by the financial analyst, statement is repeated here again: “The CCB skews the progressive tax system and imposes a high effective (marginal used in these examples) tax on low income earners with children.” Unfortunately, they create financial silos by including only one benefit without taking into consideration of the effect of other benefits. In this post, attempt was made to include Liberal income tax deductions and possible retirement benefits to provide a better ‘across the board’ analysis of how upper-middle class families and wealthy benefit most.

While many families may view the CCB to be a wonderful program, boutique tax credits when taken into consideration with other programs can be shown to be less financially beneficial to low income and middle income families, especially with a stagnant minimum wage. A stagnant minimum wage (minimum-wage) with a Canada Child Benefit may provide a better income for low income families for twenty or twenty five years during child-rearing, but will result in lower Canada Pension Plan benefits for seniors during their twenty years as seniors. A higher minimum wage during child-rearing years will result in a higher income during child-rearing years, lower CCB along with higher CPP during senior years. It is in the eye of the beholder and financial analysts to determine which is the better scenario. A higher minimum wage appears to be the better scenario.

Another negative thing that can be said about the Canada Child Benefit program is that reductions of the benefit appear to decrease slightly with the addition of each child (resulting in a little more CCB being paid out with addition of each child). This progression in CCB reductions appear to not follow equivalence scales (finances) where it is shown that cost of living per family does not increase times each additional child, but rather decreases per addition of each child. (Example: cost of living square root equivalence scale one adult 1.0, two adults 1.4, two adults one child 1.7, two adults two children 2.0, two adults three children 2.2). In scenario 2 (medium-income family) CCB benefit would be $3,598 for 1 child under 5, $7,448 for 2 children under five and $11,670 for three children under 5. So, in fact scenario 2 family with three children would receive $292 more per child than family with one child even though equivalence scales show the cost of living per child is less for three children than it is for one child.

As has been stated in past blog posts, both the Liberal and Conservative parties, while handing out marital manna benefits and family benefits, have at the same time handed out benefits that favor upper-middle class families and wealthy the most. (Singles get none of these family credits and are unable to purchase homes and max out RRSP and TFSA accounts unless they have substantial incomes.) Some of these benefits include Liberal income tax reductions, maximum CPP benefits and exclusion of net worth and assets testing while failing to increase the minimum wage to an indexed living wage. Politicians and governments continue to financially discriminate against singles and the poor while allowing the upper-middle class and wealthy to increase their wealth.

(This blog is of a general nature about financial discrimination of individuals/singles. It is not intended to provide personal or financial advice.)